Overnight – Stocks grind to new record on economic growth surprise

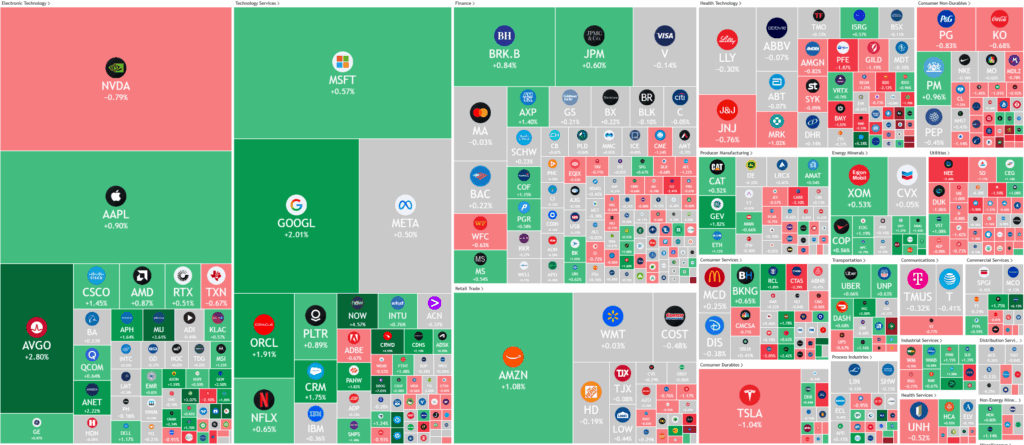

Stock crawled to another record overnight, as investors weighed a surprise uptick in GDP and investor disappointment in Nvidia results.

Nvidia reported stronger-than-expected quarterly earnings and offered upbeat revenue guidance, but investor sentiment dimmed after the company’s data center revenue fell short of expectations. Concerns deepened when Nvidia revealed it had no sales of its China-focused H20 chips during the quarter and did not include any potential shipments to China in its outlook. This combination of a key revenue miss and uncertainty over future demand in China triggered a pullback in Nvidia’s stock, denting the broader tech rally.

