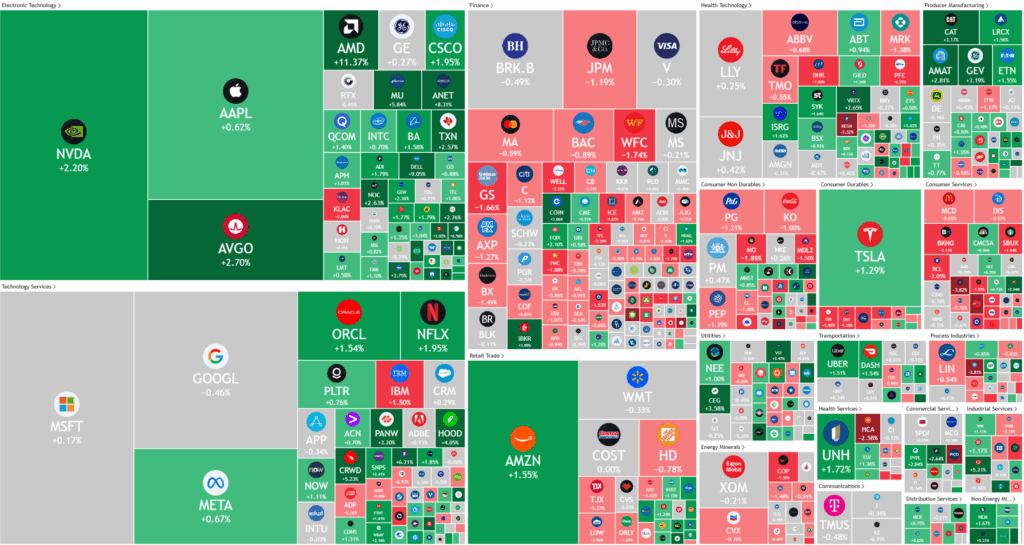

Overnight – Tech melts up as Jensen talks up AI Chips &Fed flags further rate cuts

Stocks rebounded to fresh record highs, driven by a rebound in tech as Nvidia chief executive Jensen Huang talk up AI-led chip demand and the Federal Reserve’s latest meeting pointing to further rate cuts ahead.

A prolonged U.S. government shutdown has delayed the release of key economic indicators, forcing traders to rely on alternative data to gauge the economy’s health. Market sentiment weakened after a New York Fed survey showed deteriorating future expectations and higher inflation projections. The latest FOMC minutes revealed most policymakers support further interest rate cuts amid a softening labor market, though inflation risks and uncertainty over the neutral rate remain sticking points. While some ultra-dovish members push for steeper cuts, concerns about inflation running above the Fed’s 2% target continue to limit consensus.

Nvidia shares gained after CEO Jensen Huang expressed optimism about soaring computing demand and confirmed further investment in Elon Musk’s AI startup, xAI, which is aiming to raise its valuation to $20 billion. His comments, combined with growing enthusiasm for AI, provided a fresh boost to the stock. The news reinforced Nvidia’s role in the AI investment narrative, keeping it in focus for traders seeking growth plays within a tech-driven rally.

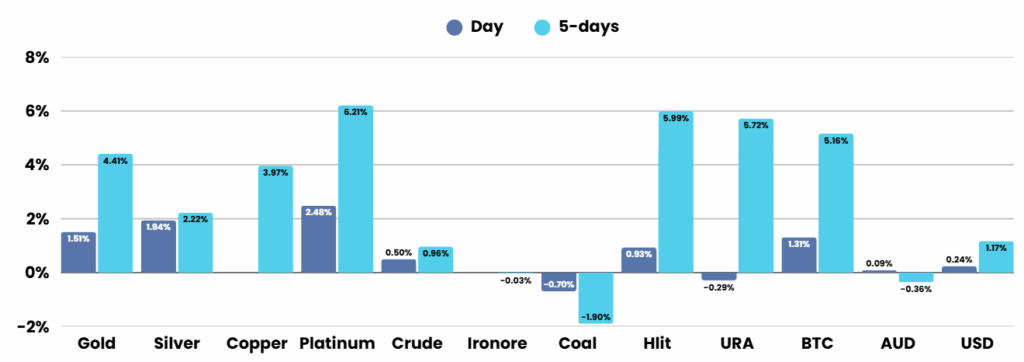

Gold prices surged above $4,000 per ounce for the first time, rising more than 50% this year and heading toward their best annual performance since 1979. Demand has been driven by investors and central banks seeking safety amid Fed rate cut expectations, a weakening dollar, and U.S. fiscal concerns. ETFs have expanded their gold holdings, while China’s central bank extended its gold-buying streak for an eleventh month despite record high prices. The Japanese yen, another traditional safe haven, weakened after Japan’s ruling party elected a dovish new leader, further highlighting gold’s appeal in the current climate.

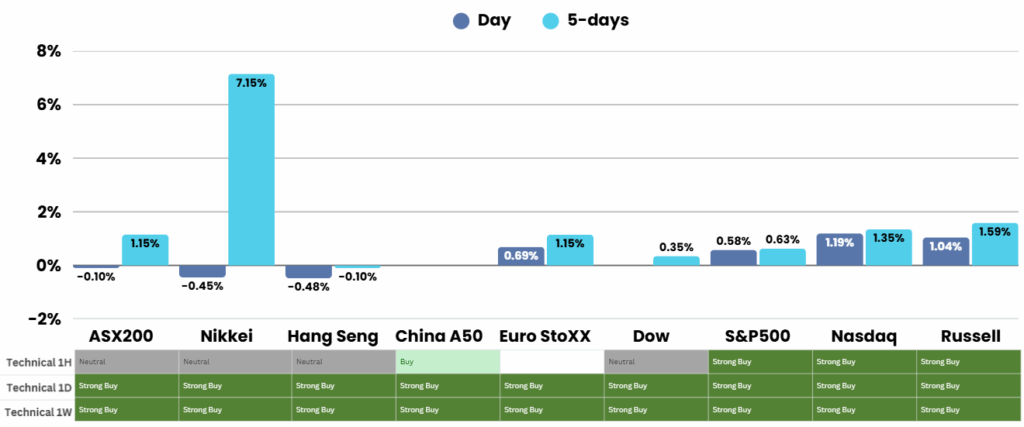

ASX Overnight: SPI 8986 (FLAT)

The Day Ahead:

There is likely to be a continued holding pattern around the highs today as the market takes a breather. Healthcare should remain resilient as the sector continues to steady after a rough 3-4 months

James Hardie soared 8.91 per cent in New York overnight after the dual-listed building-materials company reported preliminary net sales for the second quarter that beat the average analyst estimate

Yesterdays Session:

Australian shares fell on Tuesday despite Wall Street’s gains, with the S&P/ASX 200 down 0.3 per cent to 8952.1 as all sectors traded lower. Communication services led declines, particularly REA Group, Seek, and CAR Group, while financials and consumer stocks also weakened. ASX Limited slipped after new competition approval for Cboe Australia, and Breville tumbled 5.1 per cent. Gold prices surged to a record near $US4000 an ounce, boosting Newmont slightly. Among individual movers, Rio Tinto reaffirmed its Pilbara expansion, Web Travel rose on strong guidance, while St Barbara and Brisbane Broncos plunged after capital raising and post-final losses, respectively.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.