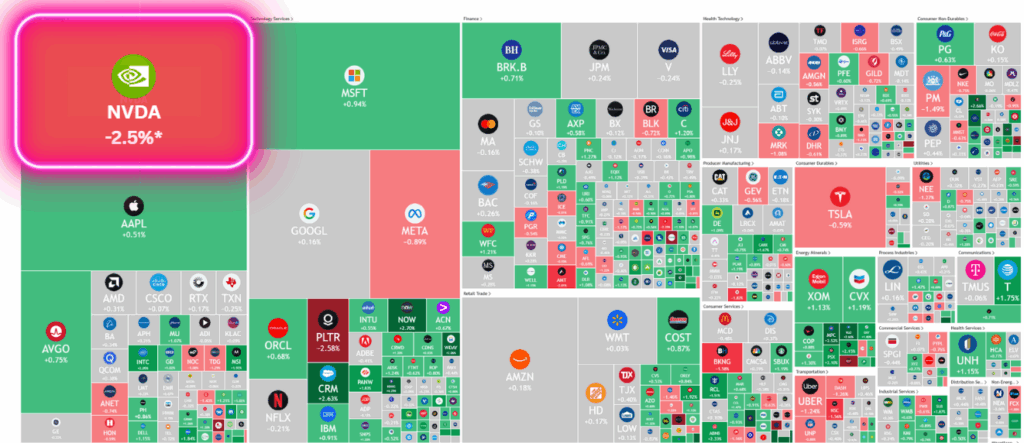

Overnight – Nvidia beats, but shares fall as Investors get valuation vertigo

Stocks eked out a fresh record in the S&P500 pre-Nvidia earnings, which beat analysts expectations, but disappointed investors, falling 2.5% in aftermarket trading

Nvidia posted stronger-than-expected second-quarter earnings, but its data center revenue narrowly missed estimates, weighed down by U.S. restrictions on sales of its H20 chips to China. While the company issued upbeat guidance for the current quarter, it highlighted uncertainties by excluding potential H20 shipments to China from its outlook. Investors remain concerned about the impact of ongoing export controls on one of Nvidia’s key markets despite its strong positioning in AI-driven chip demand.

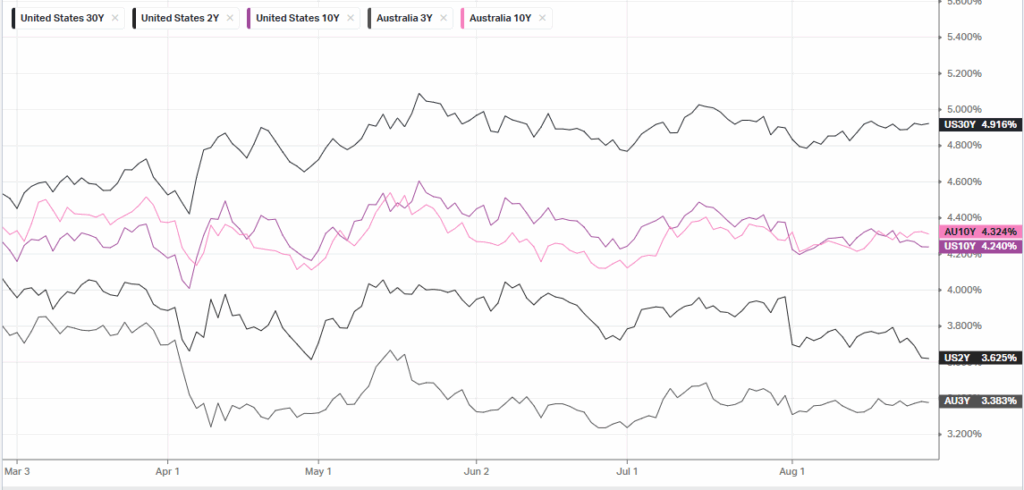

Meanwhile, U.S. political developments have drawn attention as President Donald Trump seeks to remove Federal Reserve Governor Lisa Cook, accusing her of mortgage fraud—allegations she denies. Cook intends to challenge the move legally, setting the stage for a long court process. With her tenure running through 2038, the dispute has raised alarms over possible political interference in the Fed’s independence. Trump and his allies have been pressuring the central bank to cut interest rates more aggressively, but Fed officials remain focused on balancing inflation risks and labor market strength, underscoring concerns about maintaining credibility in U.S. monetary policy.

