Overnight – Stocks head lower as investors rotate out of Tech

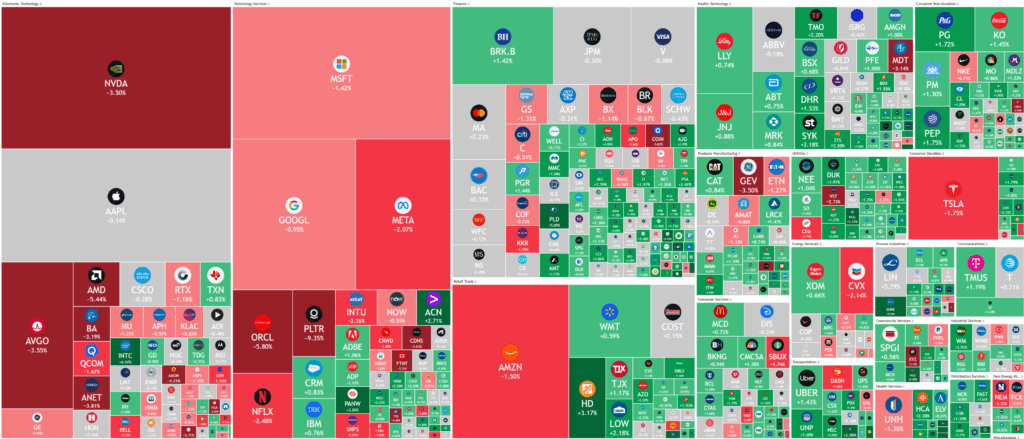

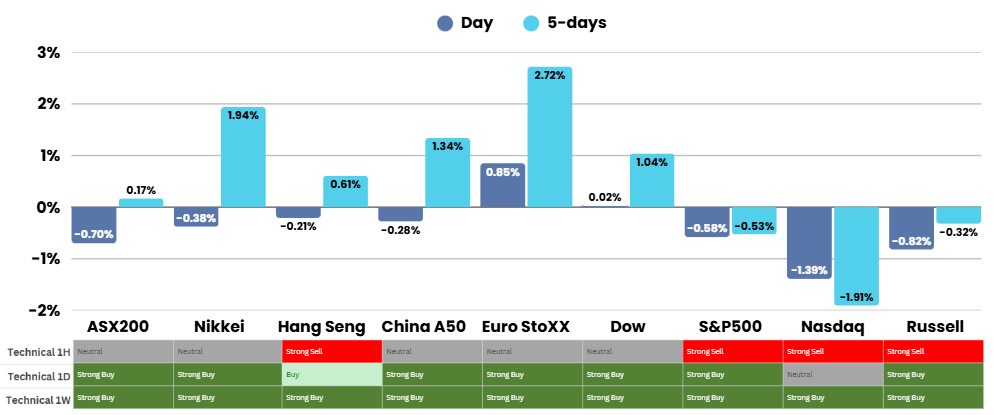

Stocks headed lower for a third day ahead of the upcoming Jackson Hole Symposium later this week, with tech stocks feeling the brunt of the pain.

Investors are paying close attention to the recent stock rotation, with money moving out of tech after significant year-to-date gains on the AI boom. Recent trading patterns have sparked concerns among investors after a notable rotation from large-cap to small-cap stocks, and from growth to value. While such shifts are not unusual, what stood out last week was that this rotation occurred alongside an overall rise in the market—something seen only once before in 2025. Analysts, like James Reilly of Capital Economics, highlight that a similar phenomenon took place during the final stages of the dotcom bubble, prompting fears that markets may once again be entering a speculative phase. These worries were echoed by OpenAI’s Sam Altman, who recently warned of a looming “AI bubble.”

