Overnight – Tech makes fresh record as AI fly’s above the Trump Chaos

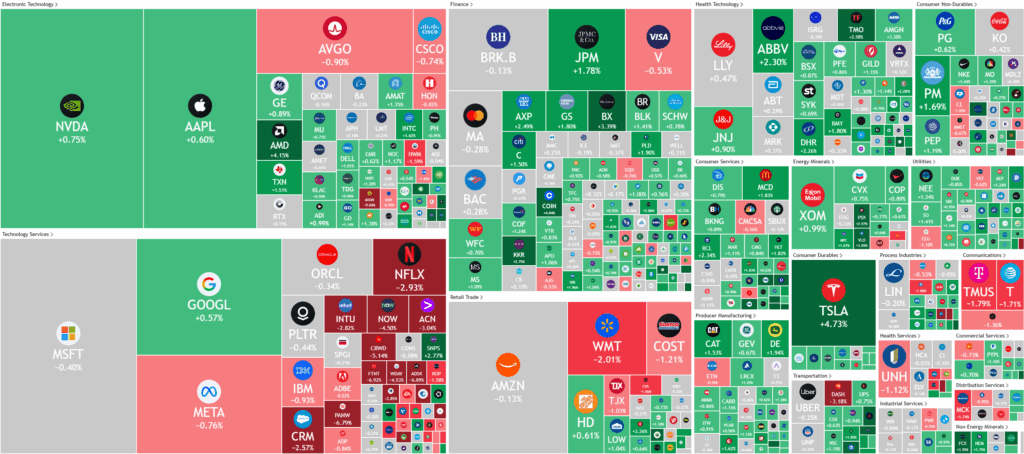

Tech stocks notched fresh record closing highs overnight, led by chip stocks on signs of ongoing AI-driven demand, overshadowing ongoing tariff uncertainty.

The rally was led by semiconductor companies, with Taiwan Semiconductor Manufacturing reporting an impressive 39% year-over-year surge in second-quarter sales, easily surpassing analyst predictions and highlighting the strength of AI-fueled demand for advanced chips. Advanced Micro Devices saw its shares climb following a favorable analyst upgrade, and NVIDIA extended its upward momentum after recently crossing the $4 trillion market capitalization threshold, underscoring the sector’s central role in powering the current bull market.

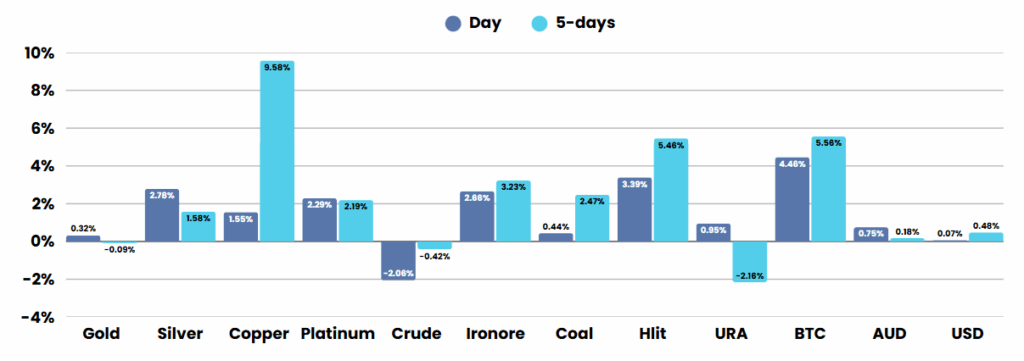

Despite these gains, the broader market mood was moderated by escalating trade tensions and policy uncertainty. President Trump announced a sweeping 50% tariff on all imports from Brazil, set to take effect on August 1, in response to diplomatic disputes and concerns over the treatment of former Brazilian President Jair Bolsonaro. Brazilian President Luiz Inacio Lula da Silva denounced the tariffs and vowed a measured response, intensifying fears of a potential trade war between the two nations. In addition, Trump imposed a 50% tariff on copper imports, citing national security interests, further fueling anxiety about inflationary pressures and the stability of global supply chains. These developments injected a note of caution into the market, as investors weighed the potential for higher costs and slower growth resulting from tit-for-tat trade actions.

