Overnight – Market grinds higher on Trade and Inflation optimism

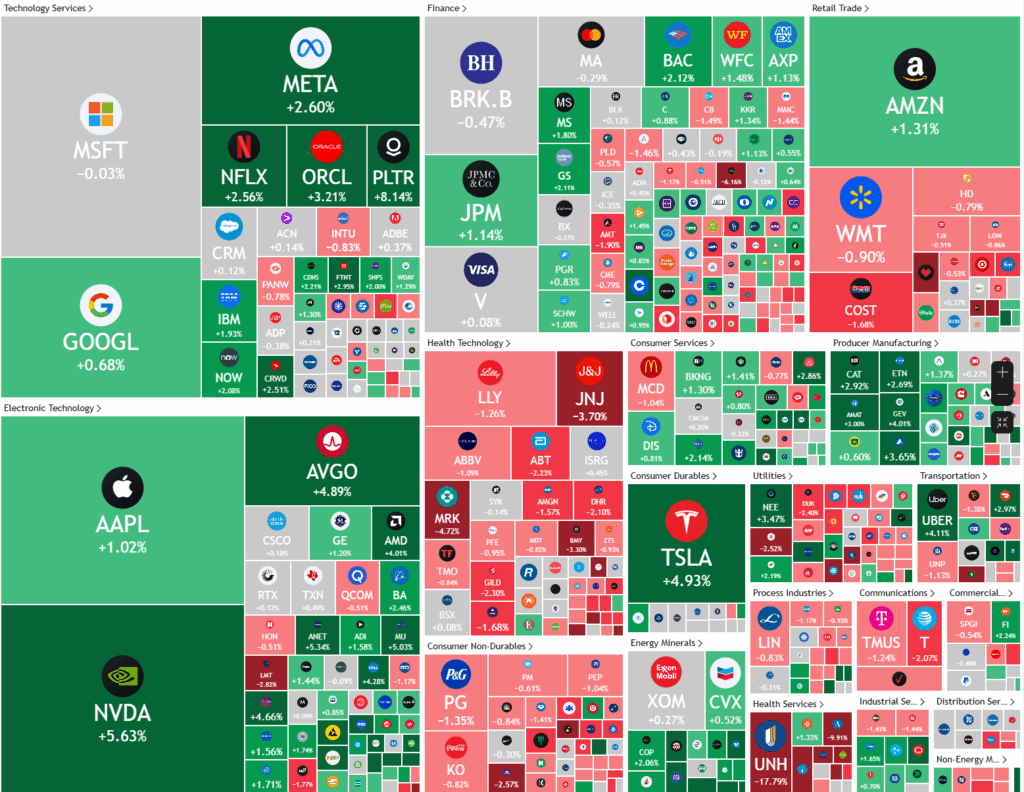

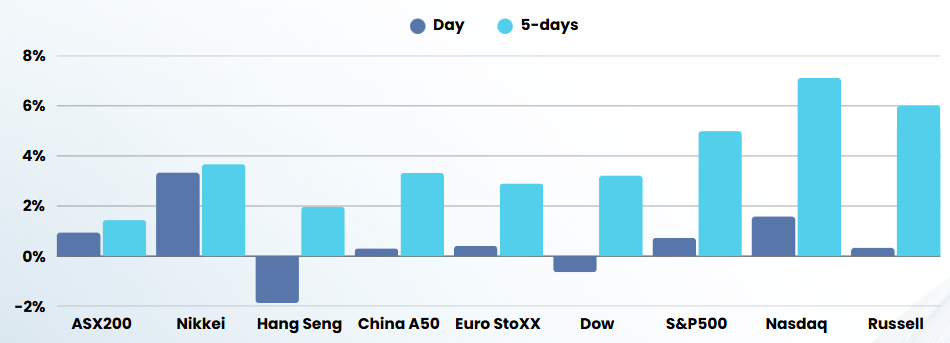

Stock closed slightly higher overnight as data showing inflation slowed in April supported bullish sentiment on risk just days after the U.S.-China trade deal agreement.

U.S. inflation showed further signs of cooling in April, with the annual consumer price index (CPI) rising by 2.3%, slightly below economists’ expectations and marking the lowest rate since February 2021. On a monthly basis, prices increased by just 0.2%, following a 0.1% decline in March, while core inflation-which excludes food and energy-also rose by 0.2% for the month and 2.8% year-over-year. These figures suggest that inflationary pressures remain subdued, despite ongoing concerns about the potential impact of recently imposed and adjusted tariffs between the U.S. and China. Notably, energy costs continued to decline and food price growth slowed, while shelter costs remained a significant driver of overall price increases.

