Overnight – Chip Stocks higher as investors focus on anything but the economy

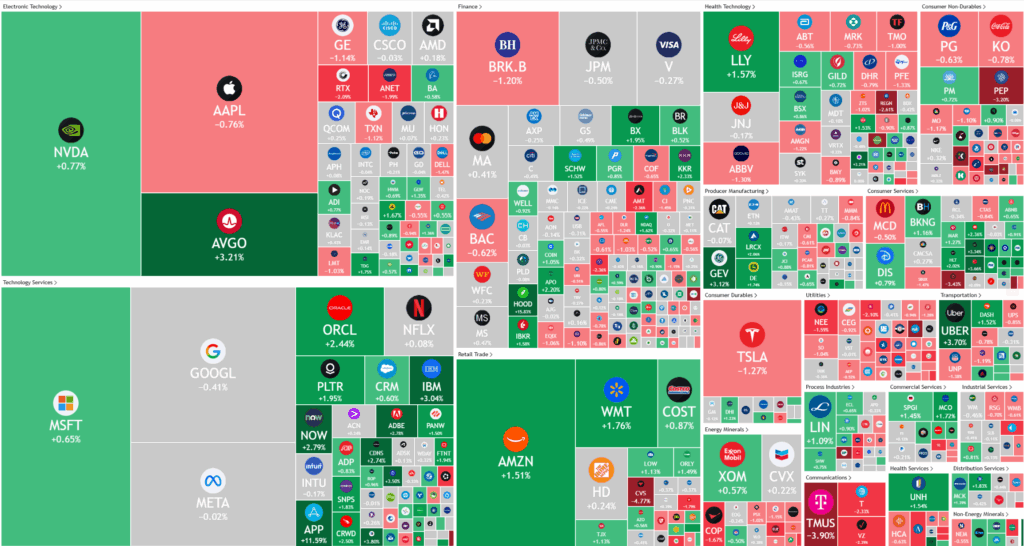

Tech stocks jumped to a closing record high Monday powered by chip stocks as investors awaited key inflation data due later this week, in a classic “head in the sand” move after Fridays US employment data

Chipmakers dominated market headlines as shares of NVIDIA and Broadcom rose, with the latter extending its rally following strong earnings and an optimistic AI-driven outlook. Analysts at UBS projected continued earnings growth for Broadcom into 2026 and 2027, highlighting the robust long-term demand for AI technologies. Meanwhile, Alibaba gained over 4% after leading a $100 million funding round for Chinese humanoid robotics startup X Square Robot, underscoring continued momentum in the AI and robotics space.

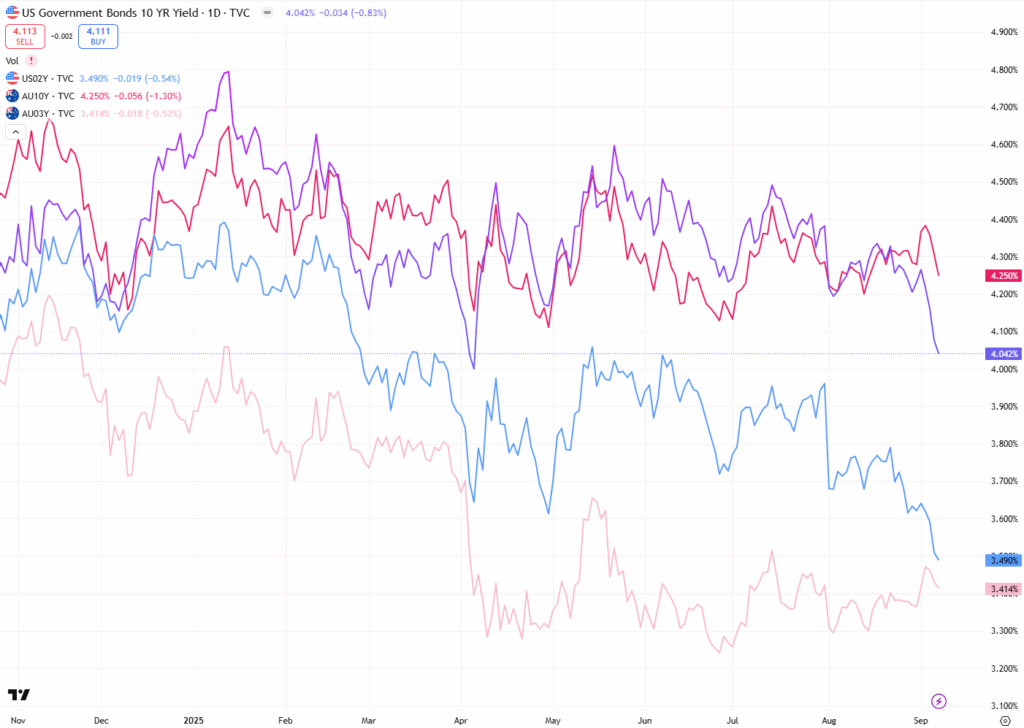

Investors are now turning their attention to U.S. inflation data, particularly the August consumer price index, expected to reveal a modest acceleration in price growth to 2.9% from 2.7% in July. Analysts note that the effects of Trump’s recently enacted tariffs are likely to show up in import costs and could fuel inflation further. While this week’s CPI and producer price index reports may not directly impact the Federal Reserve’s September rate decision, policymakers have warned that rising price pressures linked to tariffs could delay future interest rate cuts.

