Overnight – Trumps hostile takeover of the Fed weighs on investor sentiment

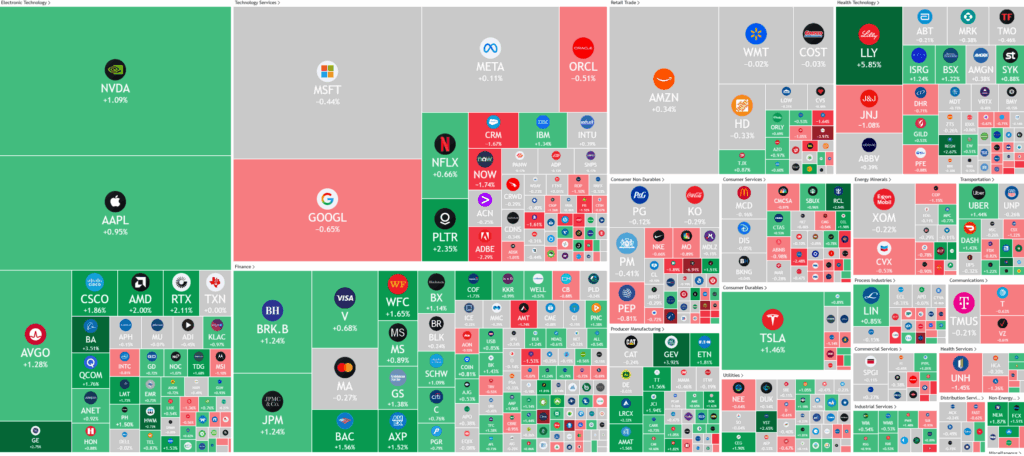

Stocks edged higher overnight as rising health care and tech stocks helped offset concerns about President Trumps apparent “hostile takeover” of the Federal Reserve, bringing into question its independence

President Donald Trump’s abrupt dismissal of Lisa Cook from the Federal Reserve has put the central bank’s independence in the spotlight once again. Trump alleged Cook was tied to mortgage fraud, claims originally raised by FHFA Director William Pulte, though Cook strongly denied any wrongdoing and vowed to challenge her removal in court. This high-profile clash underscores Trump’s ongoing push to exert influence over the Fed, previously seen in his efforts to pressure Chair Jerome Powell into cutting rates. The move fuels broader concerns that political interference could damage U.S. economic credibility and shake investor confidence in the impartiality of monetary policy.

Meanwhile, health care stocks saw sharp gains led by Eli Lilly, which surged more than 5% after reporting successful trial results for its once-daily weight-loss pill, orforglipron. Analysts at Truist Securities suggested the treatment could unlock a multi-billion-dollar opportunity given its efficacy and easier production process compared to existing drugs. Other sector players, including Regeneron Pharmaceuticals and Henry Schein, also advanced, helping to buoy health care shares more broadly. The news highlights the growing investor enthusiasm for pharmaceutical companies anchoring innovation in the obesity treatment market.

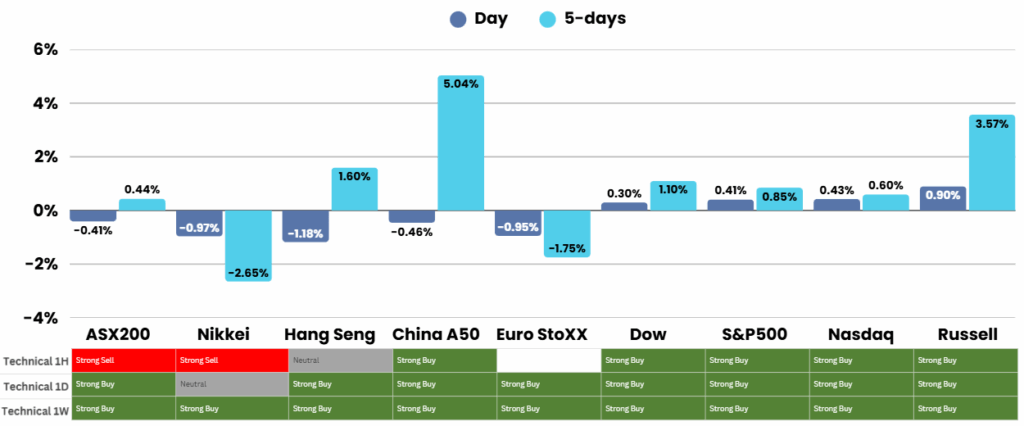

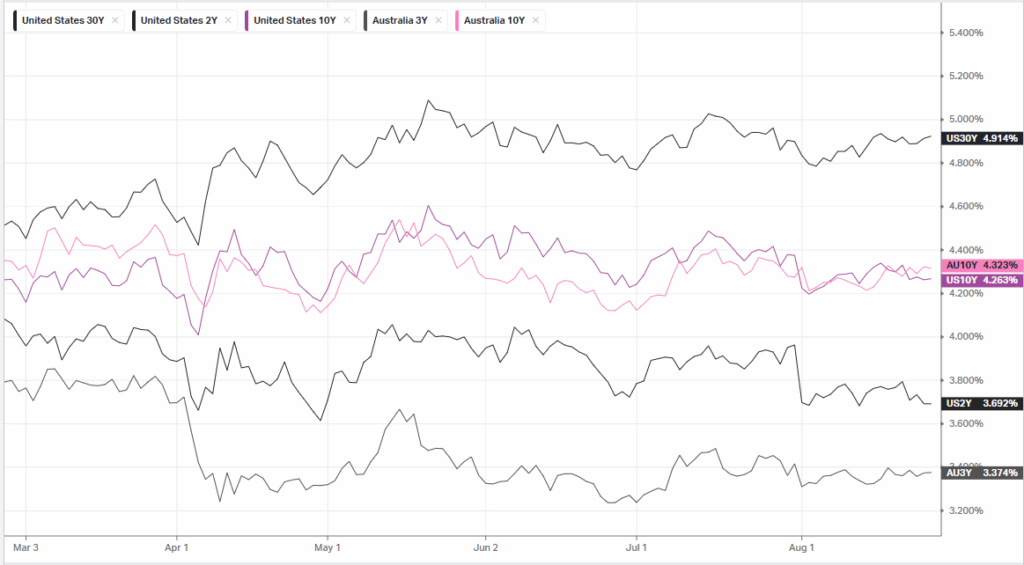

Stronger-than-expected U.S. economic data also shaped market sentiment. Consumer confidence dipped slightly in August but remained above forecasts, while core capital goods orders jumped 1.1% in July, pointing to resilience in business investment. However, overall durable goods orders fell for a second straight month, weighed down by fewer aircraft bookings. Despite mixed signals, Wall Street continues to bet on a Federal Reserve rate cut in September, with Morgan Stanley projecting a steady path of quarterly easing into 2026. Traders are now eyeing upcoming GDP revisions and jobless claims figures for further clarity on the growth outlook.

In tech, investor attention is fixed on Nvidia’s upcoming earnings, with the chipmaker expected to post a near 50% profit surge on revenue approaching $46 billion. Nvidia’s report is seen as a crucial test for the broader AI-driven rally following recent volatility in tech stocks tied to uncertainty about AI’s long-term prospects. At the same time, Apple shares edged higher after the company confirmed a September 9 event, widely expected to unveil the iPhone 17. Together, Nvidia’s results and Apple’s product launch are set to dominate near-term market drivers at the intersection of AI, consumer demand, and innovation in the tech sector.

ASX SPI 8942 (+0.53%)

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.