Overnight – Stocks grind higher despite inevitable Govt shutdown

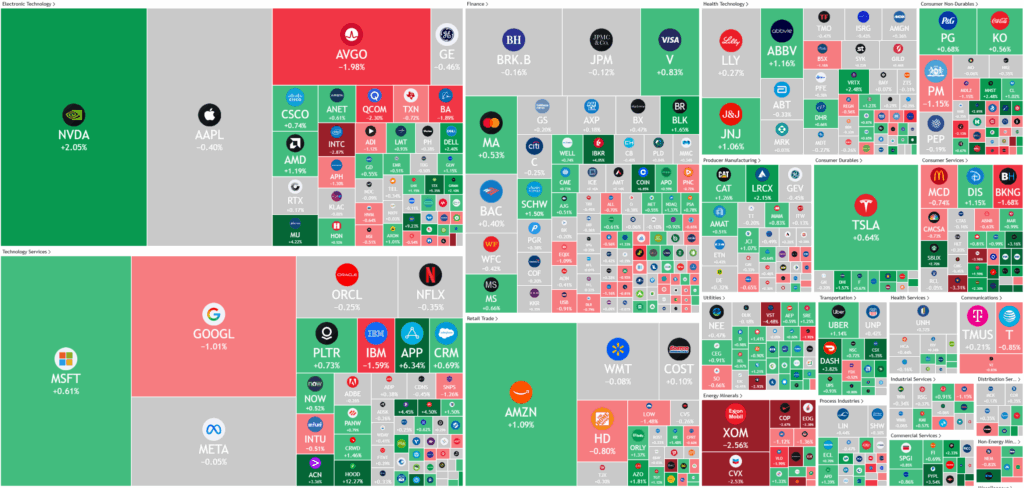

Stocks ground higher overnight as Nvidia continued its recovery following a recent rout and investors awaited the release of a key jobs report later in the week and eyed the implications of a looming federal government shutdown.

The Trump administration has warned of unprecedented mass firings across federal agencies if Congress does not avert a government shutdown, with official memos instructing preparations for permanent layoffs that could affect up to 300,000 workers by year’s end—an approach that goes far beyond traditional temporary furloughs and has intensified anxiety among federal employees as the shutdown deadline nears.

