Overnight – Stocks rally into US jobs numbers as rate cut bets rise

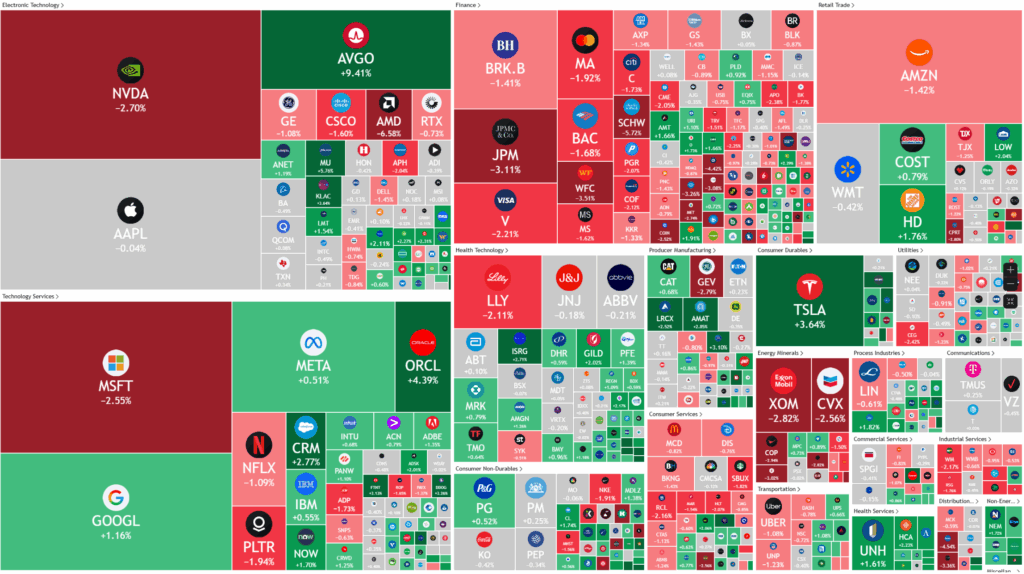

Stocks closed lower Friday after retreating from record high as signs of a cooling labor market triggered recession worries, outweighing bets that the Federal Reserve will likely cut interest rates later this month.

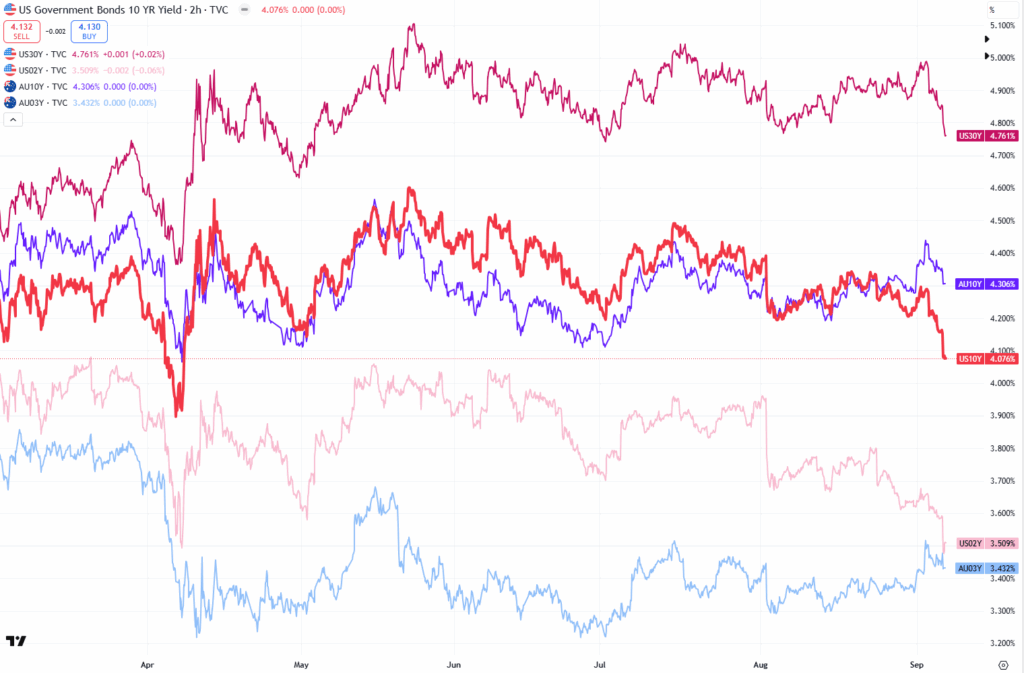

The latest U.S. jobs data showed significant weakness, with only 22,000 nonfarm payrolls added in August compared to economists’ expectations of 75,000. This marks a sharp slowdown from July’s revised 79,000 figure and reinforces concerns that the labor market is cooling further. The unemployment rate ticked up slightly to 4.3%, in line with forecasts, suggesting slowing labor demand that has been building since May. The weaker numbers are fueling speculation that the Federal Reserve may move to cut interest rates at its upcoming September 16–17 meeting.