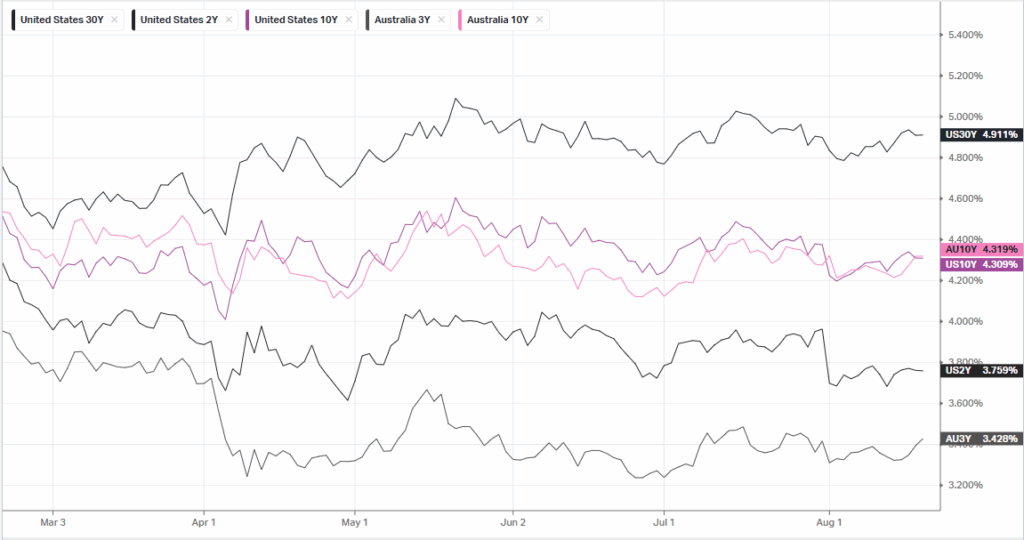

Markets are also focused on the upcoming Federal Reserve symposium at Jackson Hole, where Chair Jerome Powell will address the theme of a changing labor market. Investors are pricing in a strong chance of a September rate cut, though Powell is expected to maintain a cautiously balanced stance. Economists believe his remarks will emphasize uncertainty and data dependence, with a possible softening of tone but without committing to a definitive policy path. Meanwhile, U.S. housing data showed modest gains in new single-family construction and permits, reflecting resilience in homebuilding despite high borrowing costs.

Geopolitical developments added complexity to market sentiment, with a high-profile meeting between Ukrainian President Volodymyr Zelensky, European leaders, and U.S. President Donald Trump. Trump suggested facilitating a future meeting between Zelensky and Vladimir Putin, raising hopes for negotiations on a peace deal. However, key territorial disputes, particularly over Russian-occupied land in Ukraine, remain a major obstacle. Zelensky confirmed that discussions around security guarantees for Ukraine would intensify over the coming days, but meaningful progress toward peace remains uncertain.

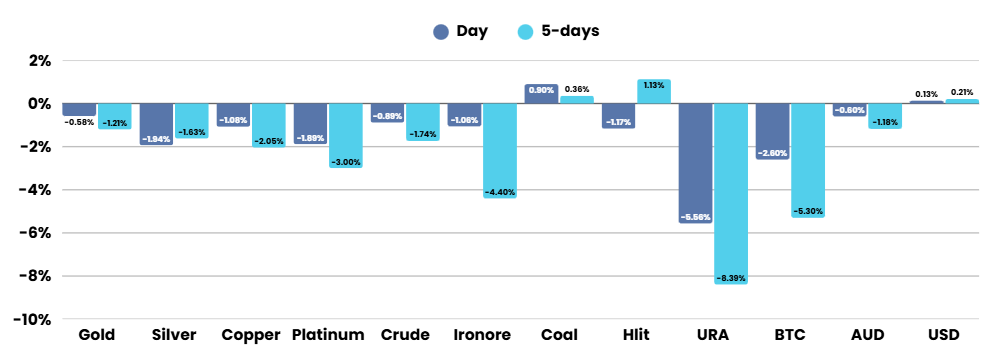

On the corporate front, earnings season continued to drive stock-specific moves. Home Depot reported modest comparable sales growth but warned of weakening demand for big-ticket items, even as its shares rose. Intel surged after SoftBank agreed to invest $2 billion to support its U.S. chipmaking ambitions, while Palo Alto Networks rallied on strong forward guidance tied to AI-powered cybersecurity demand. Investors are also awaiting results from other key retailers such as Lowe’s, Walmart, and Target to gauge consumer health. Meanwhile, oil prices slipped as prospects for possible Ukraine peace talks reignited speculation over the return of Russian supply to global markets

ASX SPI 8896 (+0.17%)

We will be earnings focused today with Santos, APA, Transurban, the Lottery Corp, Clarity Pharma, super loop and Breville delivering earnings.

Corporate Earnings

- James Hardie JHX:ASX – Building products group James Hardie says the Australian market remains “challenged” and margins were flat in the June quarter in that business. Net sales in the three months ended June 30 in the Australasian business were down 10 per cent to $US121.6 million, in part because of the closure of its small Philippines operations. Profit for the Australasian business was down 8 per cent to $US37.8 million

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.