Overnight – Wall St feels like “Groundhog Day” as Stocks hit another record

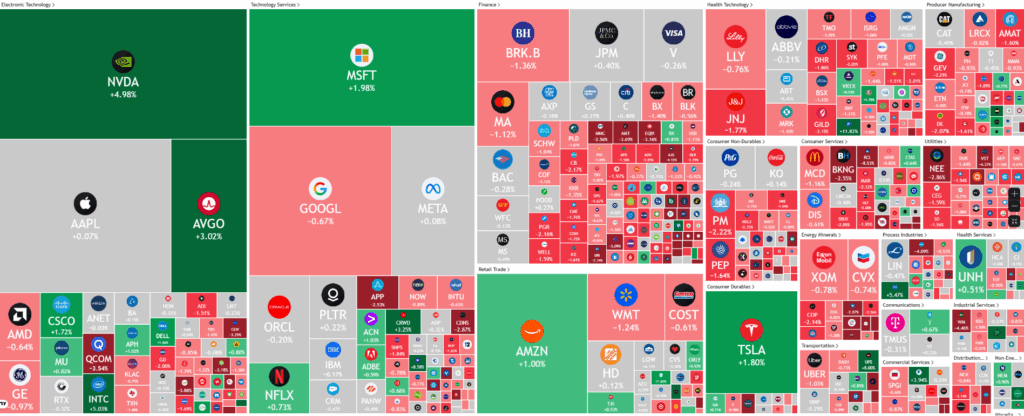

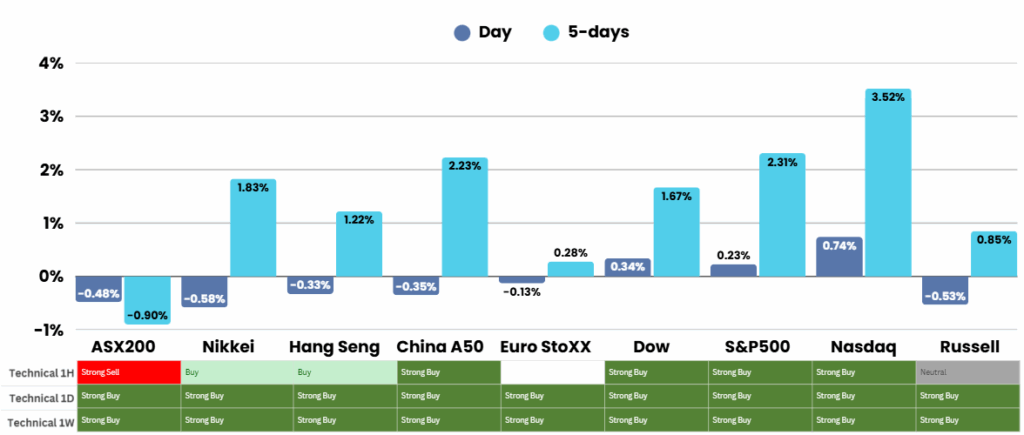

Stocks hit another record high overnight, as rising optimism for a US/China trade deal and expectations for the Fed will deliver a rate cut continued to spur bullish sentiment.

Essentially its Groundhog Day! This mornings report could almost be cut and pasted from yesterday, but

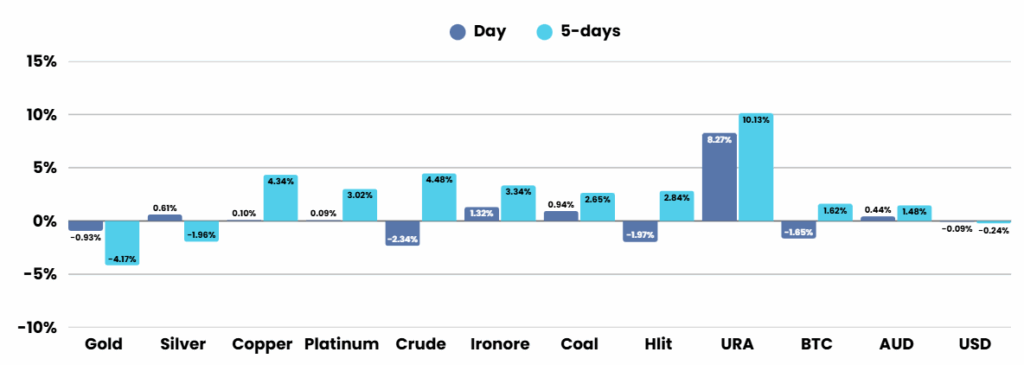

Market sentiment strengthened after reports suggested the U.S. might lower certain tariffs on Chinese exports if Beijing agreed to curb the flow of chemicals used in fentanyl production. This potential deal coincides with President Donald Trump’s recent framework agreement with Japanese Prime Minister Sanae Takaichi to secure rare earth supplies, a move indirectly aimed at reducing global dependence on China for critical minerals used in key industries such as semiconductors and electric vehicles. The dual-track diplomacy signaled an effort by the U.S. to recalibrate trade partnerships across Asia.