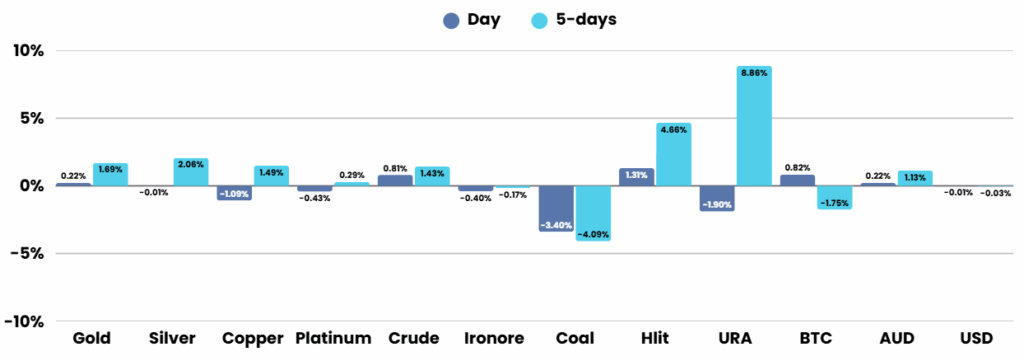

Elsewhere in corporate earnings, several companies delivered strong results. Retailers such as Kohl’s and Williams-Sonoma surprised on the upside, while MongoDB and Okta sparked rallies after raising forecasts on stronger demand, particularly from AI-driven growth in the software sector. PVH also lifted its outlook on the back of celebrity-driven sales momentum, while Canada Goose shares surged amid reports of a possible private buyout. In energy markets, oil producers and service firms advanced as crude prices rebounded following U.S. data showing a steeper-than-expected drop in inventories, helping lift broader market sentiment.

Nvidia Earnings

Nvidia posted stronger-than-expected Q2 results with earnings of $1.04 per share on $46.7 billion revenue, beating forecasts. Data center sales jumped 56% to $41.1 billion but narrowly missed estimates due to U.S. restrictions on H20 chip sales to China. Gaming revenue rose 49% to $4.3 billion, while its new Blackwell platform grew 17% sequentially. For Q3, Nvidia guided revenue of $54 billion, above expectations, and announced a $60 billion share buyback expansion. Shares fell about 2% after hours.

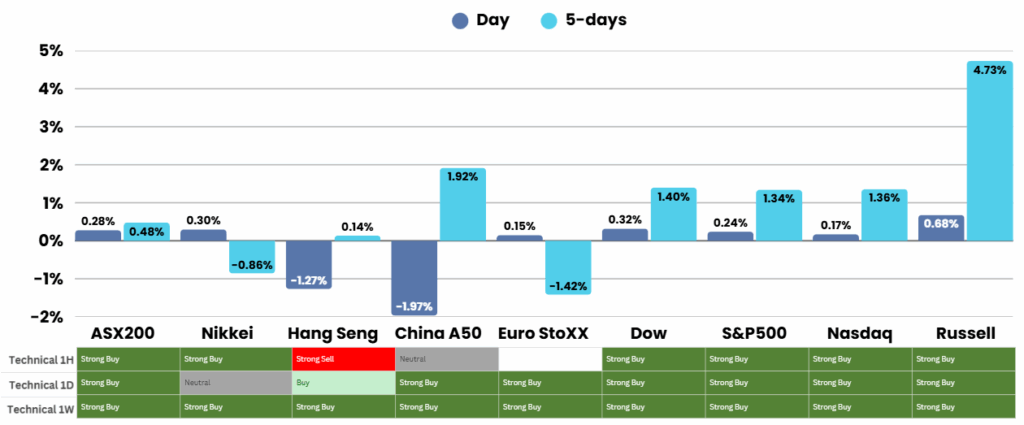

ASX SPI 8938 (+0.01%)

The local market is likely to see some risk off after the much higher than expected inflation numbers yesterday squashing hopes of an aggressive rate cut cycle. Couple this with looming seasonal weakness and poor price action in Nvidia after earnings, we are firmly on the sell side only

Earnings

- IGO Limited has posted a net loss after tax of $955 million for the 2025 financal year, down from a $3 million profit a year earlier, as impairments and weak commodity markets hit earnings.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.