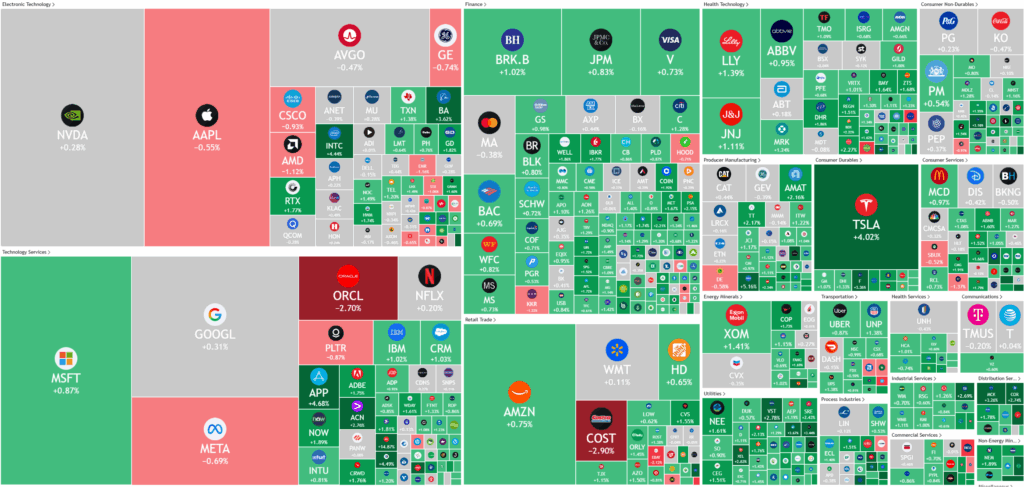

Overnight – Stocks break 3 day losing streak as precious metals continue run

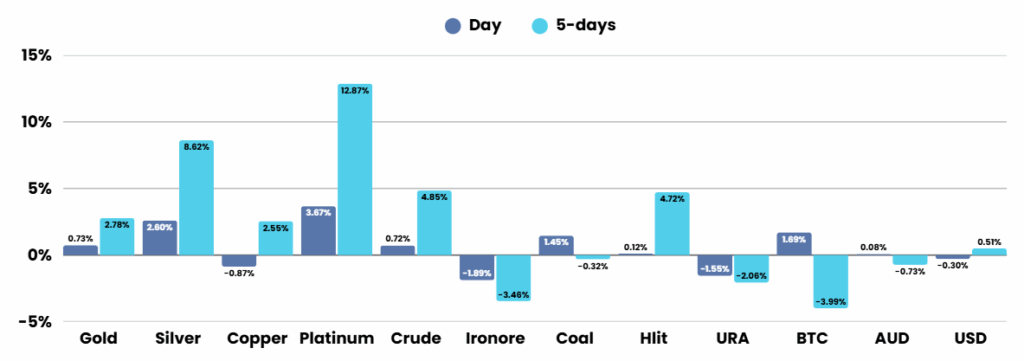

Stocks snapped a three-day losing streak as Treasury yields dropped after an in-line inflation offset concerns about a flurry of new trade tariffs from President Donald Trump. Silver and platinum continued their run, with platinum hitting its highest price since 2013 and Silver just 8% from records set in 2011

The latest Personal Consumption Expenditures (PCE) inflation report showed that price growth remained largely in line with expectations, easing fears that recent U.S. trade tariffs might drive inflation higher. The core PCE index rose 0.2% month-on-month in August, keeping the annual rate steady at 2.9%. Federal Reserve officials closely monitor this gauge, and the stable reading supported the view that inflation remains under control despite ongoing trade tensions and tariffs.

Following the data release, Federal Reserve Vice-chair for Supervision Michelle Bowman reiterated her call for rate cuts, arguing that a fragile labor market and subdued inflation warranted more decisive action. Her comments contrasted with Chairman Jerome Powell’s more measured stance from earlier in the week, where he urged patience in considering further cuts to balance risks of unemployment against inflation. Meanwhile, stronger-than-expected second-quarter GDP data hinted at underlying resilience in the U.S. economy despite lingering trade and labor market concerns.

Markets also reacted to two major policy moves from Washington. Reports indicated that the White House is preparing measures to reduce reliance on imported semiconductors, a move that boosted shares of U.S. chipmakers like Intel and GlobalFoundries. At the same time, President Trump unveiled a new wave of tariffs, including a 100% levy on branded pharmaceutical imports, additional tariffs on trucks, household fittings, and furniture. These measures are expected to significantly impact multinational pharma companies, while potentially attracting more domestic investment in manufacturing across affected sectors.

In the past 36 hours, Russia launched one of its largest aerial assaults on Ukraine, deploying nearly 600 drones and about 48 missiles, which struck multiple cities including Kyiv and Zaporizhzhia, killing at least four people and injuring over 70. In the US, President Trump announced the authorization of federal troop deployments to urban centers like Portland for security, emphasizing a crackdown on crime and unrest amid ongoing legal debate over such actions.

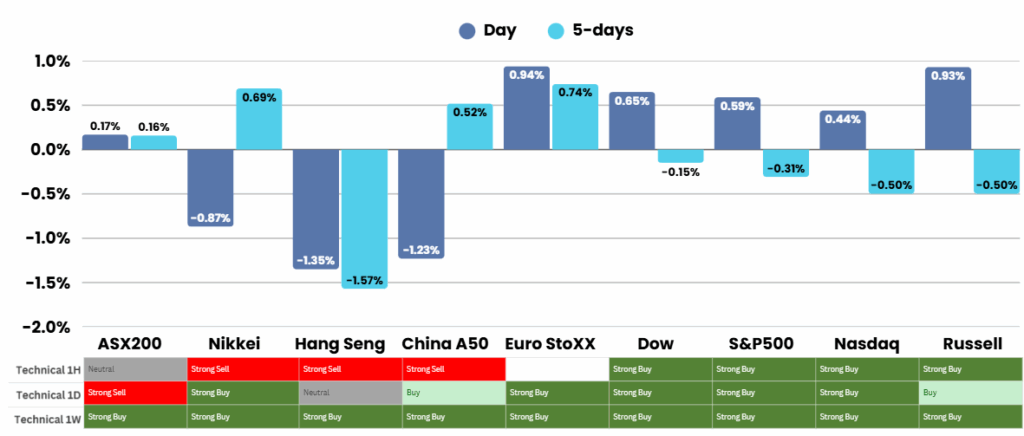

ASX Overnight: SPI 8840 (+0.23%)

The Day Ahead:

A few geopolitical events over the weekend could see caution in the ASX session. Precious metals will continue their run.

Yesterdays Session:

The Australian sharemarket ended slightly higher on Friday, with the S&P/ASX 200 rising 0.1 per cent to 8758.6 as gains in miners and banks outweighed steep losses in healthcare stocks. Healthcare fell after the US confirmed a looming 100 per cent tariff on imported branded pharmaceuticals, pressuring CSL, Telix, and Pro Medicus. In contrast, resource stocks rallied on surging silver and lithium prices, while banks also advanced modestly. Among corporate movers, Vulcan Energy jumped on a major German contract, Fortescue held steady despite new clean-energy deals, and Elanor Commercial Property rose after spurning a takeover bid.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.