Overnight – Stocks extend losing streak as economic concerns grow

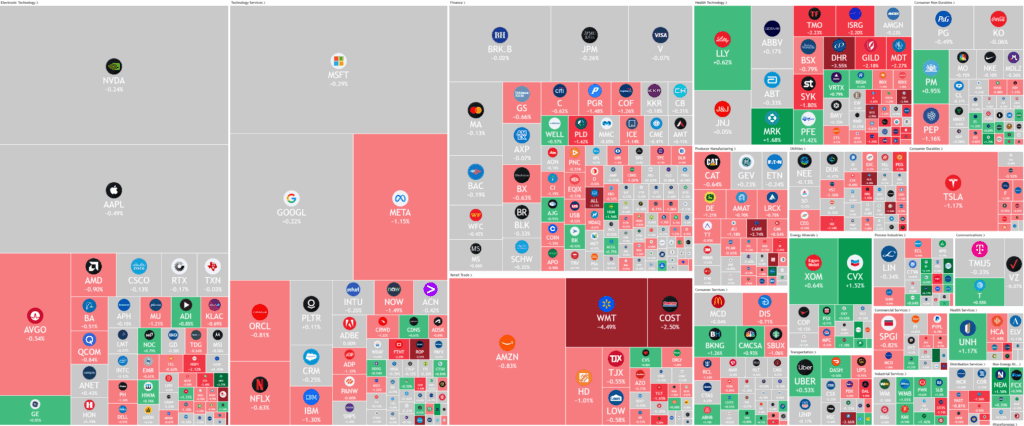

Stocks extended their losing streak to five days overnight, pressured by a fall in retail and tech stocks and concerns about the economy, a day ahead of remarks from Federal Reserve chairman Jerome Powell.

Walmart shares led a broader decline in retail stocks after the company reported mixed second-quarter results. While revenue outpaced expectations, earnings fell short of analyst forecasts, triggering a selloff. Despite this miss, Walmart raised its full-year sales and profit outlook, reflecting confidence in its strategy and resilience, particularly given its strength in groceries and low-price positioning. The company has also delivered earnings beats for 11 straight quarters, maintaining investor interest even as other consumer staples firms have faced difficulties this year.

The weak sentiment extended across the retail sector as several big-box retailers reported results this week. Home Depot set the tone earlier, followed by Target, which tumbled after announcing long-time executive Michael Fiddelke as its new CEO while maintaining subdued guidance. Beauty retailer Coty also slumped after projecting a soft first half of fiscal 2026. In contrast, Boeing saw gains, with markets reacting positively to reports of a potential major jet order from China, underscoring how sector-specific developments are driving sharp divergences in stock performance.

Beyond retail, technology stocks remained under pressure following a critical report from an MIT-affiliated research group that cast doubt on artificial intelligence profitability. The study claimed that 95% of organizations were getting no tangible returns from AI investments, fueling skepticism around one of Wall Street’s most central growth themes in 2025. These concerns weigh heavily ahead of Nvidia’s upcoming earnings, with investors looking for evidence that AI demand remains strong enough to justify lofty valuations across the chip and tech sectors.

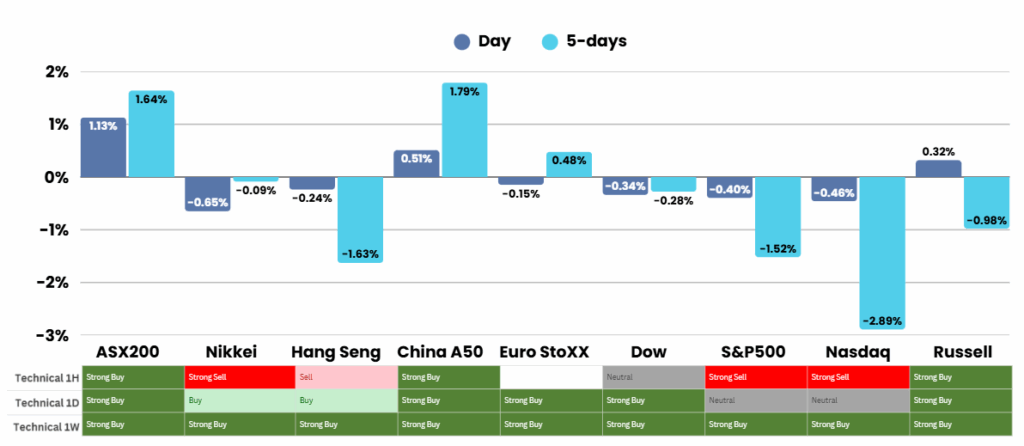

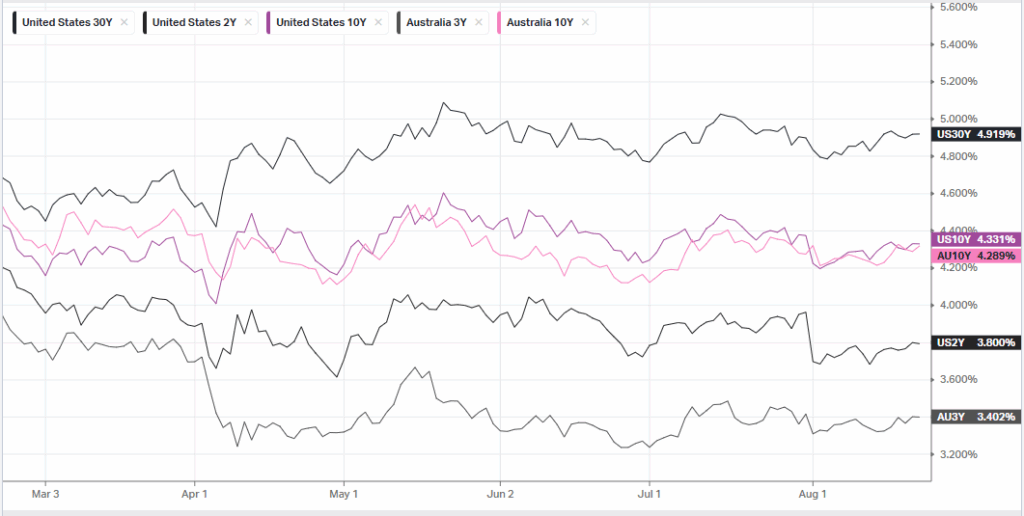

Meanwhile, fresh labor data added to signs of a cooling U.S. economy. Initial jobless claims rose to 235,000 against expectations for 226,000, continuing a trend of weakening employment metrics after July’s disappointing jobs report. Tariff-related economic uncertainty has amplified business caution in hiring. Against this backdrop, Federal Reserve policy remains in focus, with minutes from July’s meeting showing caution over rate cuts given persistent inflation risks from Trump’s tariffs. Markets are now awaiting Fed Chair Jerome Powell’s speech at the Jackson Hole Symposium for further clarity on the central bank’s policy path.

ASX SPI 8971 (-0.01%)

9000! A new record for the ASX yesterday and finally some outperformance from the local index. Give the great performance this week of the ASX200, today investors are likely to see a risk off tone, given the weekend ahead in Jackson Hole.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.