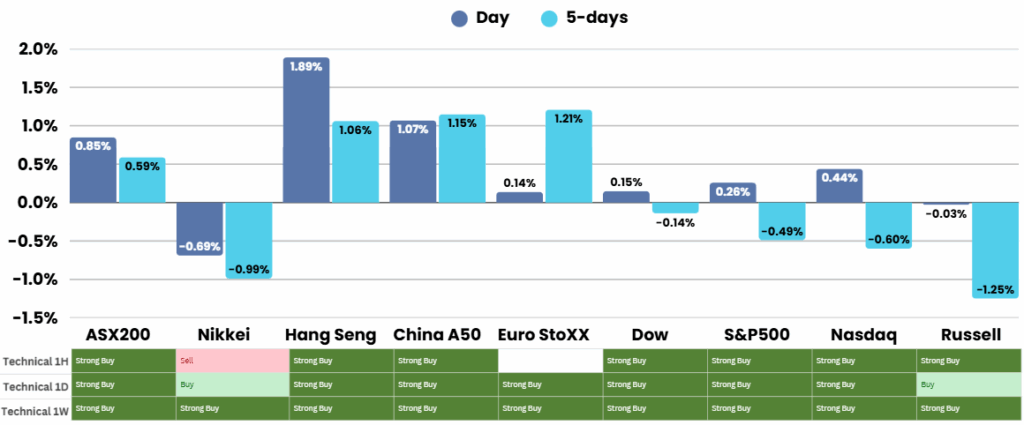

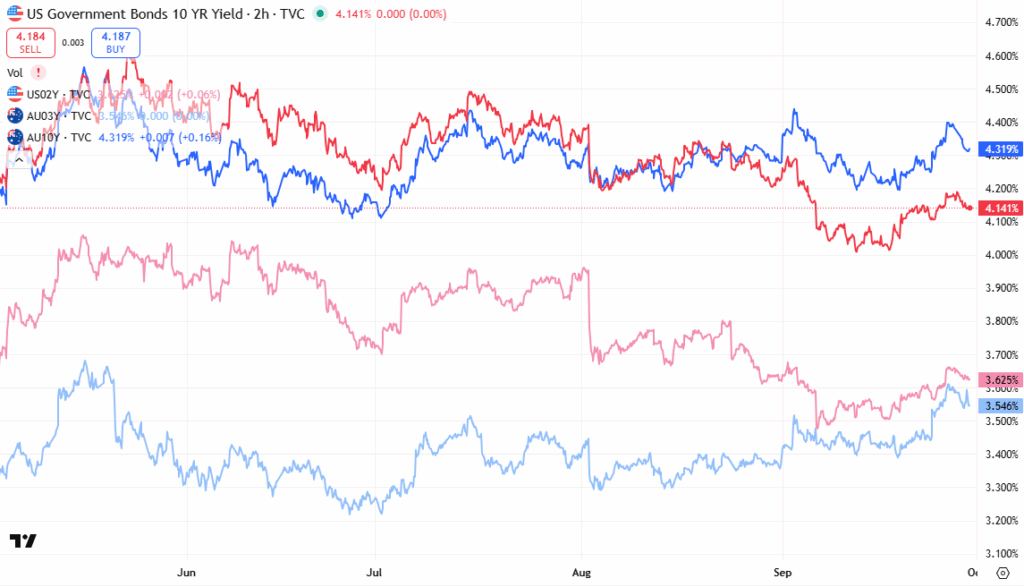

Markets are closely watching the upcoming September nonfarm payrolls report, expected Friday, as it could shape the Federal Reserve’s next move on interest rates. Policymakers earlier this month cut rates by 25 basis points, highlighting a greater concern for slowing job growth over persistent inflation. Economists project the U.S. added 51,000 roles in September versus 22,000 in August, keeping unemployment steady at 4.3%. Analysts note that a weaker-than-expected jobs number may support another rate cut later in October, while stronger employment data could temper the pace of Fed easing. The release of the jobs report, however, may be delayed if lawmakers fail to pass a funding bill before Tuesday night, triggering a government shutdown. Such a scenario would be the 15th partial closure since 1981. Currently, Republicans control Congress, but some Democratic support is needed for a deal. Democrats are pressing for reversals of certain Republican-backed healthcare cuts, while President Trump expressed cautious optimism over the weekend that a compromise might still be reached. The threat of a shutdown has already weighed on market sentiment.

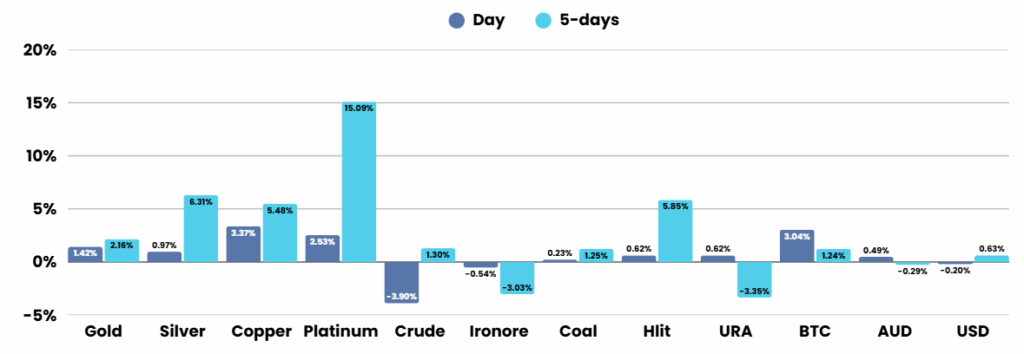

Beyond macro developments, several corporate stories drove market moves. Nvidia rose 2%, extending its rebound and boosting technology shares. Electronic Arts surged over 4% after securing a $55 billion take-private deal, while Carnival lifted its annual profit forecast once again, posting record revenue and beating earnings expectations. Meanwhile, gold prices touched a historic high of $3,800 per ounce, fueled by both safe-haven demand tied to shutdown uncertainty and investor bets that the Fed will continue cutting rates through the year.

ASX Overnight: SPI 8910 (+0.18%)

The Day Ahead:

More of the same today with precious metals looking solid and all eyes on the RBA rate decision at 1430 AEDT where the central bank is expected to leave rates unchanged. The Press conference will be the main focus of the RBA as investors look for clues on future rates movements

Yesterdays Session:

The Australian sharemarket rose 0.7 per cent on Monday to 8844.1, led by gains in major banks and rebounding healthcare stocks ahead of the RBA meeting. Commonwealth Bank and CSL were standouts, while defence tech firm DroneShield hit a record amid its rally. Novonix surged on a production milestone, though miners like BHP and Rio Tinto weighed on the index as iron ore prices weakened.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.