Overnight – Tech surges higher led by Google after rave reviews of Gemini 3

Google led the market higher overnight as enthusiasm on their TPU technology and Gemini 3 re-ignited investors AI enthusiasm.

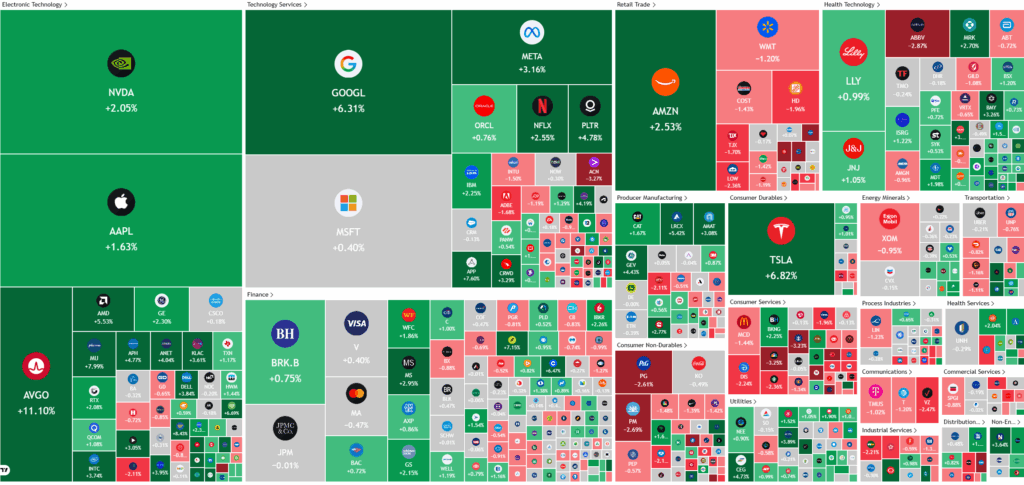

Alphabet led a tech stock revival, surging over 6% on optimism surrounding its AI model Gemini after a significant update closed the competitive gap with OpenAI. Reports of OpenAI’s CEO acknowledging Alphabet’s gains as a temporary business challenge further highlighted the market’s shifting momentum. Other AI-focused stocks such as NVIDIA and Oracle also posted gains, contributing to renewed enthusiasm in the technology sector’s AI segment.

