Overnight – Tariff uncertainty gives stocks a nervous start to September

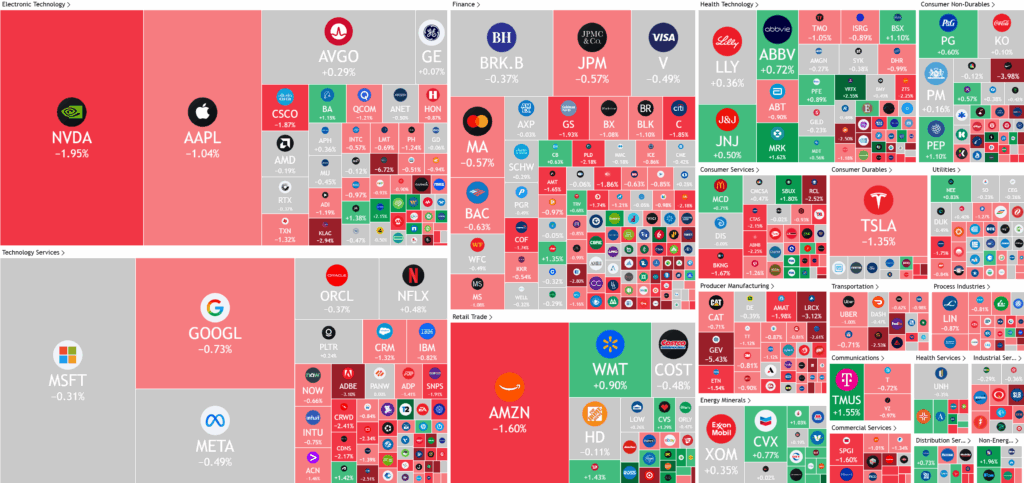

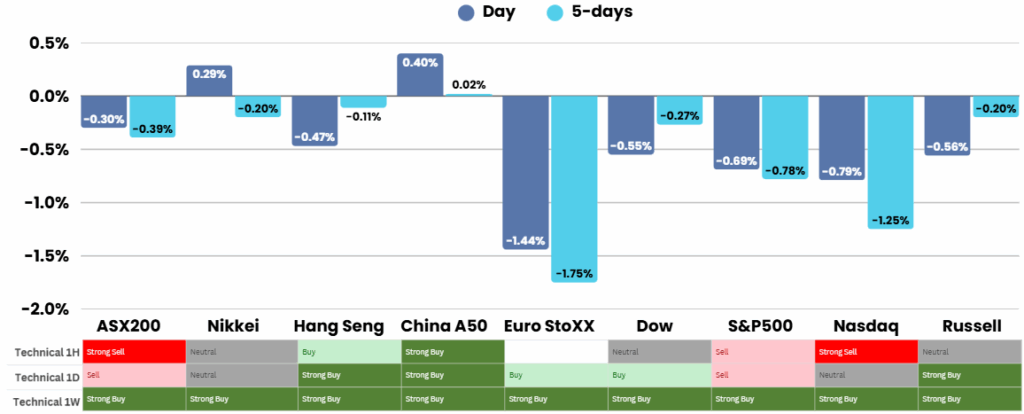

Stocks fell overnight in a poor start to September as the tech wreck continued pressured by tariff uncertainty and a jump in bond yields.

President Donald Trump’s push to uphold his tariffs faces fresh legal uncertainty after a U.S. appeals court ruled that most of the levies were illegal, asserting that only Congress has the authority to impose such duties. Trump has vowed to seek an expedited Supreme Court review, with his administration confident that the conservative majority could side with his executive power claims. Analysts, however, warn that the ruling adds uncertainty for businesses, leaving firms uncertain about the stability of U.S. trade policy. While a Supreme Court rejection could ease tariff-related disruptions, it may also force renegotiations of trade agreements and prolong economic ambiguity, with tariffs already contributing to rising inflationary pressures.

