Overnight – Stocks rejoice as the US & China do a deal… to make a deal…Maybe

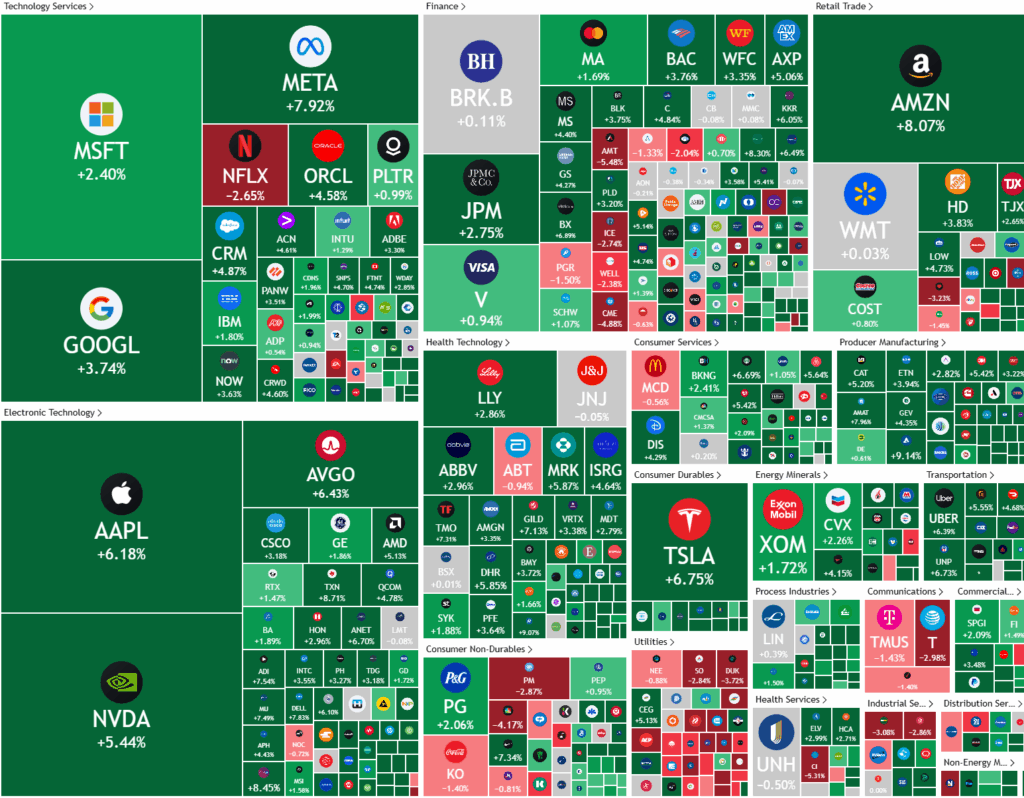

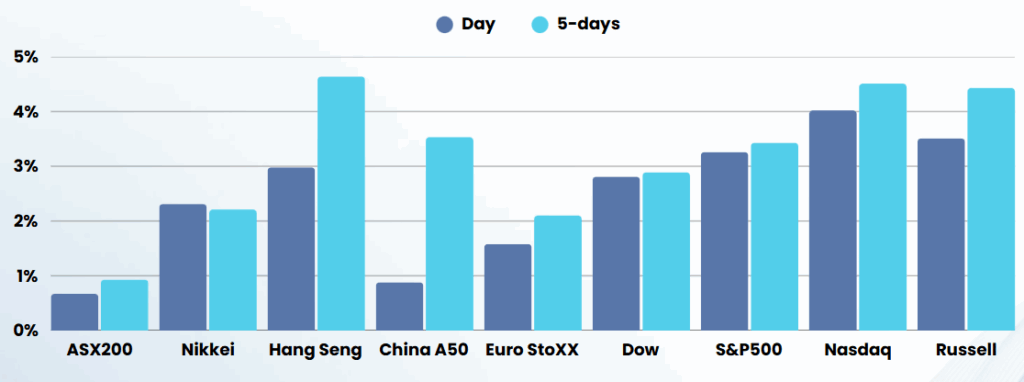

Stock market investors rejoiced overnight with the major indices soaring 3%+ after the White House announced an easing of escalated tariffs and agreeing to a 90 day “truce”, easing fears of prolonged trade war.

The United States and China have agreed to a 90-day suspension of most of the steep tariffs they imposed on each other, following high-stakes negotiations in Geneva. Under the deal, U.S. tariffs on Chinese imports will be slashed from 145% to 30%, while China will reduce its tariffs on American goods from 125% to 10%. This temporary truce comes after months of escalating trade tensions that had severely disrupted global markets, threatened supply chains, and raised fears of a recession. Both sides emphasized their mutual desire to avoid a complete economic decoupling and committed to further negotiations and working-level consultations to address ongoing trade issues.