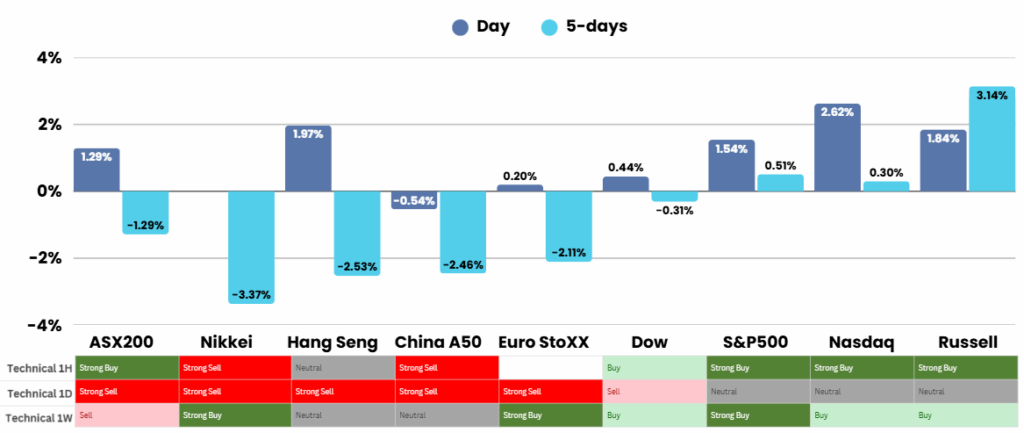

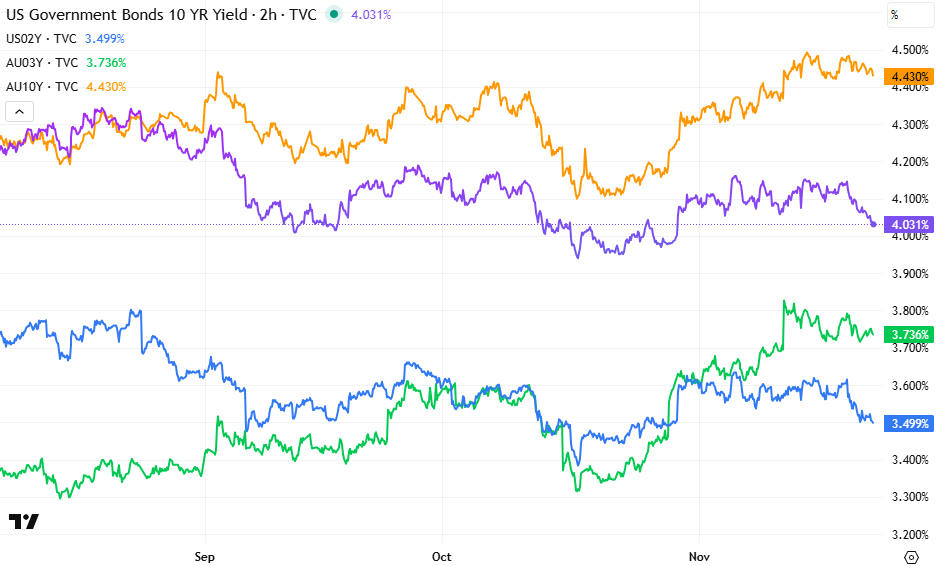

Market sentiment on U.S. interest rates turned positive after key Federal Reserve officials, including New York Fed President John Williams and Governor Christopher Waller, publicly supported a potential rate cut in December. This stance caused a sharp rise in expectations for a 25-basis-point rate cut, with probability estimates increasing from 44% to about 69% in recent sessions. Investors are closely watching several upcoming economic indicators, such as producer inflation, retail sales, industrial production, and third-quarter GDP, for further clarity on the Federal Reserve’s likely course of action.

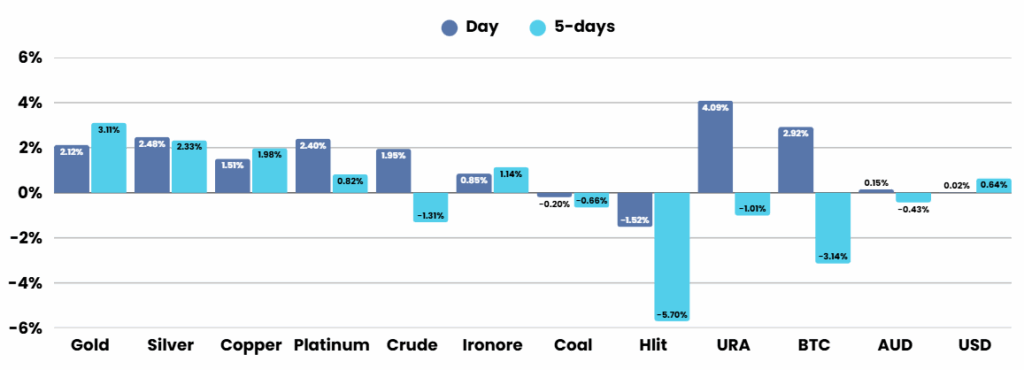

Geopolitical developments also influenced investor outlook, as President Trump accepted an invitation to meet Chinese President Xi Jinping in April, reciprocating with an offer for Xi to visit the U.S. later in the year. These planned meetings have sparked hopes that the world’s two largest economies could begin easing trade tensions, adding another layer of optimism to global financial markets.

ASX Overnight: SPI 8573 (+0.43%)

The Day Ahead: a bit of corporate activity with announcements from IPD, SRG Global, Lynas, Iress and Ramsay,

Last Session: The Australian sharemarket rebounded from a six-month low on Monday, with the S&P/ASX 200 rising 1.2 per cent to 8514.40 as optimism returned on expectations of a potential US rate cut. Gains were led by tech, industrial, and healthcare stocks, with WiseTech, Life360, and CSL posting strong advances. Qube surged nearly 18 per cent after receiving an $11.6 billion bid from Macquarie , and Monash IVF soared over 40 per cent after rejecting an unsolicited offer. Other notable gainers included Lynas , MA Financial , and Pro Medicus , while BHP edged lower after ending talks with Anglo American .

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.