Overnight – Index shrugs off Nvidia Weakness to close in the green

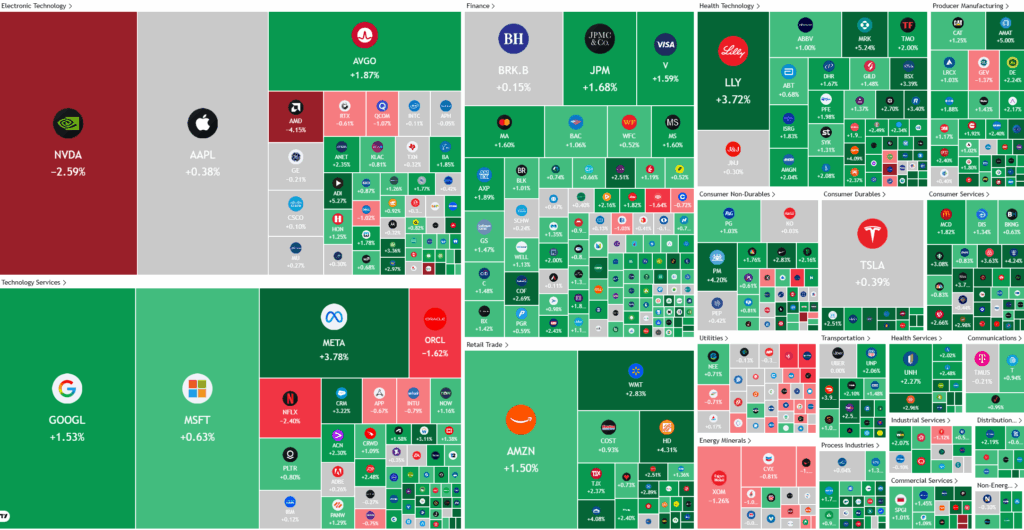

The indexes shrugged off weakness in Nvidia as a jump in other megacaps, google and Meta along with health care and consumer stocks helped carry the broader market

Nvidia shares have come under pressure on concerns about increased AI chip competition after reports that Google is in talks to supply Meta with its own AI chips from 2027, a move that has weighed on sentiment toward the tech‑heavy Nasdaq . Together, these developments highlight a market trying to balance enthusiasm for AI-driven growth with fears that margins and market share could come under strain as more large players enter the chip race.

Away from mega‑cap tech, recent earnings have been notably stronger in the retail and health care sectors, providing some support to the broader equity market. Abercrombie & Fitch , Kohl’s , Best Buy and Dick’s Sporting Goods all saw their shares jump after raising profit forecasts or delivering better‑than‑expected results, signaling resilient consumer demand across apparel, electronics, and sporting goods. Health care stocks also outperformed, with names such as Merck & Co. , Revvity and Eli Lilly and Company leading a more than 2% advance in the sector, underscoring ongoing investor appetite for defensive growth areas tied to pharmaceuticals and life sciences.