The agreement has been welcomed by investors and markets worldwide, with stock indices and China-related shares rallying sharply in response to the news. While the tariff reductions provide immediate relief and are seen as a positive step toward stabilizing the global economy, analysts caution that the underlying U.S.-China relationship remains fragile, and uncertainty persists about the long-term resolution of their trade disputes.

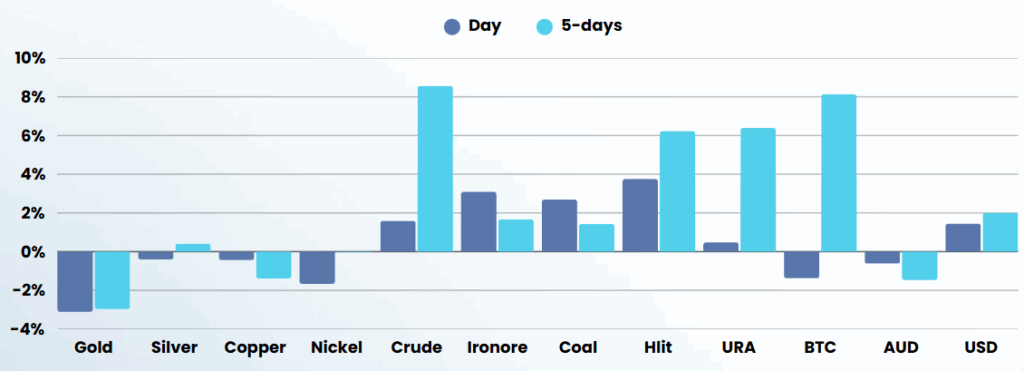

At a company level, the stocks of big pharma companies, Pfizer, Eli Lilly and Johnson & Johnson all fell after President Donald Trump said he would cut prescription drug prices by 59% but gave no further details about his plan to lower medicine costs. Elsewhere, Chevron and Exxon Mobil gained strongly as crude prices surged in the wake of the trade deal between the two largest oil consuming nations in the world.

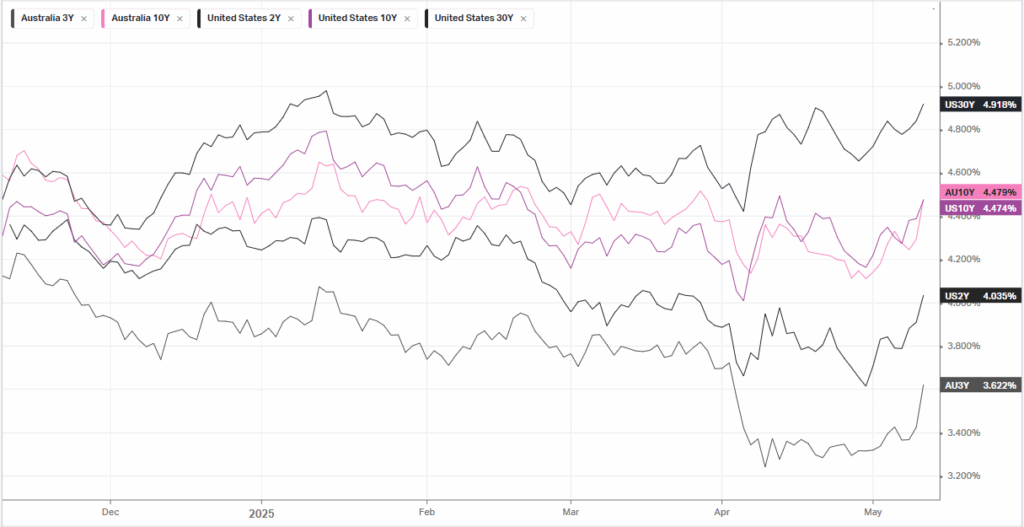

One factor stock investors are conveniently ignoring is that Long dated bond yields have also spiked higher, with the US30Y only 11bps from 17-year highs and US10Y back to key levels at 4.5% increasing the debt servicing costs for the burgeoning US Debt

ASX SPI 8364 (+1.17%)

The local market will be sucked into the slipstream of global market optimism on Trump fixing the problem he created, then backflipped on and claimed victory.

While this “deal to make a deal” is expected to boost economic activity and confidence in the short term, Equity markets are now 5.5% higher than “Liberation Day” levels and the reality is that tariffs remain elevated compared to pre-trade war levels. We see this as an opportunity to take profits on any buying in the last 6 weeks as the risk reward is heavily weighted to the downside