Overnight – US/China tensions and Earnings jitters send stocks lower

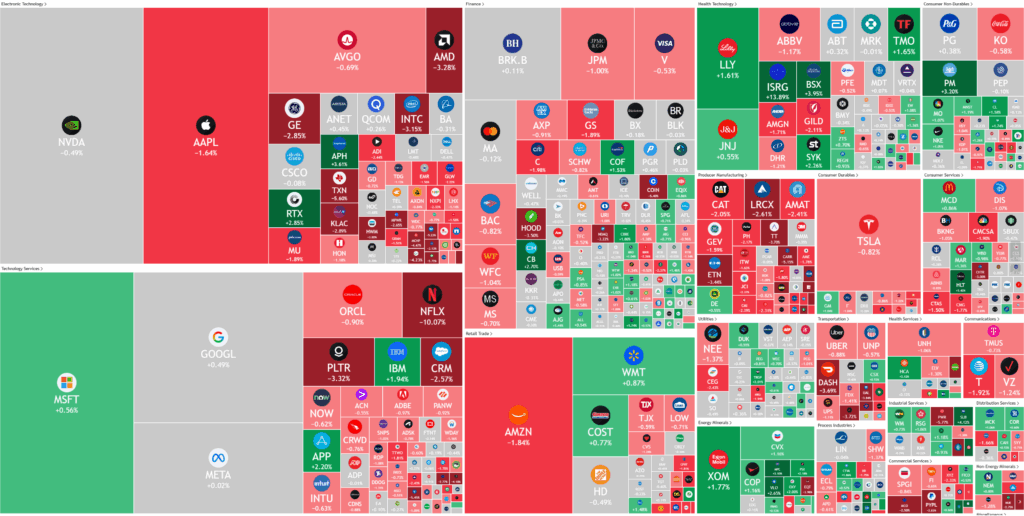

Stocks headed lower overnight, weighed down by fresh U.S.-China trade war concerns and a slump in streaming giant Netflix following an earnings miss. Tesla reported earnings after the bell with a miss on EPS but record deliveries and Free Cash Flow

Fresh tensions between the United States and China arose after reports indicated that the Trump administration is considering banning Chinese exports made with U.S. software. The potential move has heightened uncertainty over whether President Donald Trump will meet Chinese President Xi Jinping in South Korea later this month. This development threatens to further strain U.S.-China trade relations at a time when both sides are struggling to rebuild trust after years of tariff disputes.

Meanwhile, diplomatic efforts with Russia have stalled as plans for a summit between President Trump and President Vladimir Putin were shelved. Russian officials reportedly signaled no change in their stance on the war in Ukraine, casting doubt on any near-term diplomatic progress. These geopolitical complications have come amid already fragile global markets and heightened investor caution.

