Overnight – Investor optimism sky high on potential rate cuts & US/China Trade deal

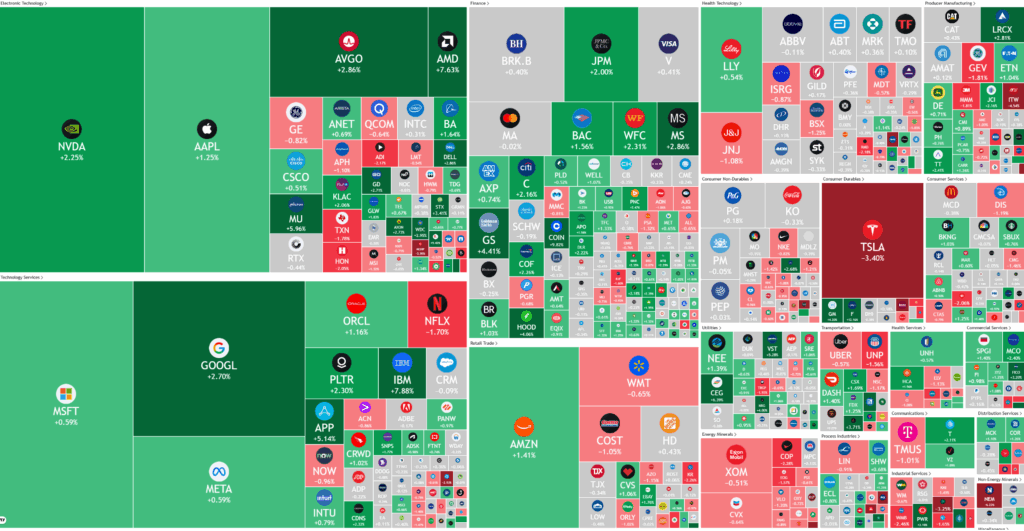

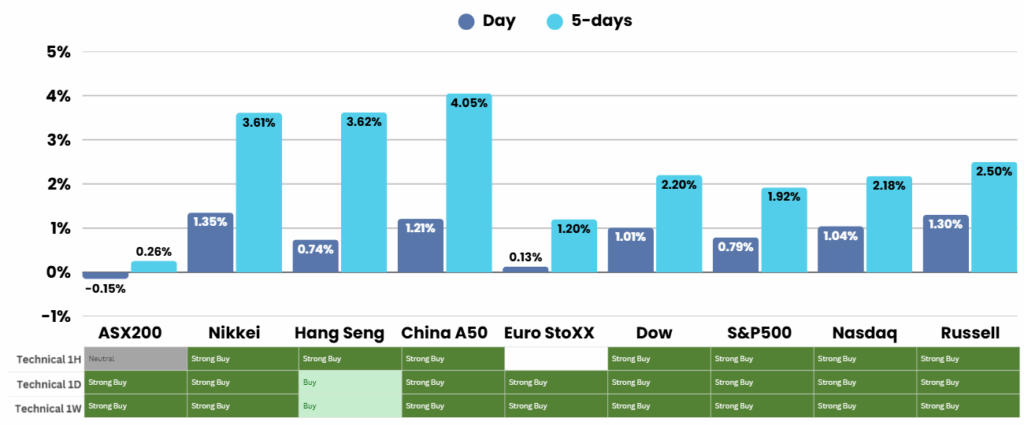

Stocks headed higher on Friday as investors saw the 3% CPI number as the “all clear” for the Fed to cut rates. Progress in the US/Chinese trade deal will also increase optimism.

