Overnight – AWS continues to drive the AI thematic, while breadth of rally narrows

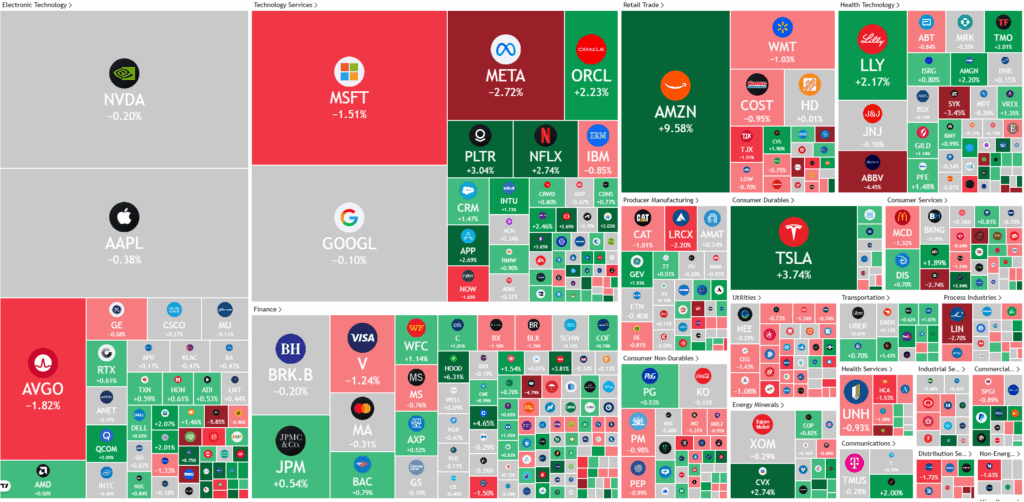

Stocks closed higher Friday, but investors had to contend with swings between gains and losses as quarterly results from big tech including Amazon and Apple continued dominate market moves and the “Hindenburg Omen* ” flagged the lack of breadth in the rally, high risk

Investor sentiment improved slightly this week as strong results from Apple and Amazon helped offset concerns about technology sector spending. Apple’s upbeat forecast projected revenue growth of 10% to 12% for the holiday quarter, supported by expectations of widespread upgrades to the new iPhone 17. Despite this, Apple’s stock retreated after initial gains. Analysts at Wedbush emphasized that the market still underestimates the strength of this upgrade cycle, with hundreds of millions of users having not upgraded in years. CEO Tim Cook told CNBC that the company expects the December quarter to be the strongest in Apple’s history.

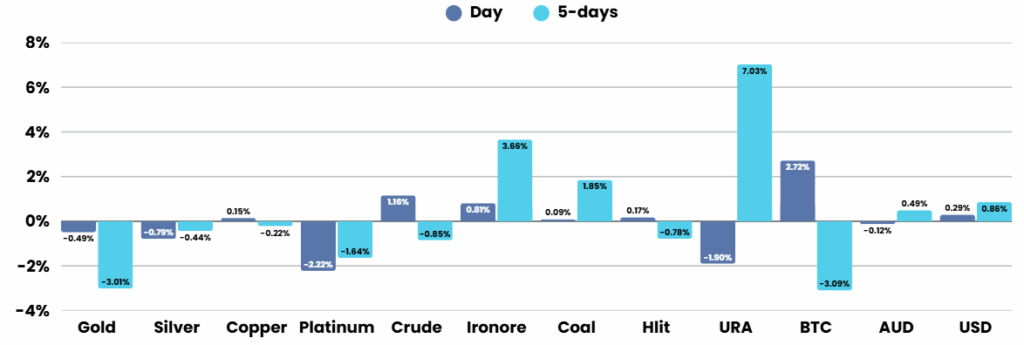

Amazon’s stock surged following robust quarterly results that exceeded expectations. The company benefited from better retail margins and accelerating growth in its cloud division, Amazon Web Services, which posted its highest increase since 2022, growing by 20%. Although Amazon is often seen as trailing in artificial intelligence development, analysts at RBC noted that it is on track to capture a growing share of AI-driven cloud revenue. Meanwhile, Netflix announced a 10-for-1 stock split, Exxon Mobil reported weaker earnings due to lower oil prices, and Chevron surpassed expectations — aided by the integration of its recent Hess acquisition.

