Overnight – Stocks hit fresh highs as US Govt hit new lows

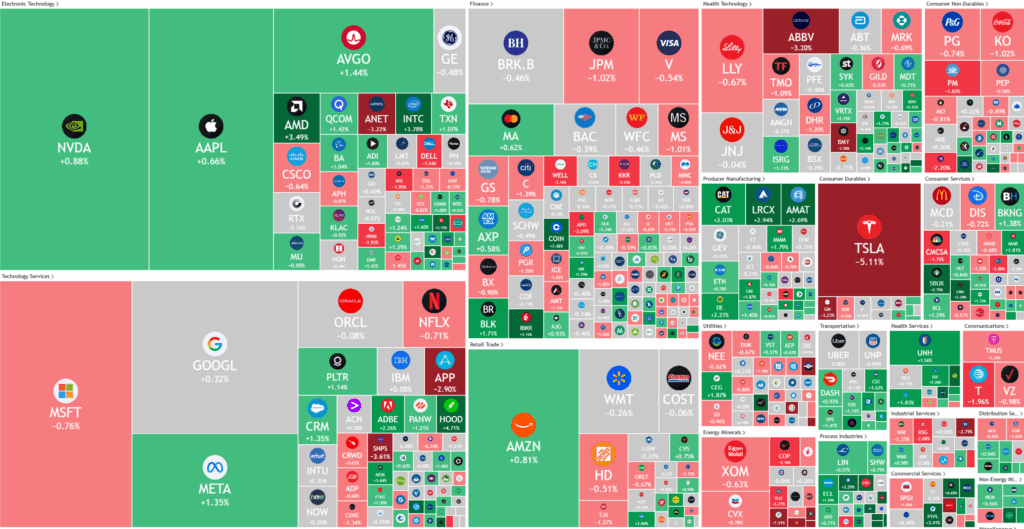

Stocks continued to ignore the possibility of a lengthy Government shutdown triggering an economic slowdown, instead choosing to focus on the knock-on effect of the rate cuts that may come from it.

The U.S. government shutdown that began Tuesday is raising concerns about economic fallout, with Treasury Secretary Scott Bessent warning it could hit GDP, growth, and working Americans harder than past shutdowns. The standoff between Democrats and Republicans shows no sign of resolution, while former President Trump has escalated tensions with threats of funding cuts and federal worker layoffs. Markets remain cautious, recalling the 2018–2019 shutdown that cost the economy about $11 billion, as betting markets now suggest the deadlock could last one to two weeks.

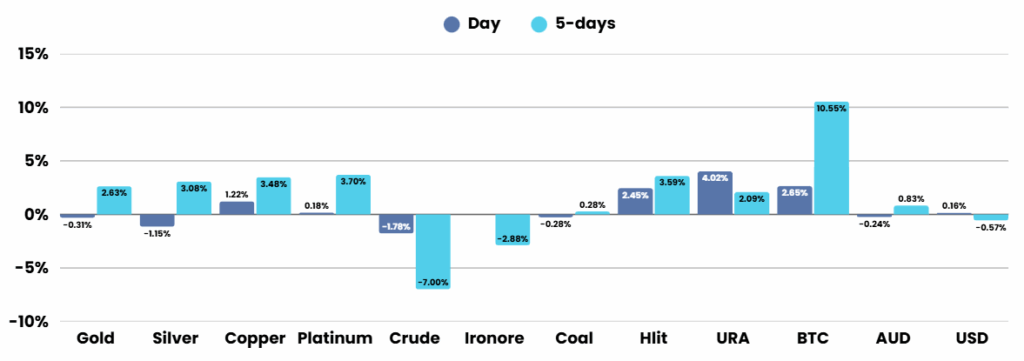

One major consequence is the likely delay of key economic data, including Friday’s nonfarm payrolls report, putting alternative indicators like Challenger layoff figures under heavier scrutiny. Recent labor trends have been mixed, with announced layoffs falling sharply in September and unemployment holding stable at 4.3%, according to a new Fed model. However, private payrolls data from ADP revealed the steepest drop in over two years, supporting expectations that the Federal Reserve may enact further interest rate cuts before year-end.

In corporate news, Tesla saw a rebound in Q3 deliveries, though its stock declined on concerns about waning demand as EV tax credits expire, while Rivian exceeded estimates with a strong 32% surge in deliveries. Occidental Petroleum’s planned $9.7 billion sale of its OxyChem unit to Berkshire Hathaway led to a share dip, whereas Stellantis surged after signs of a U.S. sales recovery. Meanwhile, OpenAI reached a $500 billion valuation in a landmark secondary sale, overtaking SpaceX as the world’s most valuable startup.

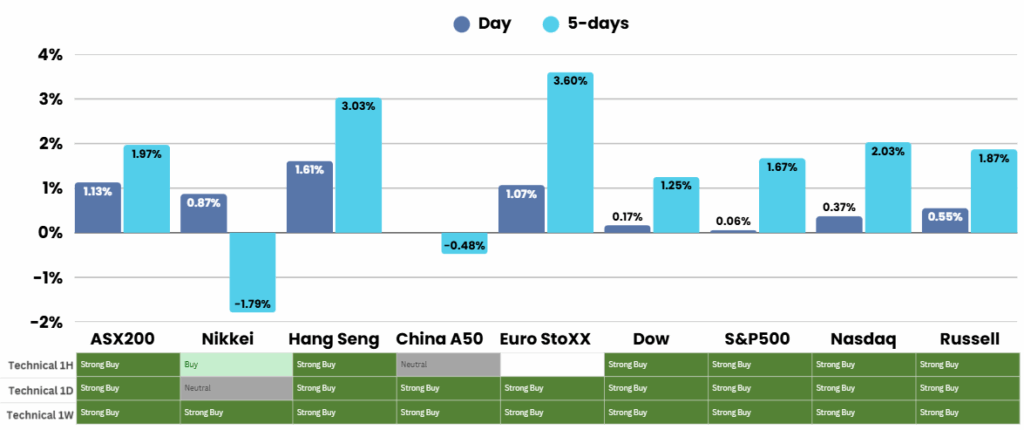

ASX Overnight: SPI 8968 (-0.01%)

The Day Ahead:

Uncertainty is the major theme this week with uncertainty around interest rates, the US government shutdown, valuations, policy…. The list goes on. We expect to see continued switch to defensive sectors, albeit subtle

Yesterdays Session:

The Australian sharemarket climbed on Thursday, with the S&P/ASX 200 up 1.1 per cent to 8944.5 as gains in banks and gold stocks drove broad sector strength. Surging bullion prices lifted the materials sector, with gold miners like Westgold, Northern Star, and Evolution rallying strongly, while BHP and Rio Tinto also advanced. Commonwealth Bank and CSL led financials and healthcare higher, though corporate moves saw ARN Media, REA Group, and News Corp fall, while James Hardie edged higher despite governance scrutiny.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.