Healthcare (+31,000) and social assistance (+16,000) led job gains, but losses hit federal government (-15,000), manufacturing (-12,000), wholesale trade (-12,000), and mining/oil extraction (-6,000). Revisions lowered prior months’ figures by a net 21,000, with June turning negative. Average hourly earnings rose 0.4% on the month and 3.7% year-over-year to $31.46, while the average workweek held steady at 34.2 hours.

Wall Street economists see the report as both a risk and an opportunity for the Fed. While the slowdown raises fears of a possible recession if hiring continues to stall, analysts such as Morgan Stanley argue it is not weak enough to justify an aggressive 50-basis-point cut in one move. Instead, they believe the data strengthens the case for a gradual but sustained easing path, including potential back-to-back rate cuts in the coming meetings. This sentiment highlights the delicate balance the Fed faces between supporting growth and avoiding perceptions of being behind the curve.

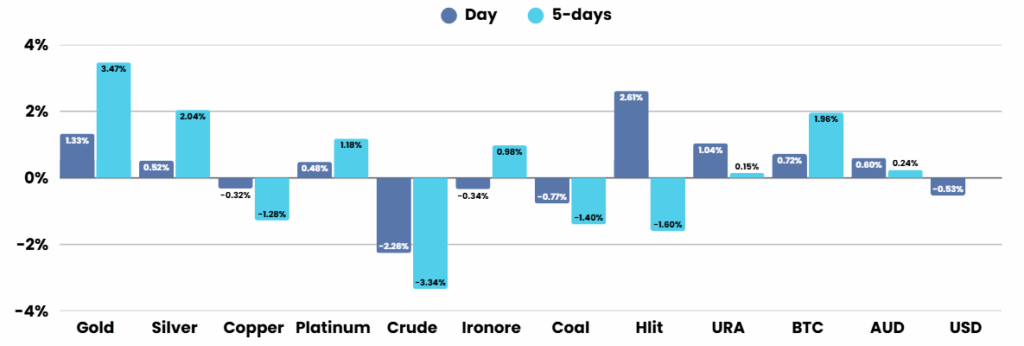

Beyond the macroeconomic backdrop, corporate earnings drove notable stock market moves. Broadcom surged on robust results and upbeat AI chip demand, while DocuSign and Samsara both topped expectations, boosting their shares. Alphabet rose despite being hit with a €2.95 billion ($3.5 billion) EU antitrust fine, and Tesla gained 3% after outlining a bold new compensation package for CEO Elon Musk. The plan, which ties Musk’s pay to ambitious milestones, could ultimately be worth up to $1 trillion if Tesla’s valuation reaches $8.5 trillion over the next decade.

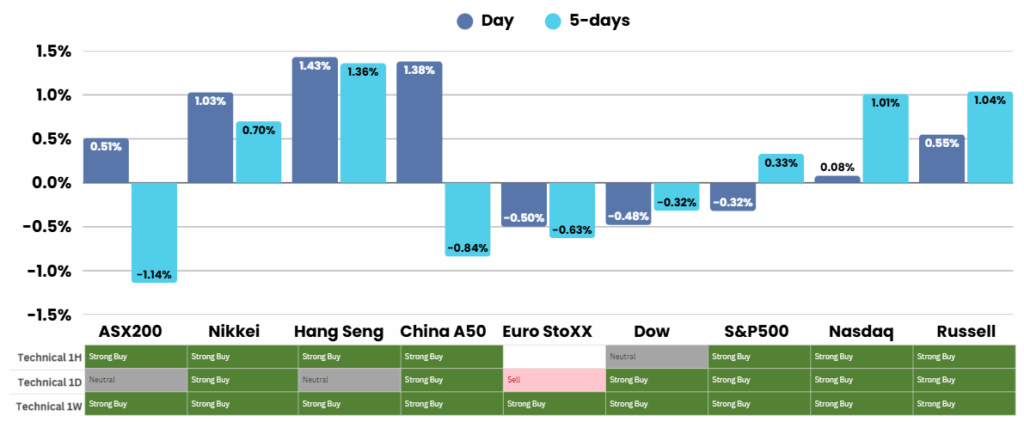

ASX SPI 8848 (-0.19%)

The ASX will be in for a quiet day and a fairly quiet week ahead in Australia, with consumer confidence and the NAB Business Survey on Tuesday. There will be a series of investor meetings this week, including Novonix, Brickworks, Soul Patts, Metcash and Strike Energy. Also, about $723 million worth of dividends are expected to be paid to investors in the coming week.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.