Overnight – Investor optimism on …. everything, pushes stocks to fresh highs

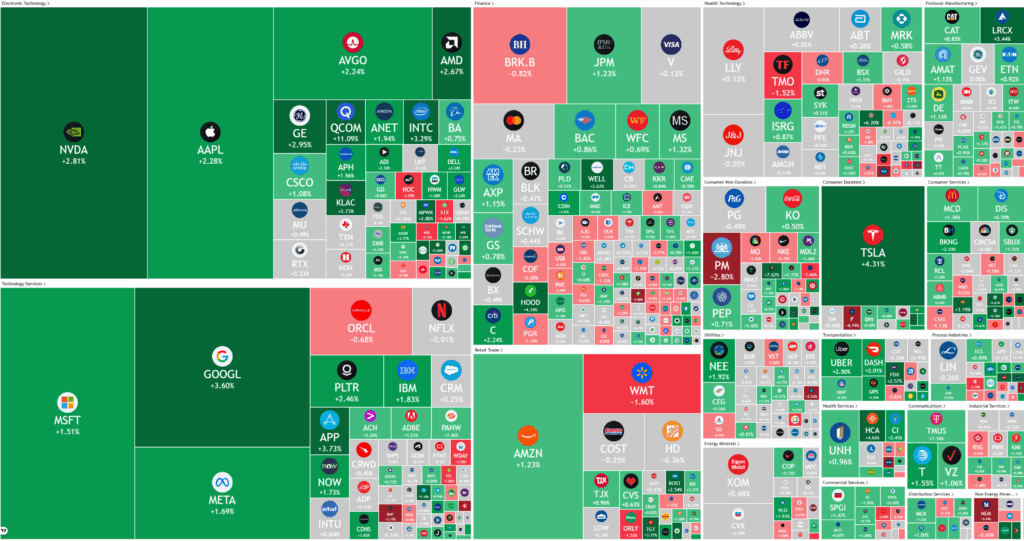

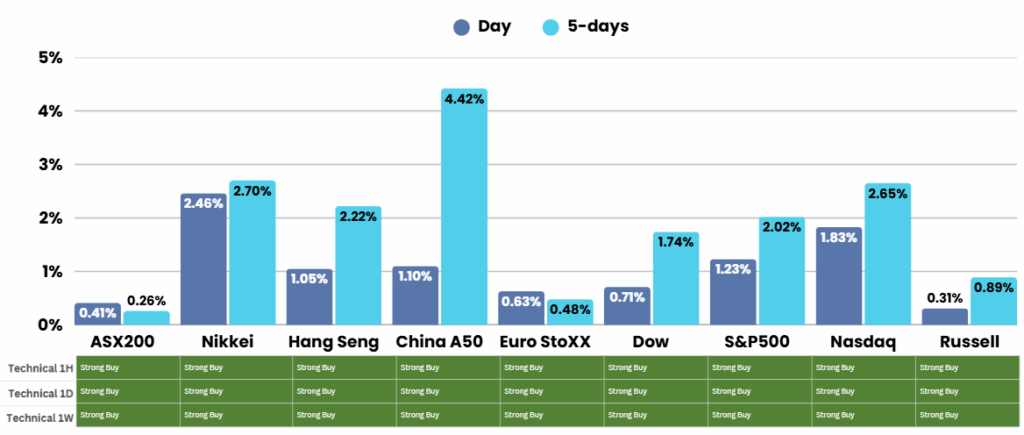

Records everywhere overnight as investors optimism on everything from rate cuts to AI to Global trade had investors piling into the equity market

The U.S. and China made substantial progress toward resolving their trade dispute over the weekend by agreeing on the framework of a deal. U.S. Treasury Secretary Scott Bessent confirmed that the outline effectively removed the risk of President Donald Trump imposing 100% tariffs on Chinese imports starting November 1. The framework, expected to be finalized when President Trump meets Chinese President Xi Jinping later this week, has lifted market confidence by reducing fears of a fresh escalation. The breakthrough came on the sidelines of ASEAN meetings in Malaysia, with the finalized agreement potentially marking a significant step toward normalizing global trade relations.