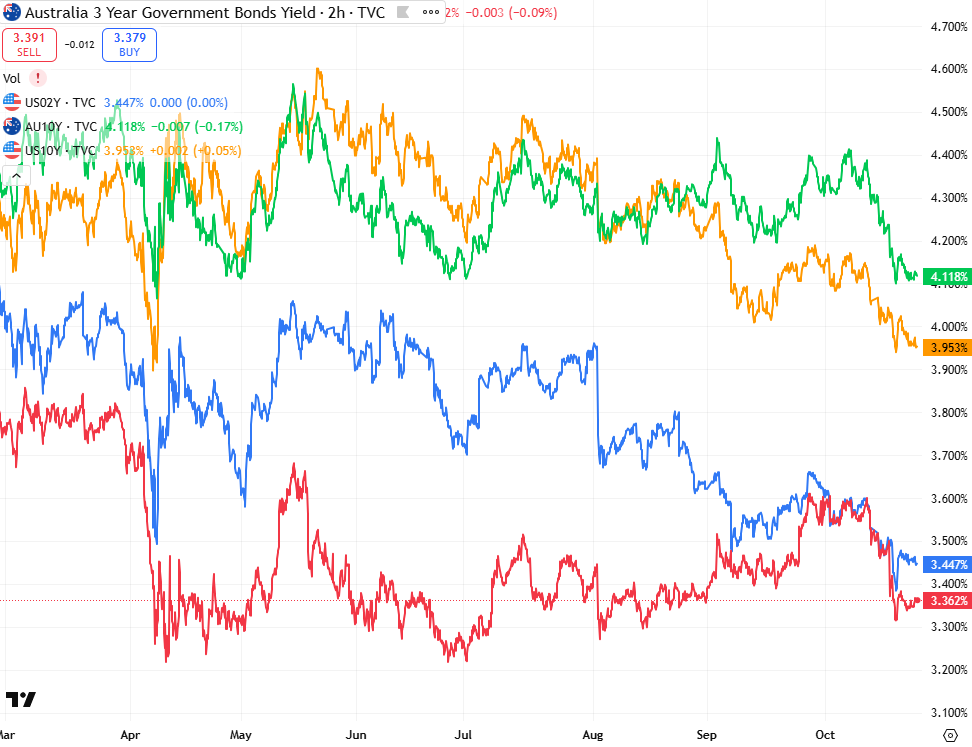

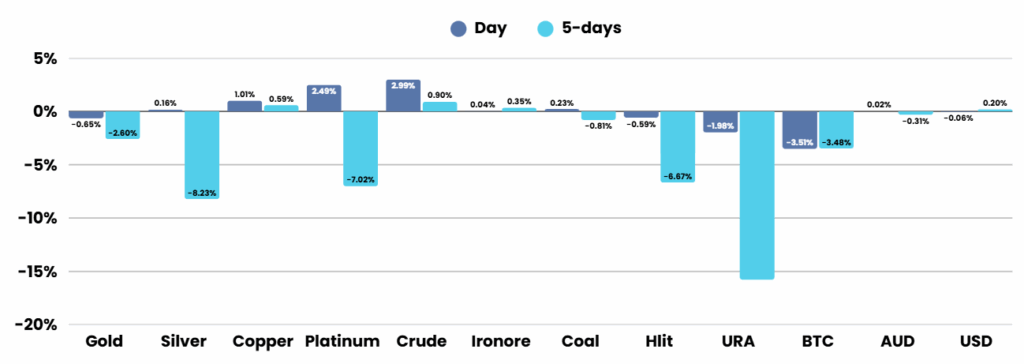

Investor focus now turns to the upcoming U.S. consumer price index report, expected to influence the Federal Reserve’s decision on an October interest rate cut. However, the prolonged federal government shutdown—now in its fourth week—is disrupting key data releases, creating additional uncertainty for policymakers. Gold prices slipped 1.49% to $4,062.39 an ounce as investors took profits, though the metal remains up more than 50% for the year, marking its strongest performance since 1979.

Corporate News & Earnings

- Tesla -2% – the company reported adjusted earnings per share (EPS) of $0.5 on revenue of $28.1 billion, compared with Wall Street estimates of $0.54 a share and $26.22B, respectively. Total deliveries for Q3 jumped 7% to 497,098 from the same period a year earlier. Sales were boosted by surge in consumers rushing to secure a $7,500 EV tax credit that expired late last month. But a jump in sales was offset by higher operating expenses. Gross margins excluding credits, a closely watched metric, rose to 17% in Q3 roughly unchanged from a year ago. Free-cash-flow FCF number came in 4x the expectation at 3.3B. The main show will be the earnings call where it is expected Elon will talk about Optimus Robots, energy and FSD

- AT&T -1.54% – added more wireless subscribers than expected in the third quarter, as bundled plans and heavy promotions around the latest iPhone launch helped it attract more customers in a fiercely competitive market.

- GE Vernova stock fell after the energy transition company missed third-quarter earnings estimates, despite revenue exceeding expectations on robust growth in orders and backlog.

- Hilton Worldwide +3.75% – stock gained after the hotel operator outpaced quarterly earnings expectations, even after it slashed its forecast for 2025 room revenue, hurt by muted U.S. travel demand.

- Netflix -10% – stock slumped after it reported a third-quarter operating margin of 28%, which missed Wall Street expectations, due largely to charges related to a spat with tax authorities in Brazil. Still, revenue and profit for the period grew, powered by the firm’s best-ever quarter for advertising sales, along with a jump in membership and higher prices.

- Apple -1.85% – stock fell after the Nikkei reported that the tech giant is “drastically” cutting production orders for its new iPhone Air model and shifting focus toward other iPhone 17 variants.

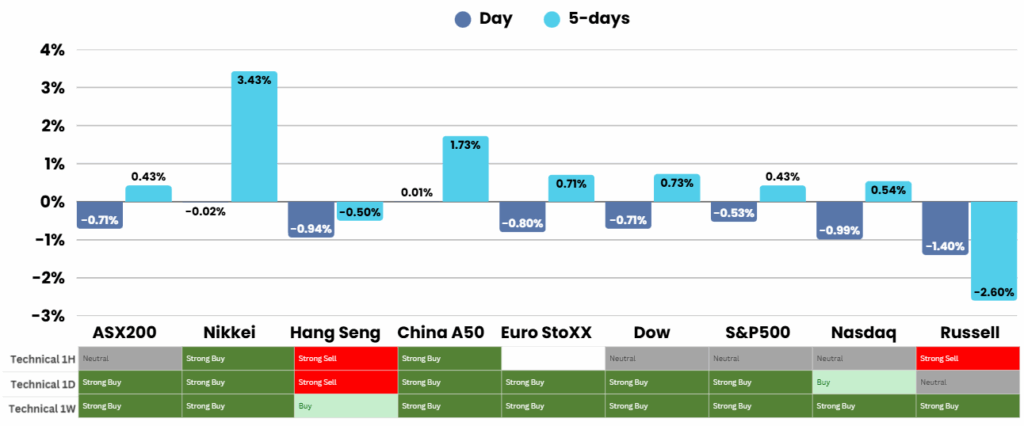

ASX Overnight: SPI 9020 (-0.16%)

The Day Ahead:

Should be a fairly mixed with a few company updates coming through

- Fortescue Metals recorded a first-quarter iron ore shipment of 49.7 million tonnes, up four per cent on the prior year and a record for a first quarter.

- Australian Clinical Labs will start a 12-month on-market share buyback of up to 19.5 million shares, representing about 10 per cent of its outstanding capital.

- IAG has upgraded its 2026 fiscal year guidance following the completion of its RACQ Insurance acquisition.

Yesterdays Session:

The Australian sharemarket pulled back from record highs on Wednesday, with the S&P/ASX 200 dropping 0.9 per cent to 9009 as a steep plunge in gold and silver prices sparked a broad sell-off in mining stocks. Major miners like BHP, Newmont, and Bellevue Gold were hit hard, while gains in energy and financial stocks, including Woodside and Pinnacle Investment Management, helped limit losses. Among standout movers, 4DMedical surged on a US rollout milestone and Adairs climbed despite issuing softer sales guidance.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.