Overnight – Stocks rally into US jobs numbers as rate cut bets rise

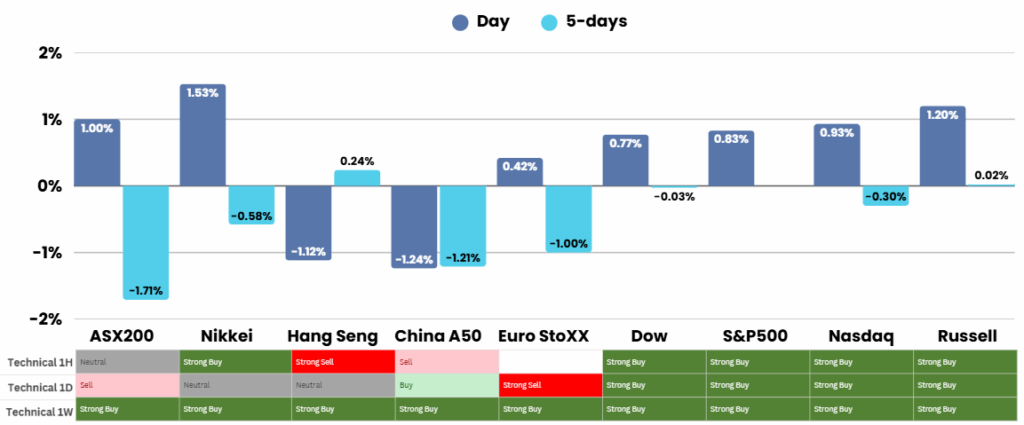

Stocks a fresh closing record high overnight as weaker-than-expected U.S. private payrolls data stoked optimism for a Federal Reserve rate cut this month.

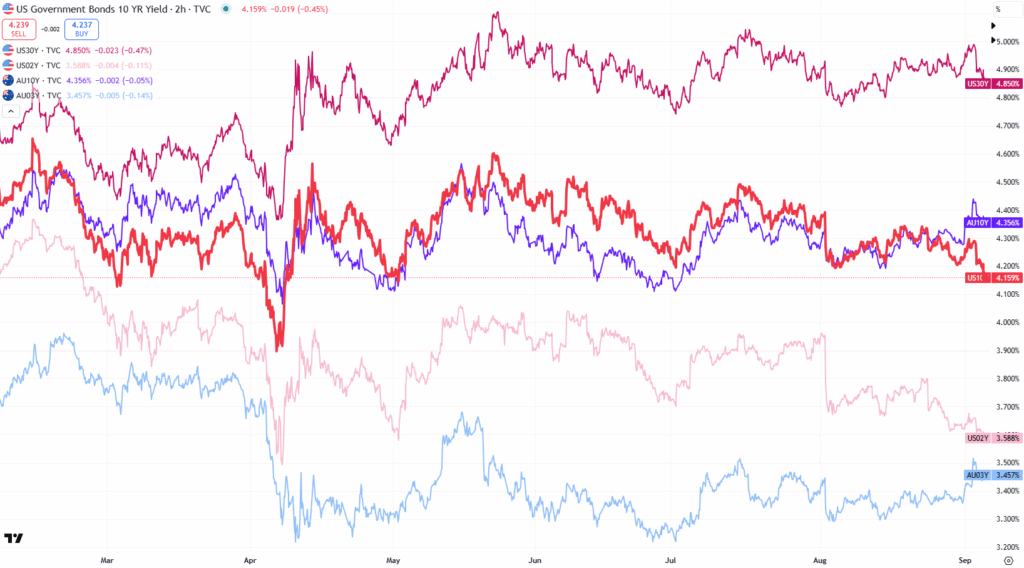

Private-sector labor market data pointed to weakness in August, with ADP reporting just 54,000 job gains, the slowest pace since June and well below the 73,000 economists had forecast. Weekly jobless claims also rose to 237,000, higher than expectations, underscoring growing softness in hiring and employment conditions. The weaker data reinforced market bets on a Federal Reserve rate cut at its September 16–17 meeting, with CME’s FedWatch Tool now showing a near 97% probability of a 25-basis-point reduction. Attention now turns to Friday’s official nonfarm payrolls report, where economists expect 75,000 new jobs following a weak July reading.

Corporate earnings also drove market sentiment. Salesforce shares fell more than 4% after reporting disappointing quarterly results and issuing revenue guidance below Wall Street expectations. The company’s struggles to quickly monetize its AI platforms raised investor concerns, though losses were pared after Salesforce announced a $20 billion expansion of its share buyback program. Elsewhere in tech, newly listed Figma plunged over 18% on its maiden earnings report, despite beating revenue and earnings forecasts. Analysts flagged the stock’s rich valuation and rising competition, which have pressured its performance following its high-profile IPO in July.

Additional corporate movers included Texas Instruments (-3%) after its CFO highlighted weak demand pressures tied to U.S. tariffs. In retail, American Eagle Outfitters surged over 30% following stronger-than-expected Q2 earnings, standing out in a sector under pressure from slowing U.S. consumer demand. Overall, markets weighed weak labor data and soft corporate results against expectations of imminent Fed easing, with investor focus fixed on Friday’s employment report as the next catalyst.

Corporate Earnings

- Broadcomm (AVGO) +1% – the chip company forecast fourth-quarter revenue above Wall Street estimates on Thursday, bolstered by strong demand for its custom AI chips as enterprise clients invest heavily in data centers and machine learning applications. The company has been one of the biggest beneficiaries of the generative artificial intelligence boom, with hyperscale customers, including Google, adopting its custom accelerators due to their ability to process large quantities of data quickly. Its chips have also emerged as an alternative to Nvidia’s costly processors as companies look for hardware that can be tailored to specific needs as AI becomes increasingly advanced.

ASX SPI 8872 (+0.63%)

The ASX is in for a quiet day with some possible “risk off” in the afternoon into US Employment numbers. Employment is expected at 75k and 4.3% unemployment rate and will be the pivotal economic number this month which is likely to dictate the broad direction for September

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.