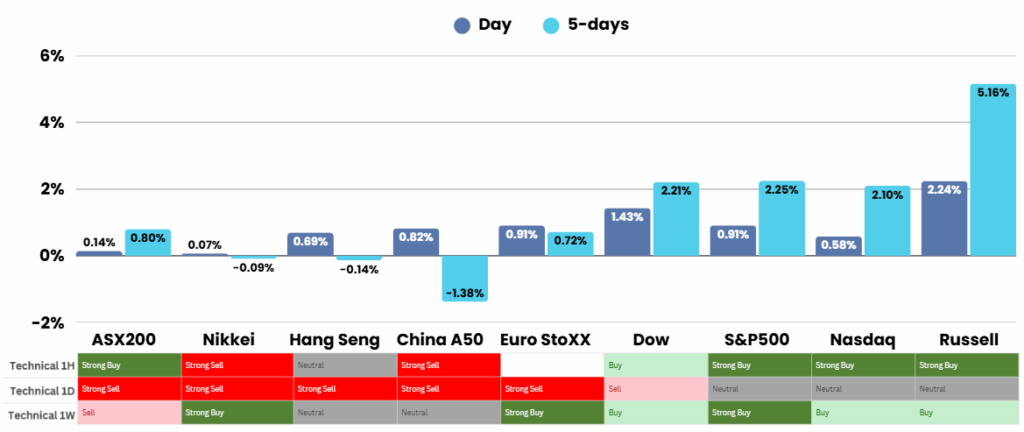

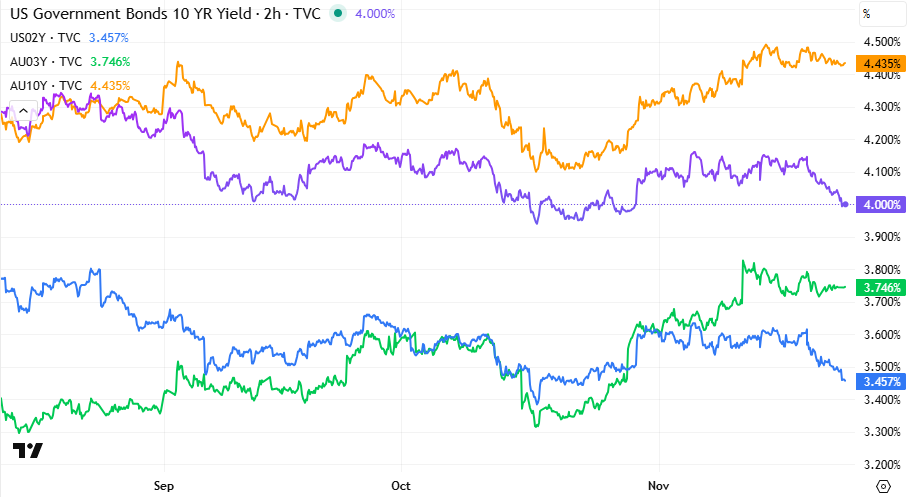

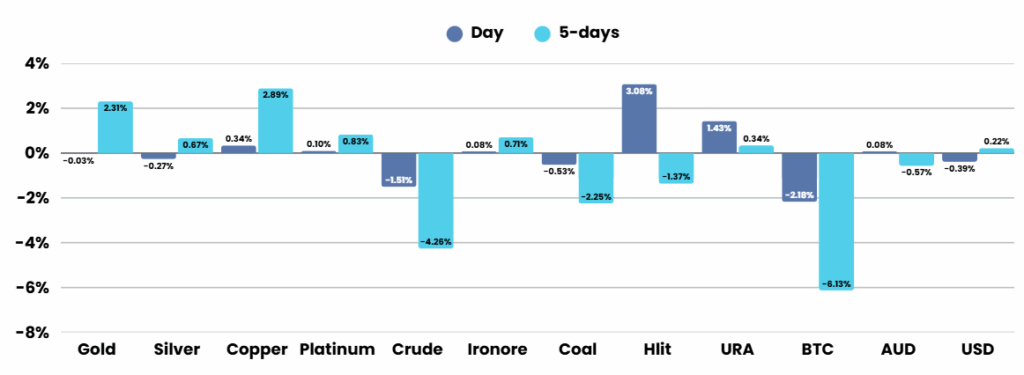

On the macro front, the Federal Reserve is moving toward a critical December 9–10 meeting amid growing expectations of another interest rate cut, supported by dovish remarks from key officials including New York Fed President John Williams and others aligned with Chair Jerome Powell. September U.S. retail sales rose 0.2%, a marked slowdown from August’s 0.6% gain and below economists’ forecasts, reinforcing the message of a cooling but still steady consumer and giving policymakers some cover to ease further, even as internal divisions on the committee remain. With odds of a December cut still around 80% and the Fed’s preferred PCE price index data due next, markets are weighing softer growth and inflation against the risk that the central bank may not feel enough urgency to deliver additional policy support beyond year‑end.

ASX Overnight: SPI 8646 (+1.13%)

The Day Ahead: the ASX is starting to look like value compared to it US peers, significantly lagging in the tech sector.

The first monthly CPI release is set for Wednesday, at 11.30am AEDT. NAB said it expects headline CPI of 3.6 per cent year-over-year, a tenth higher than our estimate of the September print.

You can now listen & Watch to the Pre Market Pulse

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.

DIY US Employment Data – US Corporate Lay-off announcements

In the absence of US Govt figures from the BLS, we collated the publicly announced corporate lay-offs