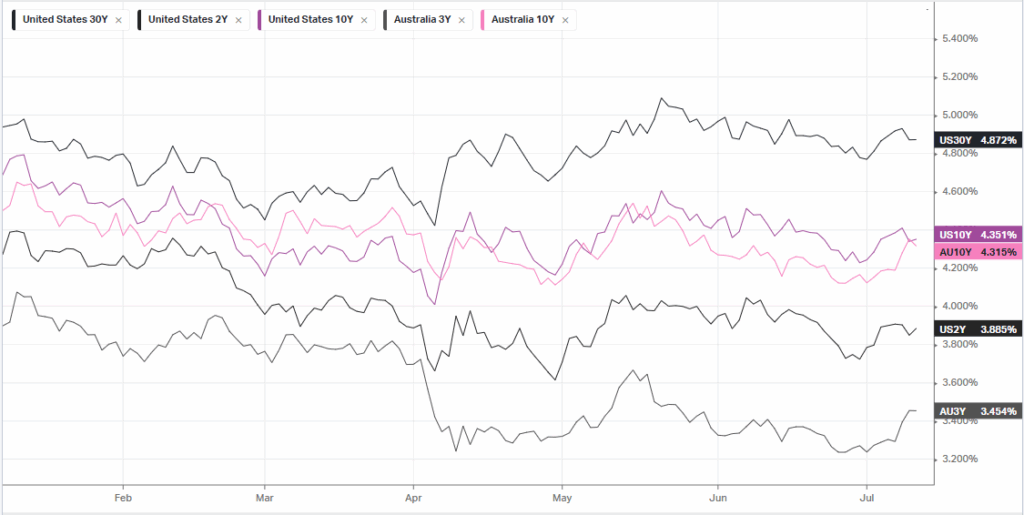

On the economic front, data offered some reassurance, with initial jobless claims declining to 227,000—lower than expected—signaling continued resilience in the labor market. The latest Federal Reserve meeting minutes revealed that most policymakers are inclined to maintain a cautious, wait-and-see stance on interest rate cuts, mindful of the risk that new tariffs could stoke inflation and dampen economic growth. In the corporate arena, WK Kellogg shares surged after Ferrero agreed to acquire the cereal maker for $3.1 billion, reflecting robust deal activity. McDonald’s stock jumped over 2% following a Goldman Sachs upgrade based on expectations for increased demand among cost-conscious consumers. Delta Air Lines also rallied after restoring its full-year guidance and reporting record quarterly revenue, demonstrating confidence in its business outlook despite tariff-related headwinds. Meanwhile, the U.S. dollar index strengthened, Treasury yields edged higher, oil prices fell more than 2% amid concerns about global growth, and gold prices rose as investors sought safety in the face of mounting economic uncertainty.

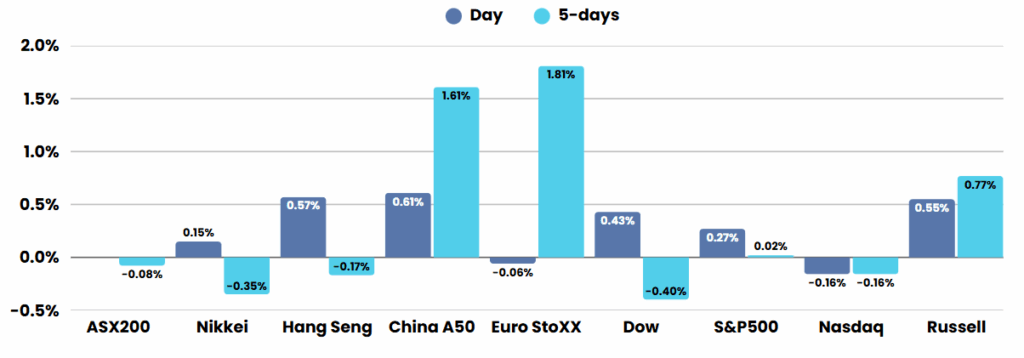

ASX SPI 8600 (+0.31%)

The ASX is poised to open modestly higher today, buoyed by mixed Wall Street cues and a sharp rally in commodity prices that is set to energize the materials sector.

Iron ore prices jumped 3%, adding to the strong rebound from recent lows amid renewed optimism over Chinese demand signals and global supply chain adjustments in response to impending U.S. tariffs. Copper also extended its surge, climbing more than 2%, fueled by President Trump’s confirmation of a 50% tariff on imports effective August 1, which has ignited short-term bullish sentiment for Australian producers despite longer-term trade risks. This momentum could drive gains of 1-2% in major miners like BHP and Rio Tinto, providing a lift to the overall materials sector.

That said, the market at large appears anchored in a cautious holding pattern, as investors await further clarity on Trump’s expanding tariff regime—including new rates up to 40% on various countries—before the August 1 implementation, which could trigger retaliatory actions affecting Australian exports.

Todays ASX summary and predictions were produced by Elon Musk’s newest version of his AI model, Grok 4.0, released yesterday. I thought it was impressive enough to give you an example of what the new benchmark is for AI

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.