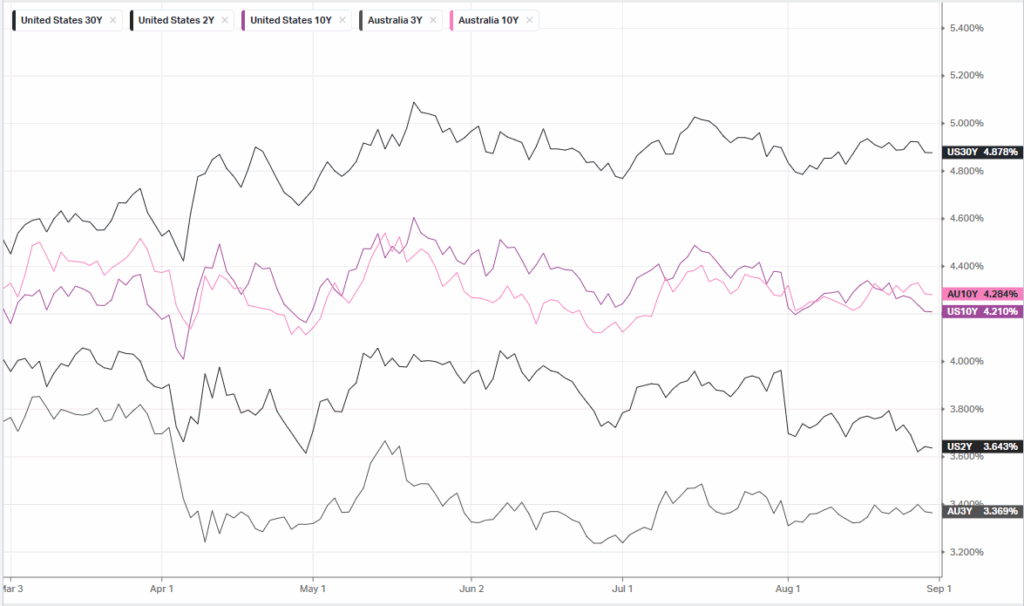

On the macroeconomic front, fresh data showed the U.S. economy grew by 3.3% in the second quarter, stronger than previously estimated. The economic strength, coupled with solid earnings season results, had supported markets earlier in the summer, but momentum waned heading into late August as doubts grew over Federal Reserve policy and technology stocks suffered. Still, expectations for a September Fed rate cut increased after Fed Governor John Williams reiterated that upcoming meetings remain “live” and risk assessments appear more balanced. Markets are now closely watching Friday’s PCE price index release and the next payrolls report for further policy signals.

Elsewhere in corporate earnings, several major names posted results that moved their shares. CrowdStrike rose after reporting solid quarterly performance, while Snowflake shares jumped following an increase in its annual product revenue guidance. Brown-Forman saw steady demand for its ready-to-drink beverages, beating sales estimates, while Bath & Body Works struggled with higher costs that pressured profits. Dollar General, meanwhile, raised its annual forecasts, benefitting from resilient demand from economically cautious shoppers amid inflationary pressures.

Earnings

- Snowflake (SNOW) +20% – rocketed by a jaw-dropping 20% after hours, posting Q2 revenue of $1.14 billion—**beating analyst estimates by $50 million and marking 32% year-over-year growth. Adjusted EPS came in at $0.38, smashing the $0.27 forecast and more than doubling last year’s result. Snowflake also raised its FY26 product revenue guidance to $4.40 billion and improved its operating margin outlook, impressing both Wall Street and analysts with robust cloud and AI-driven demand.

- CrowdStrike (CRWD) +5% – delivered solid Q2 numbers, but the market focused on its cautious outlook—**revenue hit $1.17 billion (up 21% YoY), narrowly topping estimates, while EPS of $0.93 beat the $0.83 consensus. However, CRWD guided Q3 revenue slightly below expectations ($1.208–$1.218 billion vs. $1.23 billion consensus), citing lingering effects from last year’s botched update and timing of incentive programs—prompting a pre-market drop despite strong underlying cybersecurity demand

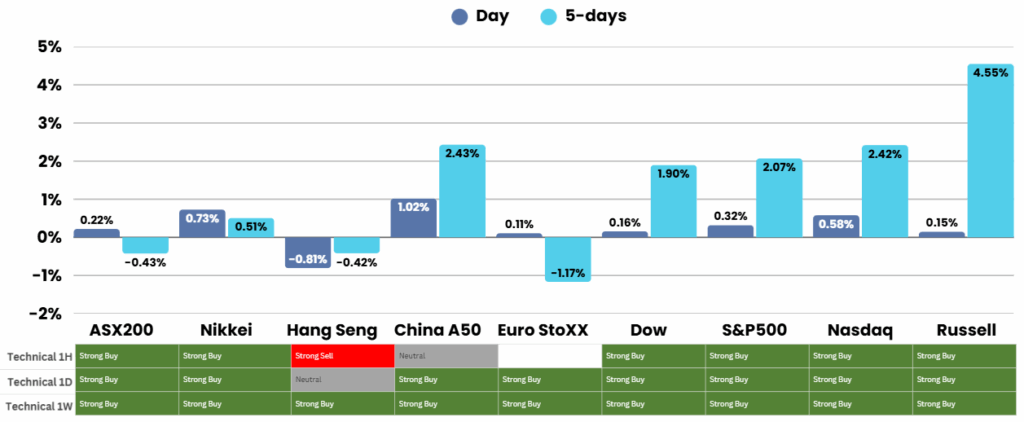

ASX SPI 8928 (-0.30%)

The ASX is likely be a little “risk off” today as we head into a long weekend in the US, with Trump very active in controversial announcements. Congress returns next week and will have to address the debt ceiling and potential government shutdown along with key US jobs numbers next week

Earnings

- Cettire, Virgin, Star Group, Steadfast are due today

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.