On the political front, France’s government suffered another collapse after Prime Minister Francois Bayrou lost a confidence vote, forcing President Emmanuel Macron to weigh whether to hold a new snap election or appoint a replacement. Concerns are growing over France’s surging debt burden, especially with 30-year bond yields hitting decade highs. In Japan, Prime Minister Shigeru Ishiba announced his resignation shortly after striking a trade deal with the U.S., leaving a power vacuum within the ruling Liberal Democratic Party. His sudden departure raises the likelihood of fresh political uncertainty in Japan, particularly in the wake of his party’s recent electoral defeat.

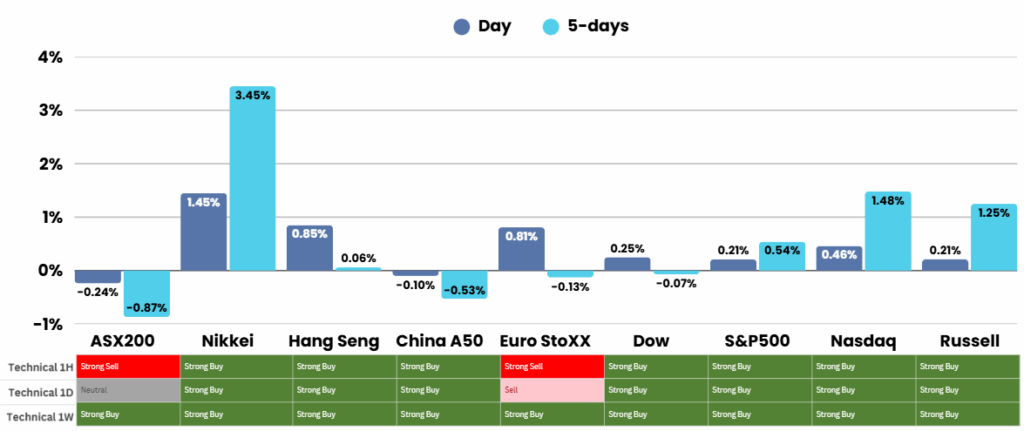

ASX Overnight: SPI 8826 (-0.35%)

The Day Ahead:

The local market is likely to be softer as the strength in chips stocks doesn’t translate to the ASX200. In terms of economic numbers Westpac will release its monthly consumer confidence survey result at 10.30am, while NAB will its business confidence and conditions reports at 11.30am.

Yesterdays Session:

ASX Slips as Energy and Banks Weigh on Market

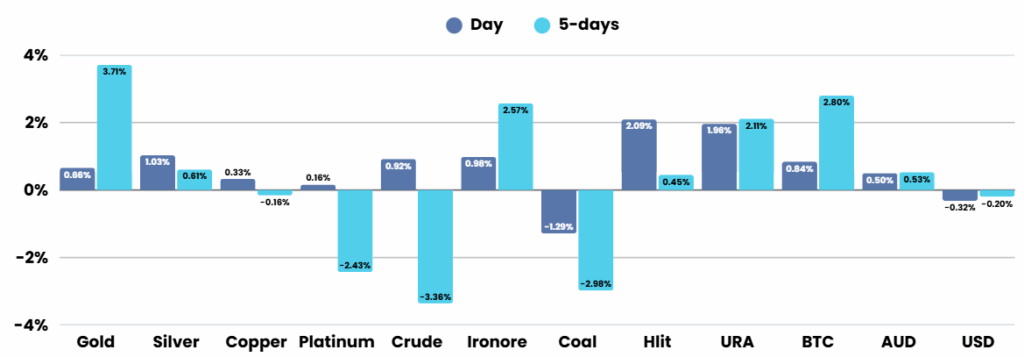

The Australian sharemarket slipped 0.4 per cent on yesterday, dragged down by energy and banking losses despite strength in technology and lithium stocks. Woodside, Beach Energy and Santos led the energy declines, while major banks also eased. Gold hovered near record highs but gold miners fell, contrasting with gains for lithium producers and uranium player Boss Energy. Tech stocks like Life360 advanced, and DroneShield surged on ASX 200 entry, while Mayne Pharma slumped on takeover concerns. Coles and Woolworths traded mixed after outlining $800 million in backpay provisions.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.