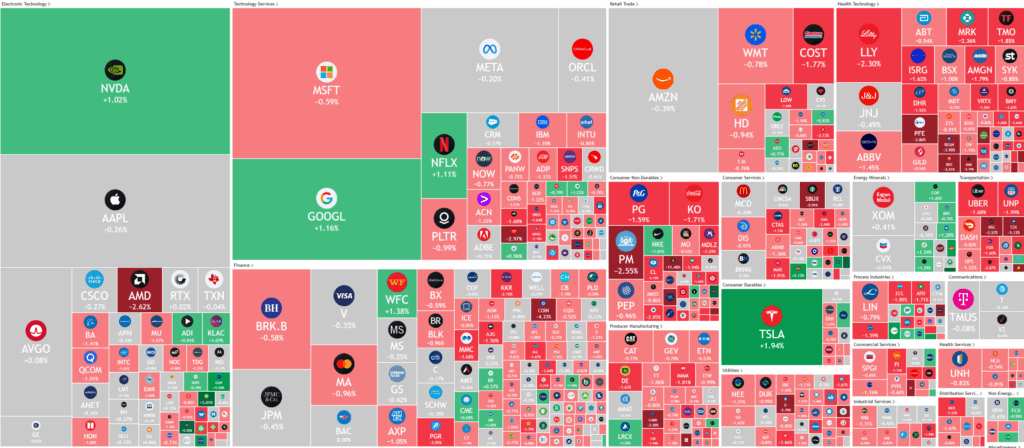

Overnight – Nvidia carries index as broader markets drift lower

The broader market was weaker overnight, saved only by strength in Nvidia as investors remain positive on the chipmakers earnings this Wednesday

Nvidia led gains in the technology sector at the start of a critical week for chipmakers, with investors optimistic ahead of its quarterly earnings report due Wednesday. Wall Street expects the company to beat forecasts and deliver strong guidance, supported by robust demand trends and a rebound in China sales following President Trump’s decision to ease restrictions on H20 chip exports. Analysts at Wedbush raised their projections, citing stronger-than-expected demand and improved outlook for Chinese revenues. In contrast, Intel’s stock slipped after cautioning that a U.S. government stake of nearly 10% could expose it to regulatory and geopolitical risks overseas. Apple also edged higher on reports of a major three-year redesign plan for its iPhone lineup.

Elsewhere, deal activity accelerated, with Keurig Dr Pepper announcing an $18 billion acquisition of Dutch coffee company JDE Peet’s. The companies aim to split operations into separate divisions focusing on coffee and cold beverages post-merger. In private equity, Thoma Bravo continued its buying spree with a $2 billion purchase of Verint Systems, adding to its expanding software portfolio. This follows its recent $10.6 billion acquisition of Boeing’s Jeppesen navigation unit, signaling the firm’s push deeper into enterprise technology.

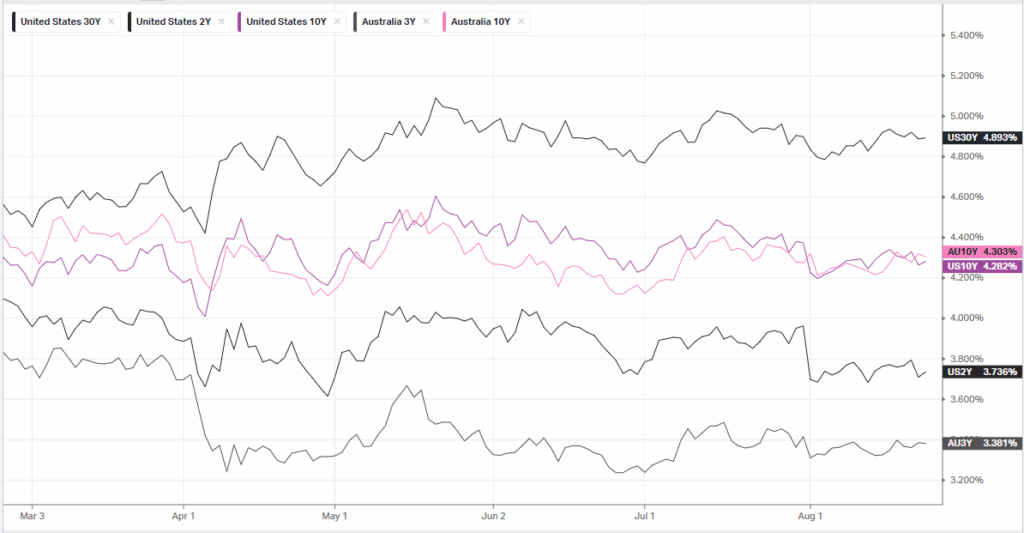

Meanwhile, U.S. Treasury yields extended gains as investors weighed remarks from Federal Reserve Chair Jerome Powell at Jackson Hole, where he hinted at the possibility of a September rate cut. Powell highlighted that weaker labor market conditions reduce inflationary risks from tariffs, effectively lowering the threshold for monetary easing. Markets are now awaiting additional signals from Fed officials and key inflation data due Friday, which could further shape expectations for the Fed’s next move.

ASX SPI 8930 (-0.02%)

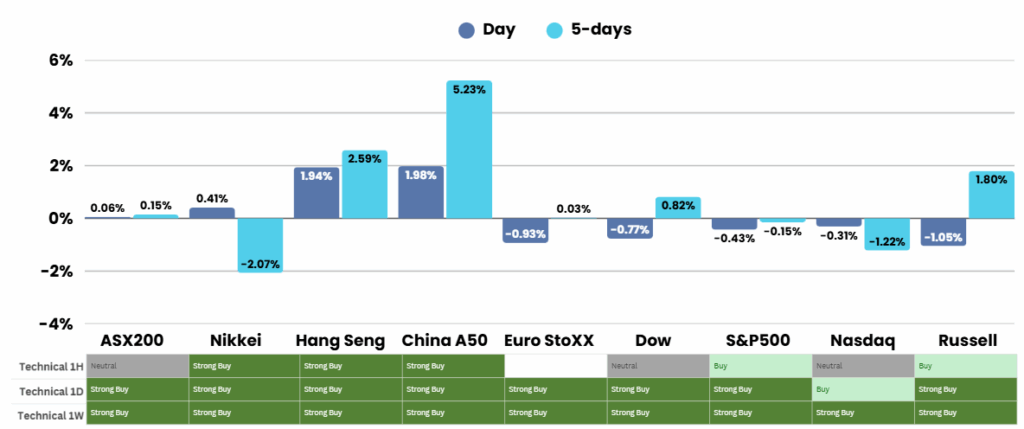

Indicies worldwide saw selling on Monday, starting in Asian session yesterday. We expect this to continue into September with seasonal softness.

The main earnings today expected are Coles, Viva Energy, AUB Group

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.