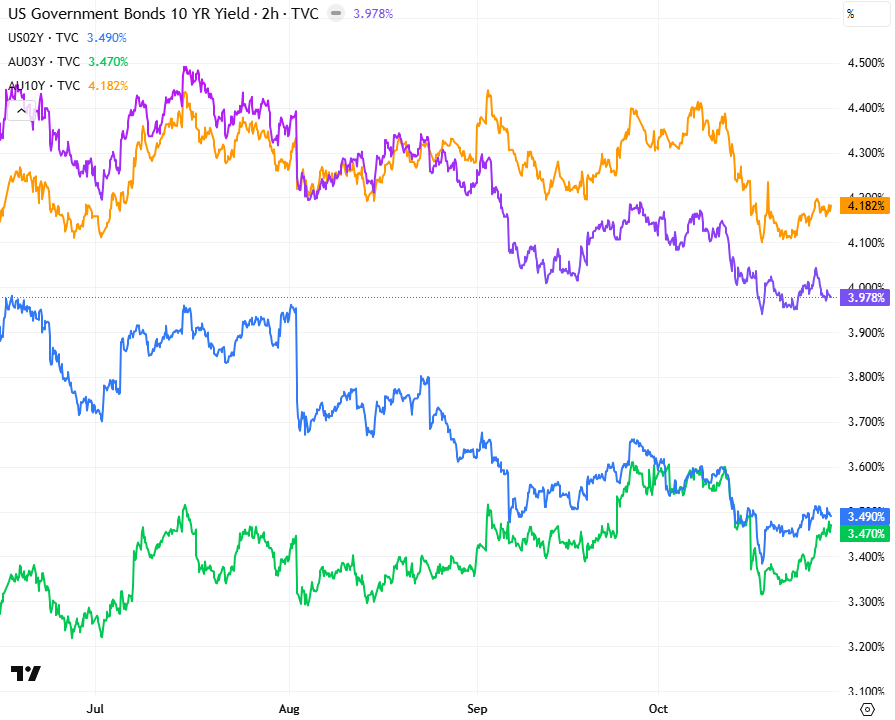

Meanwhile, the Federal Reserve began its two-day policy meeting, where a 25-basis-point rate reduction is widely anticipated. The expected cut, the second of the year, comes amid signs of soft inflation and a cooling labor market. Market analysts, including Wells Fargo and UBS, maintain a bullish outlook through 2025 and beyond, forecasting sustained equity gains fueled by AI-driven investment and policy support. On the corporate front, Amazon announced it would cut 14,000 jobs in an efficiency drive ahead of key earnings reports from major technology firms, while Nvidia shares climbed on news of new partnerships.

Microsoft announced a new agreement with OpenAI that values Microsoft’s stake in the AI company at approximately $135 billion.

Corporate News & Earnings

- Unitedhealth Group 0.51% –lifted its annual adjusted income per share forecast, citing quarterly earnings which topped Wall Street expectations, as CEO Stephen Hemsley aims to reposition the health insurance giant for “durable and accelerating growth” next year.

- United Parcel Service +8% – reported third-quarter earnings that significantly exceeded analyst expectations, despite ongoing volume challenges in its domestic segment.

- PayPal Holdings +3.9% – announced it had signed an agreement with OpenAI to embed its payments wallet into ChatGPT.

ASX Overnight: SPI 9041 (+0.12%)

The Day Ahead:

Price action looks toppy, risk off recommended

- Quarterly results expected from: Woolworths and Boss Energy. Companies hosting annual meetings include: Ansell, Data#3, Dexus, EBOS Group, Endeavour Group, Nick Scali and Siteminder.

- Medibank Private is holding an investor day.

- Australia third-quarter CPI is set to be released at 11.30am.

Yesterdays Session:

The Australian sharemarket fell on Tuesday, with the S&P/ASX 200 dropping 0.5 per cent to 9011.9 as declines in technology and healthcare outweighed gains in banking and retail stocks, despite a positive lead from Wall Street. CSL and WiseTech Global each plunged 15 per cent on negative company news, while Domino’s Pizza soared 17.4 per cent before a trading halt amid takeover speculation. Gold miners weakened alongside lower bullion prices, though major banks rose up to 2.4 per cent and consumer stocks like Wesfarmers and JB Hi-Fi also gained. AUB climbed 8.2 per cent on a takeover bid, but Liontown tumbled 11.8 per cent after revealing a large cash outflow.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.