Overnight – Stocks finish lower led by tech leading into September weakness

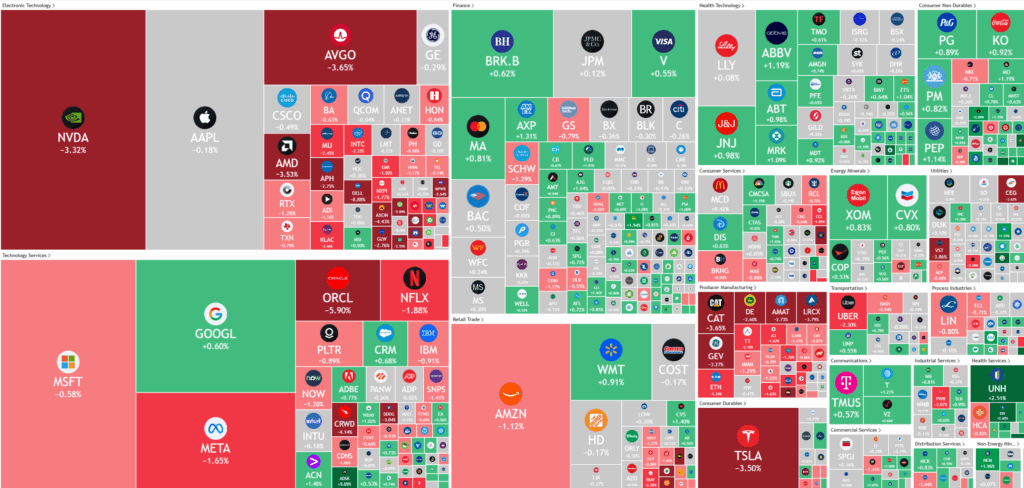

Stock headed lower on Friday night, pressured by an Nvidia-led stumble in tech, but wrapped up August with its fourth-straight monthly win.

Nvidia led a decline in the tech sector, falling over 3% as investors reacted to concerns about its sales in China due to ongoing regulatory restrictions and Beijing’s focus on reducing dependence on U.S. chipmakers. In contrast, Alibaba surged after reports that it had developed a new AI inferencing chip, signaling progress in China’s push for domestic chip innovation; although inferencing remains less advanced than training, the move underscores China’s strategic response to supply limitations.