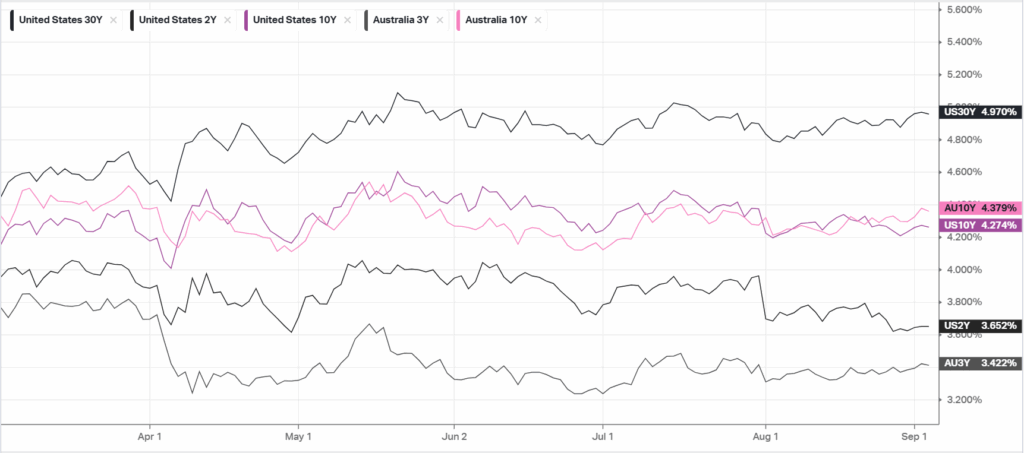

Meanwhile, global financial markets are reeling from a sharp rise in Treasury yields, which climbed amid broader concerns about soaring global debt and the possibility that the U.S. may need to repay illegally collected tariff revenues. The surge in yields put pressure on tech stocks, with Nvidia leading declines, while defensives like gold miners benefited as the precious metal hit new highs on safe-haven demand. PepsiCo shares saw gains after reports that activist investor Elliott Management had taken a $4 billion stake, pushing for initiatives to lift the company’s valuation.

On the monetary policy front, Wall Street remains split on the Federal Reserve’s next move. Recent inflation data showed persistent price pressures, complicating prospects for swift rate cuts, though markets are still pricing in a high probability of a quarter-point reduction in September. The Fed’s position has also been clouded by political interference, with Trump reportedly attempting to dismiss central bank officials, drawing legal resistance. Investors now look to Friday’s nonfarm payrolls report, where weak job growth could strengthen the case for a rate cut. Ahead of that, attention will also focus on manufacturing activity and corporate earnings results from key tech and retail firms.

ASX SPI 8843 (-0.39%)

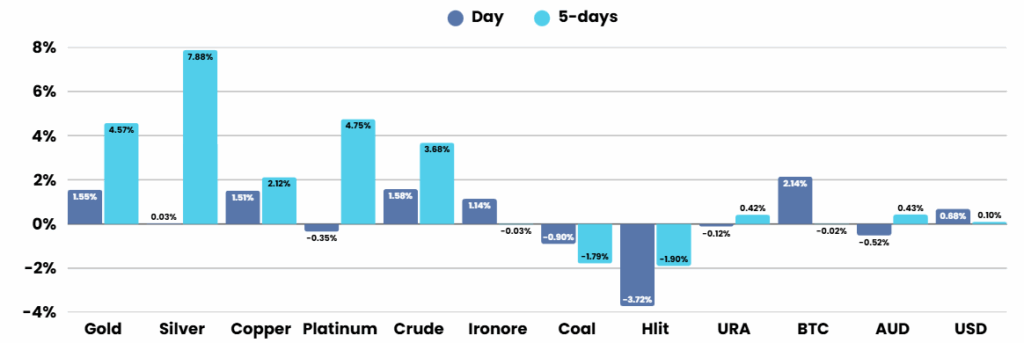

Gold and silver stocks should be well supported again as Silver pushed a new 15 year high and gold breached $3,600 for the first time in history.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.