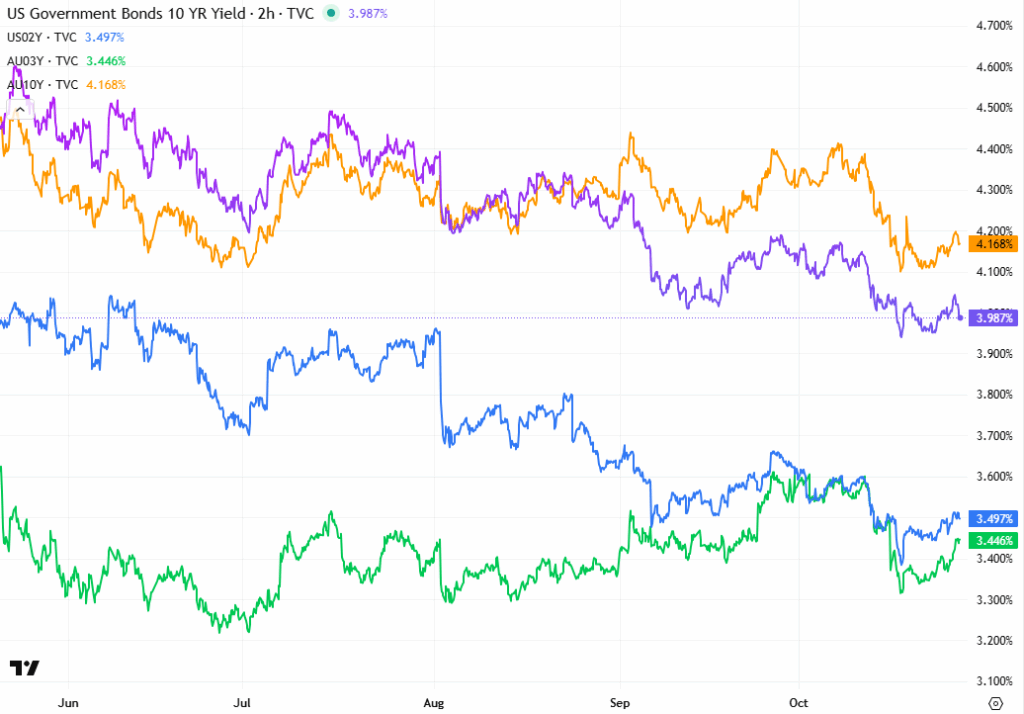

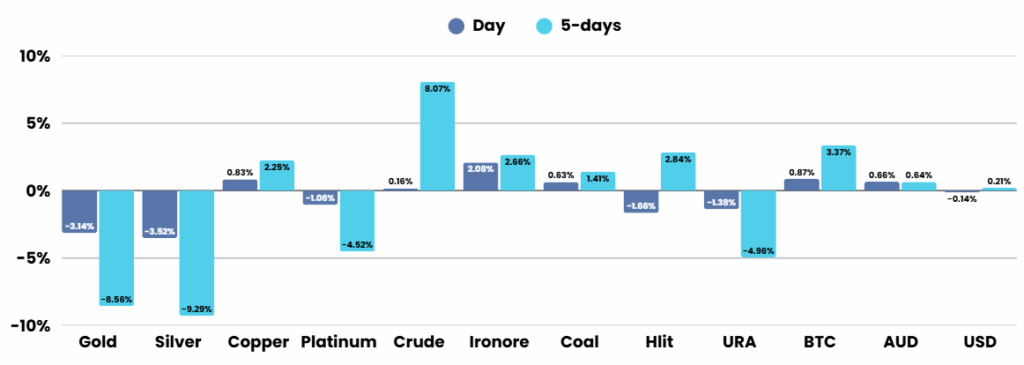

Investor sentiment improved further ahead of the Federal Reserve’s policy meeting on October 29, after September’s U.S. inflation data came in softer than expected. Markets have now priced in a 25-basis-point rate cut, with expectations of more easing into early 2026. Analysts from ING forecast additional rate reductions in December and early next year. Despite the improving trade outlook, easing inflation reinforced the view that the Fed will continue to support economic growth through monetary stimulus. Meanwhile, gold prices fell sharply as easing trade tensions reduced demand for safe-haven assets, though expectations of looser policy helped limit the downside.

In the corporate sector, Qualcomm surged over 11% after launching a new AI chip designed to challenge Nvidia and AMD, ahead of the Nvidia GTC event in Washington this week. Investor attention now turns to key tech earnings, with Microsoft, Meta, and Alphabet reporting midweek, followed by Apple and Amazon later. Reports indicate Amazon is preparing to cut around 30,000 corporate jobs as it refocuses spending. Broader commodity markets reflected improving trade optimism: silver and platinum eased, while copper prices rose to record highs amid tight global supply and the ongoing shutdown of Freeport’s Grasberg mine in Indonesia.

ASX Overnight: SPI 9041 (-0.40%)

The Day Ahead:

The rally currently like a train without a station and there is no reason to get in the way until later this week. Most of the positivity was already in US futures when we shut

Yesterdays Session:

The Australian sharemarket rose on Monday, lifted by hopes of a U.S. Federal Reserve rate cut and progress in U.S.-China trade talks. The S&P/ASX 200 gained 0.4% to 9058.4, with most sectors advancing, led by industrials, financials, and technology. Major banks climbed around 1%, tech stocks rallied, and industrials outperformed with Qantas up 3.5%. In contrast, rare earths producers slumped after recent gains, while Nuix and Ramelius Resources fell sharply and PolyNovo rose despite leadership changes.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.