Overnight – Stocks bounce as Fed Williams breaks ranks to give a rate cut hope

Stocks bounced back on Friday on very thin hopes for a December rate cut, as Fed Williams went against all the recent Fed speak and suggested a cut could come soon.

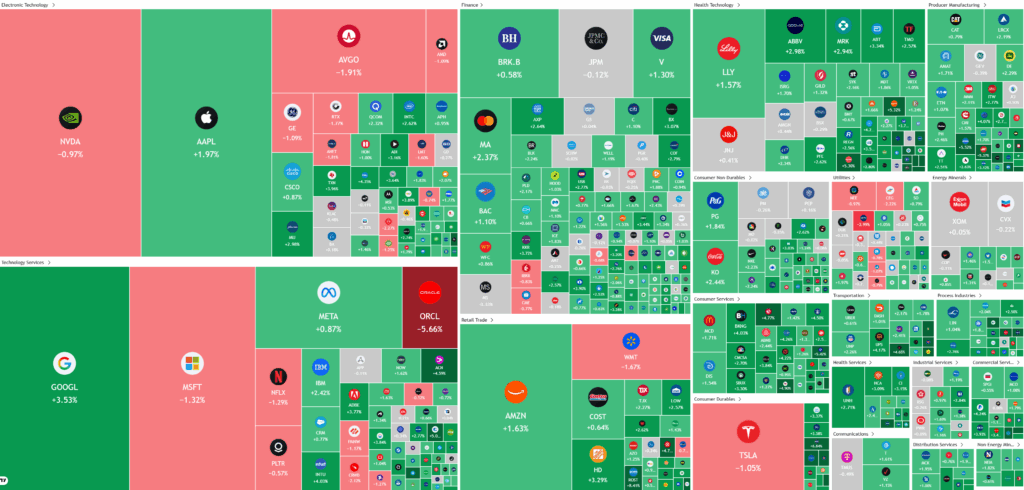

Big tech shares bounced back as investors bought into recent weakness in major names including Alphabet and Apple , while enthusiasm around Nvidia faded despite reports U.S. officials are exploring whether to allow sales of its H200 AI chips to China. The prospect of loosened export curbs briefly supported AI-related stocks, but concerns about overstretched valuations lingered, highlighted by Michael Burry’s warning that true end demand for AI may not justify current pricing, even as some economists argue an eventual correction would likely be milder and shorter than the dot-com bust.

Broader market sentiment improved after Fed official John Williams signaled there is room to lower the federal funds rate in the near term, describing policy as only modestly restrictive and noting that inflation risks have eased while employment risks have grown. His comments pushed market-implied odds of a December rate cut sharply higher and helped calm fears that strong recent jobs data would force the Federal Reserve to keep rates on hold for longer.

In corporate earnings, retailers were standouts: BJs Wholesale Club Holdings gained after beating third-quarter expectations and raising full-year profit guidance on stronger membership income, while Gap rallied on better-than-expected comparable sales driven by strong demand at Old Navy and Banana Republic. Ross Stores also advanced after topping Wall Street forecasts, with management highlighting a robust back‑to‑school season and solid trends through the rest of the quarter.

ASX Overnight: SPI 8519 (+1.09%)

The Day Ahead: there will be a bounce from the open today, but it is likely to be short lived.

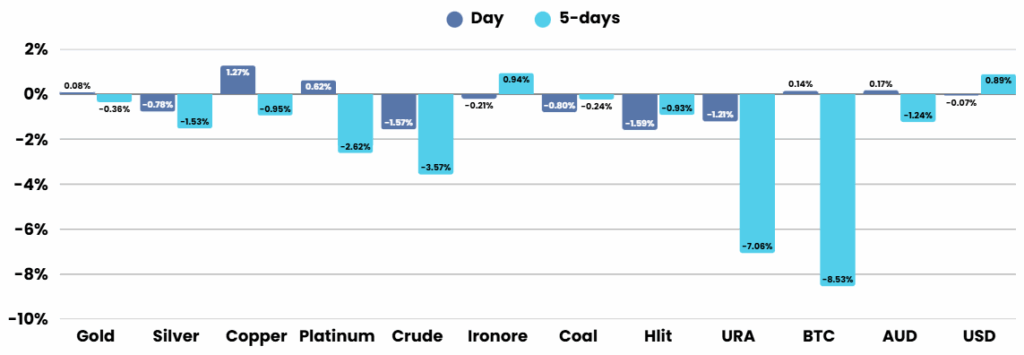

Last Session: The Australian sharemarket has its fourth consecutive weekly loss, with the S&P/ASX 200 down 1.5% to 8424.20 by Friday afternoon and November losses nearing 5%, its weakest month since September 2022. Sentiment soured after a stronger-than-expected US jobs report raised doubts about near-term rate cuts by the Federal Reserve. Materials led the decline, sliding nearly 4%, as BHP dropped 3.2% following reports of Chinese buyers halting some iron ore purchases. Gold stocks also fell, while Lovisa and Accent Group slumped on earnings concerns, and Webjet gained 1.1% after a higher takeover offer from BGH Capital.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.