Overnight – Tech stocks lower as Wall St CEO’s warn on valuations

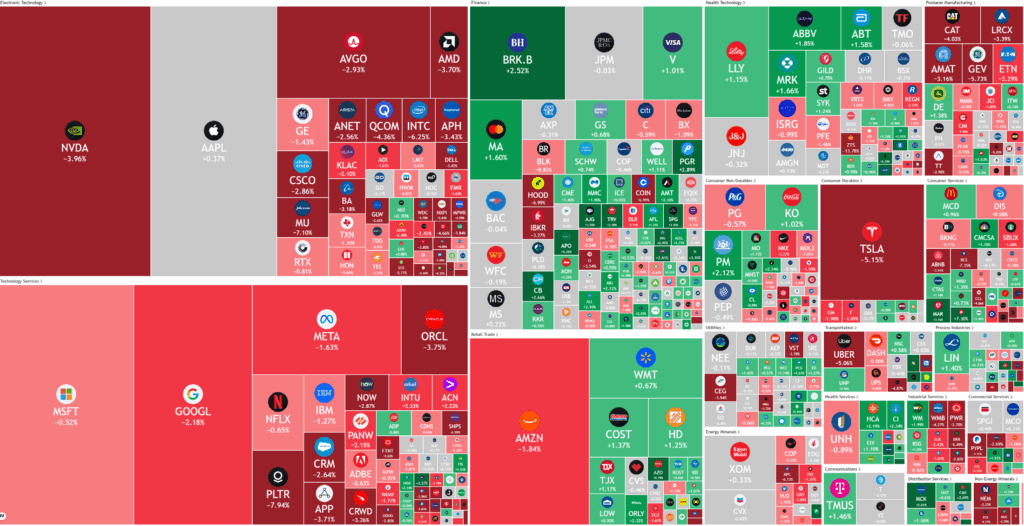

Investor optimism took a hit overnight after major Wall Street CEOs warned of a possible pullback ahead amid concerns about tech valuations and uncertainty on further rate cuts.

Goldman Sachs and Morgan Stanley both cautioned investors about a potential stock market correction, warning that recent valuations may have become excessive. Morgan Stanley CEO Ted Pick said investors should be prepared for a drawdown of 10–15%, emphasizing that such a correction would not necessarily indicate a deeper economic problem. Goldman Sachs CEO David Solomon shared similar sentiments, noting that valuations in the technology sector, particularly, have reached their limits.