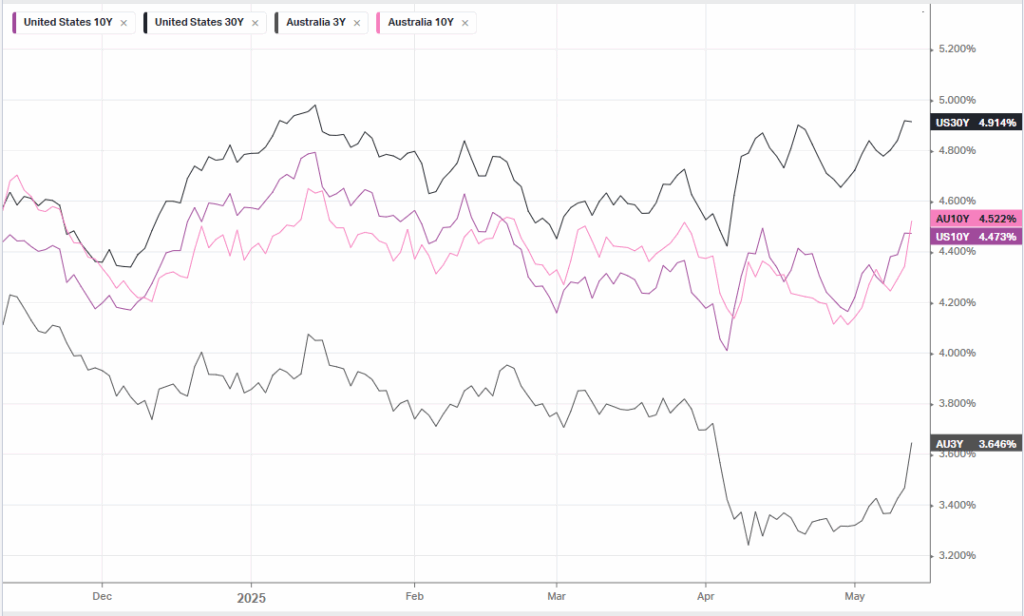

Economists remain cautious, however, as the effects of new tariffs have yet to fully materialize in consumer prices. Recent trade agreements have temporarily paused or reduced some tariffs, which may help contain future price increases, but analysts warn that inflation could rise again if tariff costs are eventually passed on to consumers. The current inflation data, combined with easing trade tensions and improving economic indicators, has led some analysts to lower their estimates of recession risk. Nevertheless, the Federal Reserve is expected to remain cautious, holding off on interest rate changes until there is more sustained evidence that inflation will continue to move closer to its 2% target

Company Earnings

- United health – slumped after the health insurer suspended its full-year financial forecast due to a bigger-than-anticipated spike in medical costs, while CEO Andrew Witty has decided to step down from the helm of the company.

- Under Armour – stock rose after the sportswear maker’s quarterly revenue topped expectations, even after it reported a first-quarter loss.

- Coinbase Global – surged, with the crypto exchange set to join the S&P 500 index, replacing Discover Financial Services

ASX SPI 8310 (+0.21%)

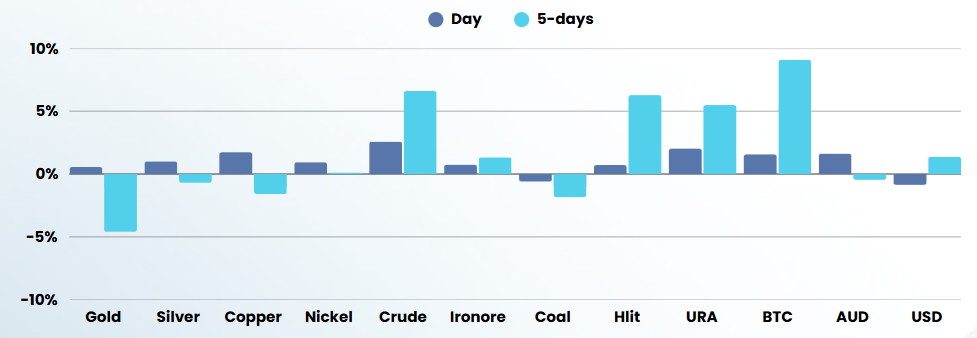

The local market is likely to head higher today as confidence continues to return. investors are digesting half-year results from index bellwether Commonwealth Bank. The lender’s profit rose 6 per cent in the third quarter to $2. 6 billion, underpinned by strong growth in business lending. And ASIC is suing Macquarie Securities, alleging that the business engaged in misleading conduct by misreporting millions of short sales to the market operator between 2009 and 2024. Energy stocks are likely to extend a bull run as oil powered higher. Brent leapt 2.5 per cent to $US66.55 as investors bet lower tariffs on China would boost its demand for commodities, while Donald Trump threatened to increase sanctions on Iranian crude.

- Billionaire businessman Bruce Gordon has increased his stake in Nine Entertainment, consolidating his position as the media group’s largest shareholder.

- Aristocrat Leisure’s half year net profit inched up 0.1 per cent, as higher revenue was offset by rising costs and lower income. The gaming company declared an interim dividend of 44¢, a jump of 22 per cent.

- Bain Capital has withdrawn its bid for wealth manager Insignia owing to “macro uncertainty” and volatility in global markets, the latter said on Tuesday.