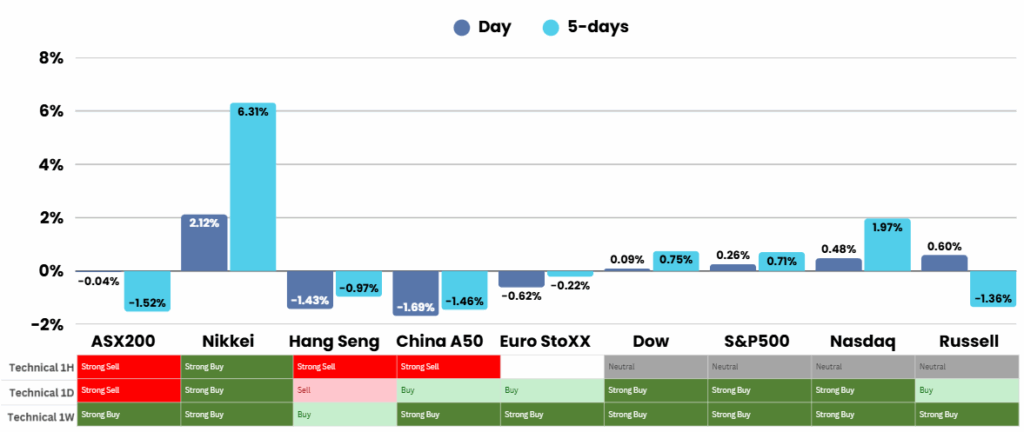

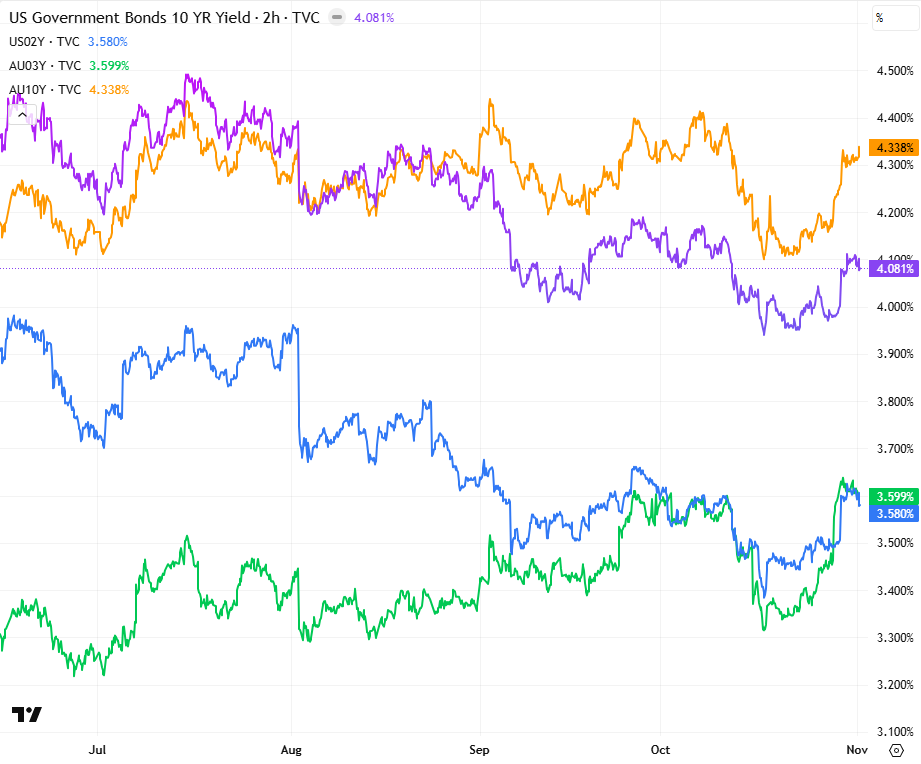

Beyond corporate developments, markets continued to process signals from the Federal Reserve and political discussions between Washington and Beijing. While the Fed cut interest rates by 25 basis points, Chair Jerome Powell tempered expectations for additional near-term easing, saying another cut was “not a foregone conclusion.” In global affairs, President Donald Trump met with Chinese President Xi Jinping, describing the talks as “amazing” and expressing confidence that a trade deal could be reached soon. He indicated plans to visit China in April, though no timeline for a formal agreement was given.

* The Hindenburg Omen is a technical indicator that signals a heightened risk of a stock market downturn or crash, triggered when a large number of stocks simultaneously hit new highs and lows, the market is in an uptrend, and specific breadth indicators turn negative, suggesting underlying instability and possible correction ahead.

Corporate News & Earnings

- Exxon Mobil +0.46% – reported a year-on-year fall in third quarter earnings, as oil prices tumbled due in large part to OPEC+ increasing production.

- Chevron +2.95% – posted third-quarter profit which topped estimates, thanks in part to a boost from oil production linked to its acquisition of Hess earlier this year.

ASX Overnight: SPI 8887 (-0.01%)

The Day Ahead:

Unlikely to be any major movement.

Yesterdays Session:

The ASX rose 0.3% to 8914.9 on Friday afternoon, lifted by gains in major banks and gold miners after gold prices rebounded 2.5% following positive signals from the Trump–Xi meeting. Gold producers like Westgold, Evolution, and Newmont rallied strongly, while Commonwealth Bank gained 1.2% as financials strengthened despite ANZ dipping ahead of its results. Wall Street was mixed overnight, with Meta plunging but Amazon and Apple posting gains. On the local front, ResMed rose on strong earnings, while Mayne Pharma tumbled 32% after its takeover faced rejection and Steadfast slid amid a CEO probe.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.