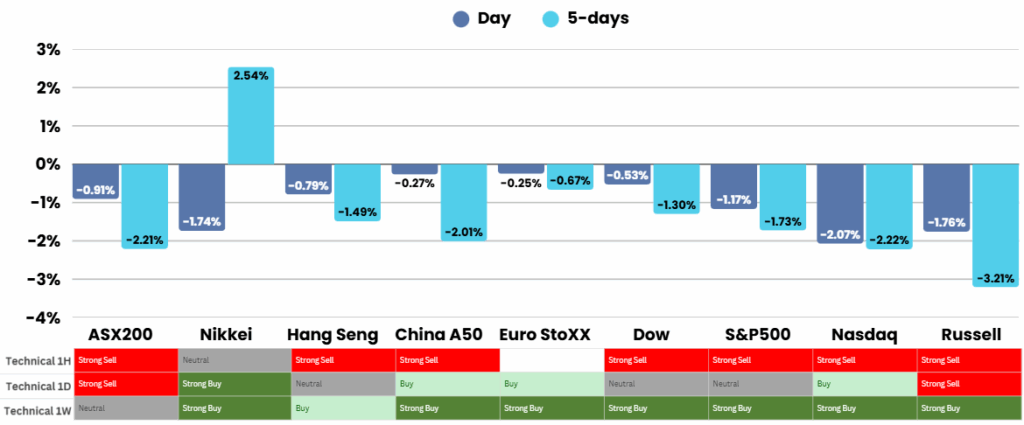

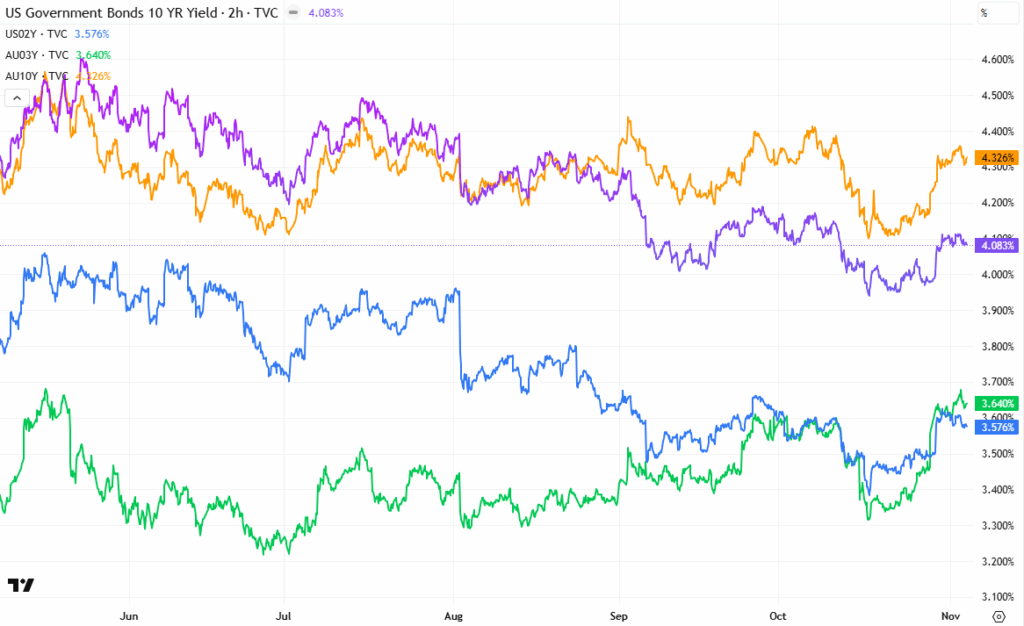

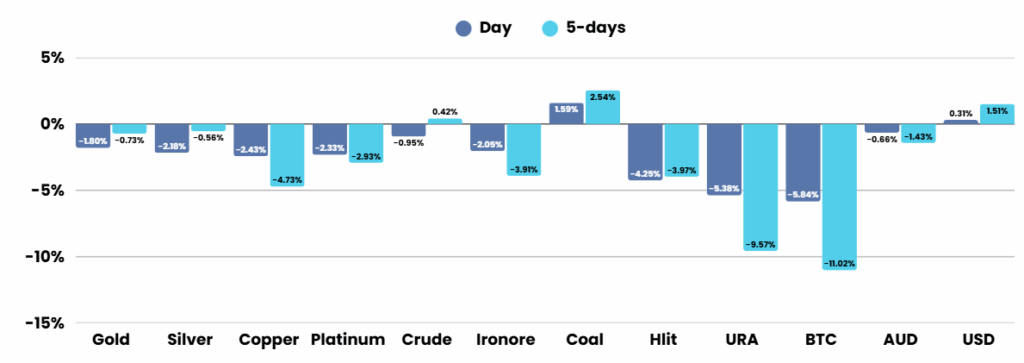

These warnings come amid broader economic uncertainty in the United States. The ISM manufacturing index for October recorded its eighth straight month of contraction with a reading of 48.7, highlighting weakness in industrial activity. A protracted government shutdown has also disrupted access to key economic data, adding to investor unease. Meanwhile, Federal Reserve Chair Jerome Powell suggested that the recent interest rate cut might be the last for this year, though other policymakers have not ruled out another move in December, leaving monetary policy direction uncertain.

In the corporate sphere, several major companies reported contrasting performance. Palantir Technologies’ stock slipped even after the company posted record quarterly profit and revenue, boosted by rising demand for AI-driven software. AMD is expected to release its earnings after the bell, with investors watching closely following its recent multi-year AI chip deal with OpenAI. Among other movers, Uber’s shares declined on weaker guidance despite strong results, while Yum! Brands gained after announcing a strategic review of its Pizza Hut division. Marriott shares also rose modestly after reporting robust earnings, supported by steady demand in its luxury hotel segment.

Corporate News & Earnings

- Uber Technologies -5% – stock fell after the ride-hailing company offered soft earnings guidance for the current quarter, overshadowing its better-than-expected third-quarter results

- Advanced Micro Devices AMD -7% – reported third quarter EPS of $1.20, $0.03 better than the analyst estimate of $1.17. Revenue for the quarter came in at $9.25B versus the consensus estimate of $8.74B.

- Palantir -8% – saw a sharp 7.36% drop to $191.94 despite posting record Q3 results with revenue up 63% to $1.181 billion and margins surpassing 51%. The decline stemmed from valuation concerns, profit-taking, and Michael Burry’s $912 million bearish bets on the stock.

ASX Overnight: SPI 8830 (+0.20%)

The Day Ahead:

Most of the overnight move was already priced into the ASX200, and it was largely an AI move causing the fall. Expect the ASX to try and hold ground today, although interest rate sensitive

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.