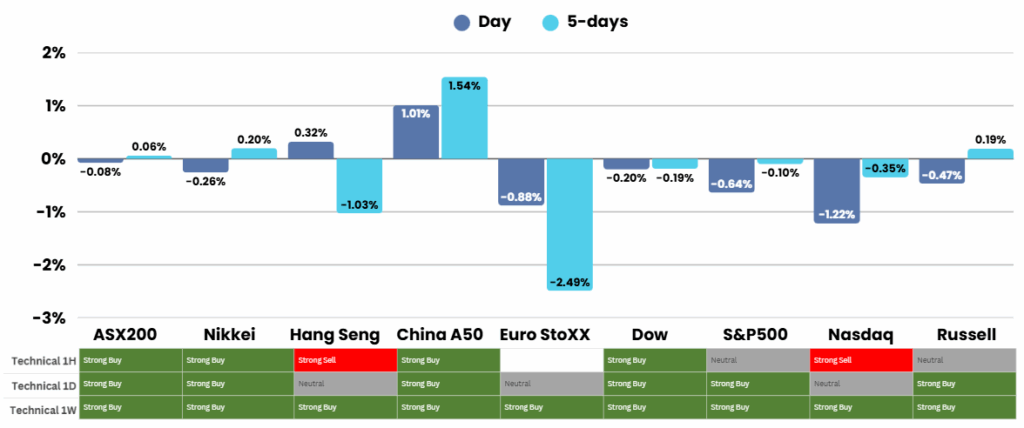

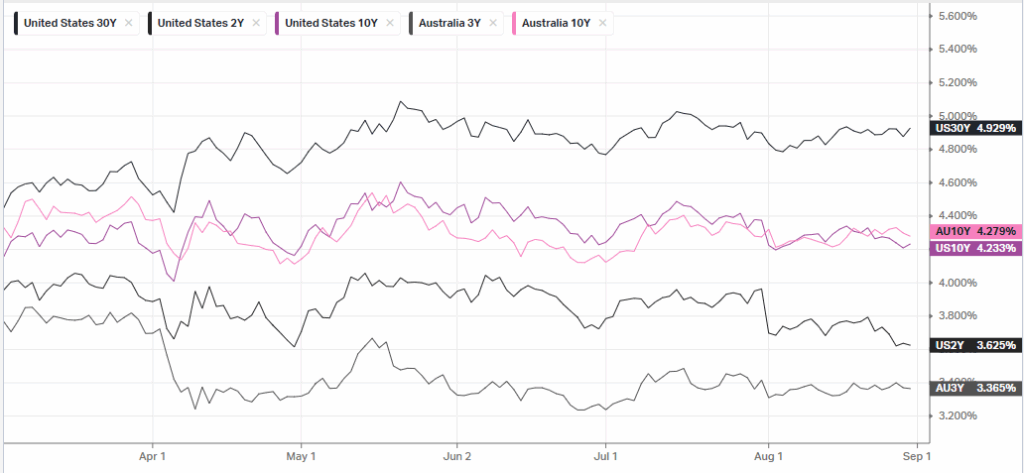

U.S. economic data showed the core PCE price index, the Federal Reserve’s preferred inflation measure, rose 0.3% monthly and reached 2.9% year-over-year, its highest in five months—matching expectations and indicating that recent Trump-era tariffs have yet to substantially impact consumer prices. This inflation print is unlikely to diminish market expectations for a rate cut in September, especially after Fed Chair Powell noted cooling in the labor market but remained cautious about future policies given trade-related inflation risks.

In corporate news, Dell dropped on weaker-than-expected guidance despite strong prior earnings, while Marvell Technology slumped after delivering a disappointing forecast for the current quarter. Caterpillar also declined due to anticipated higher tariff expenses amid evolving U.S. trade policies, whereas Autodesk soared following strong quarterly results. Other major movers included Ulta Beauty, which fell despite raising its outlook due to concerns about inventory and Affirm Holdings, which jumped on robust revenue growth and a bullish forecast thanks to resilient consumer spending.

Corporate news

- Alibaba – announced a new, domestically produced AI chip last week, marking a strategic move to reduce reliance on U.S. semiconductor technology amid export restrictions. The chip is designed for a broad range of AI inference tasks, not training, and demonstrates Alibaba’s commitment to cloud scalability, cost efficiency, and software ecosystem compatibility. Backed by a $53.1 billion investment over three years, this initiative aligns with China’s push for semiconductor self-sufficiency and highlights Alibaba’s strengthening position in the fast-growing AI cloud market, while investors responded positively to the news with a notable rise in the company’s shares.

ASX SPI 8912 (-0.30%)

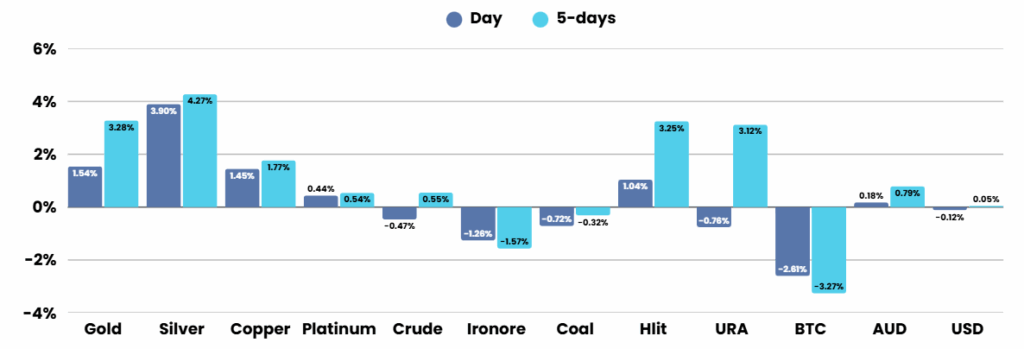

The ASX is in for a softer day with the highlights being the sold and silver sectors, the lowlight is likely tech. We expect a quiet few sessions as the US breaks for Labour day

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.