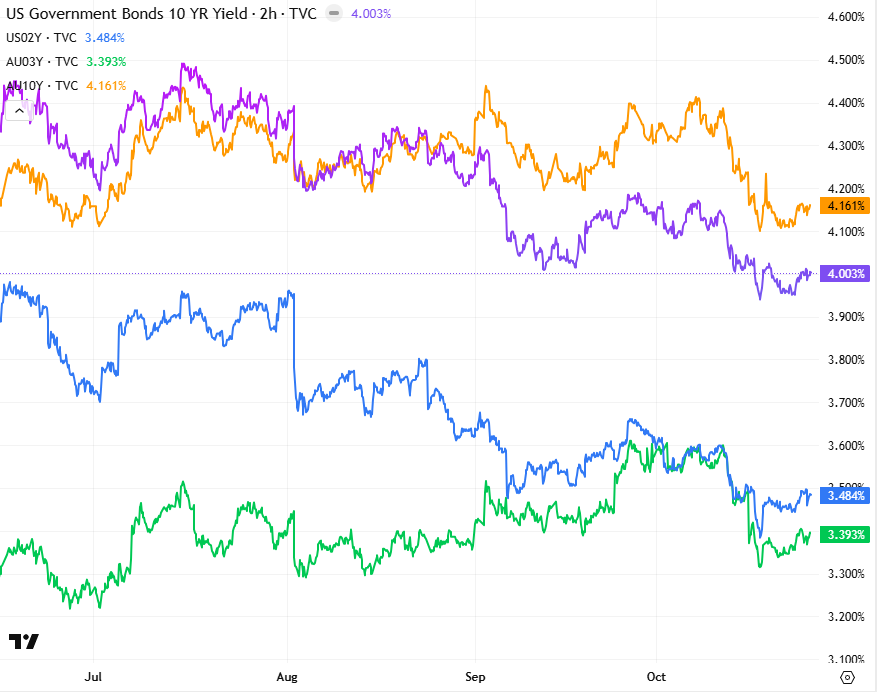

U.S. inflation data released Friday showed that consumer prices rose less than expected in September, reinforcing expectations for an October rate cut by the Federal Reserve. The Consumer Price Index increased 3.0% annually and 0.3% month-over-month, both slightly below forecasts, while the core CPI – which excludes food and energy – also eased to 3.0% from the prior month’s rate. Economists interpreted the cooling inflation as a signal that the Fed could move forward with ending quantitative tightening and begin monetary easing. The release carried added importance after a prolonged government shutdown delayed key economic reports.

Corporate earnings provided additional momentum for markets. Intel’s stock surged following a strong third-quarter performance driven by aggressive cost reductions and strategic investments from Nvidia, SoftBank, and the U.S. government. Ford also beat expectations, aided by robust demand for SUVs and trucks, while Target announced plans to cut roughly 1,800 corporate roles in a major restructuring effort. Attention now turns to next week’s earnings from five of the “Magnificent Seven,” including Apple and Microsoft, which are expected to influence broader market sentiment.

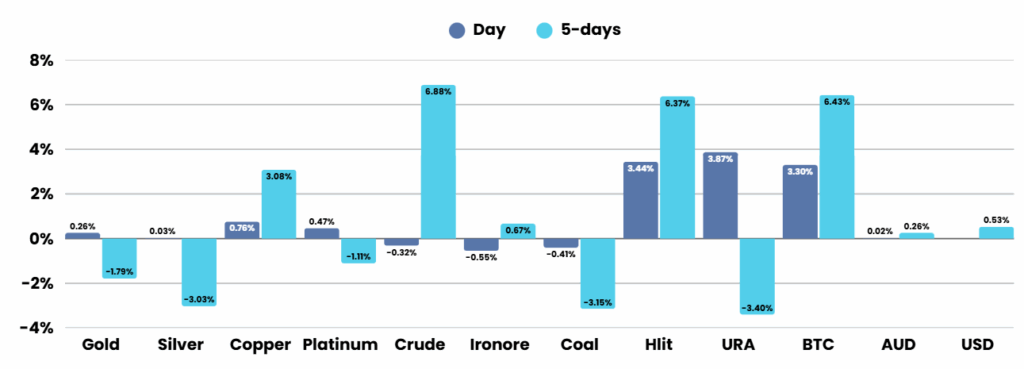

Geopolitical developments lifted investor confidence after the White House confirmed that President Donald Trump will meet Chinese President Xi Jinping during the upcoming APEC summit in South Korea to ease tensions following recent trade threats involving potential U.S. tariffs and Chinese restrictions on rare earth exports. Markets welcomed the possibility of renewed dialogue between the world’s two largest economies, even as President Trump ruled out resuming trade talks with Canada over alleged deceptive advertising practices. In the past 48 hours, both the U.S. and China confirmed reaching a preliminary trade deal framework under which China will delay rare earth export controls and increase U.S. agricultural imports, while the U.S. will suspend new tariffs, extend the current truce, and pledge cooperation on restricting fentanyl precursor exports, pending final approval from Trump and Xi later this week.

ASX Overnight: SPI 9061 (+0.28%)

The Day Ahead:

Rate cut optimism and significant progress in the US/Chinese trade deal will increase optimism across the board, expect a rally in the first half of the week

Yesterdays Session:

The Australian share market slipped 0.2% on Friday as investors grew cautious ahead of next week’s meeting between President Donald Trump and China’s Xi Jinping, and amid renewed trade tensions with Canada. Tech stocks advanced but healthcare and major banks weighed on the S&P/ASX 200, which closed at 9019.1 yet remained up 0.2% for the week. Energy shares were mixed following US sanctions on Russian oil majors, miners moved unevenly, and lithium producers surged led by Pilbara Minerals’ 8.3% jump. GPT rose on a major property deal, while Mount Gibson Iron plunged after shutting its Koolan Island mine.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.