Overnight – Stocks salvage small gain as Tech carries the index

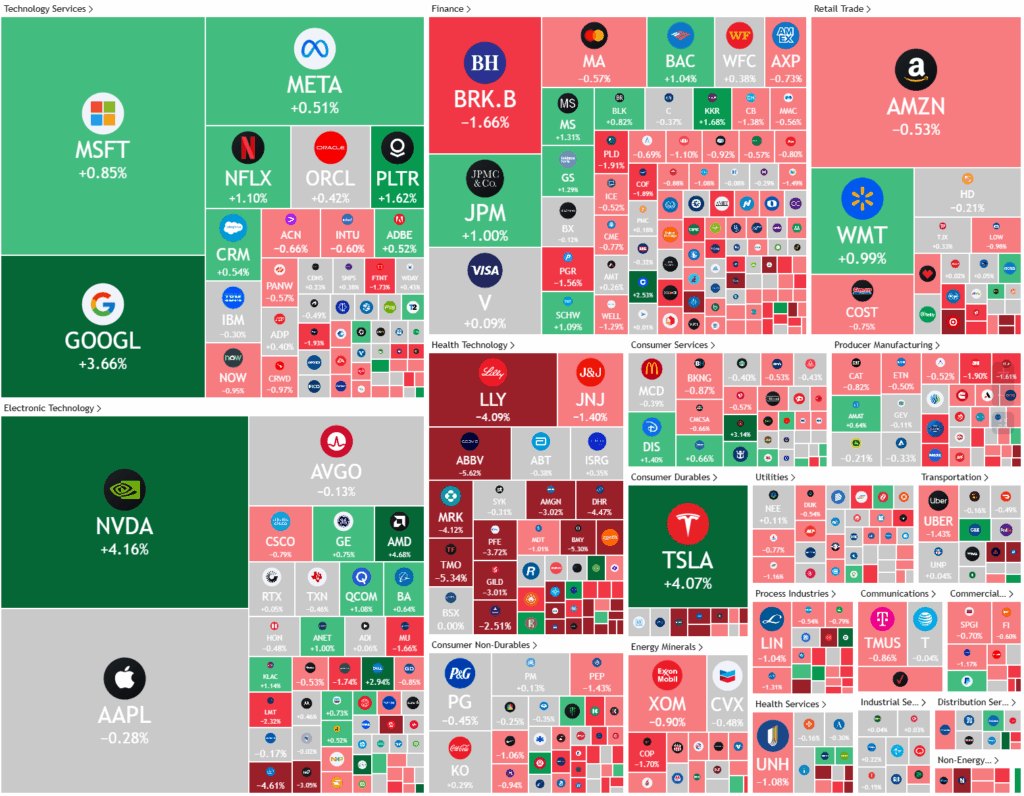

Stock squeezed out a small gain, led by tech, a day after turning positive for the year amid ongoing optimism surrounding the U.S.-China trade deal.

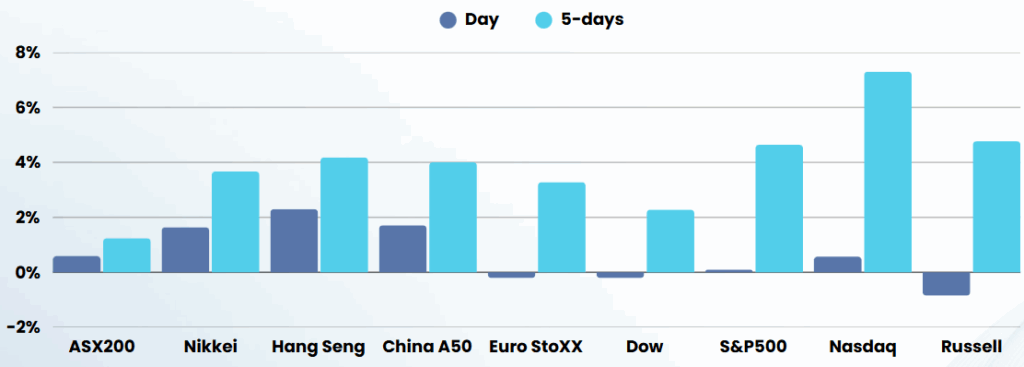

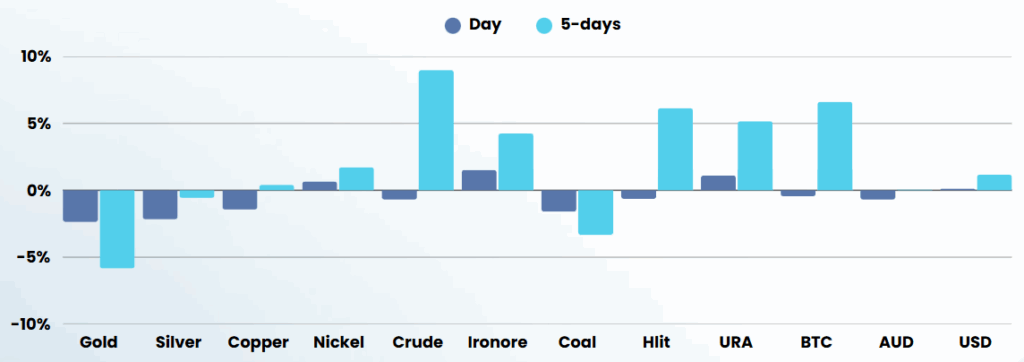

Investor optimism has been buoyed by a series of major trade and investment announcements. President Trump secured a landmark agreement with China to drastically reduce tariffs for an initial 90-day period, easing tensions that had rattled global markets and disrupted supply chains.

Simultaneously, President Trump announced a $600 billion investment commitment from Saudi Arabia, encompassing a mix of public and private partnerships, a record $142 billion arms deal, and significant technology and infrastructure projects involving major U.S. firms. While some details of the investment remain vague, the White House characterized the agreements as transformative, aiming to strengthen economic and security ties between the two nations for years to come. Notably, Saudi digital infrastructure firm DataVolt pledged $20 billion for AI data centers in the U.S., and several American companies, including Google, Uber, and Boeing, are set to play key roles in Saudi infrastructure initiatives.

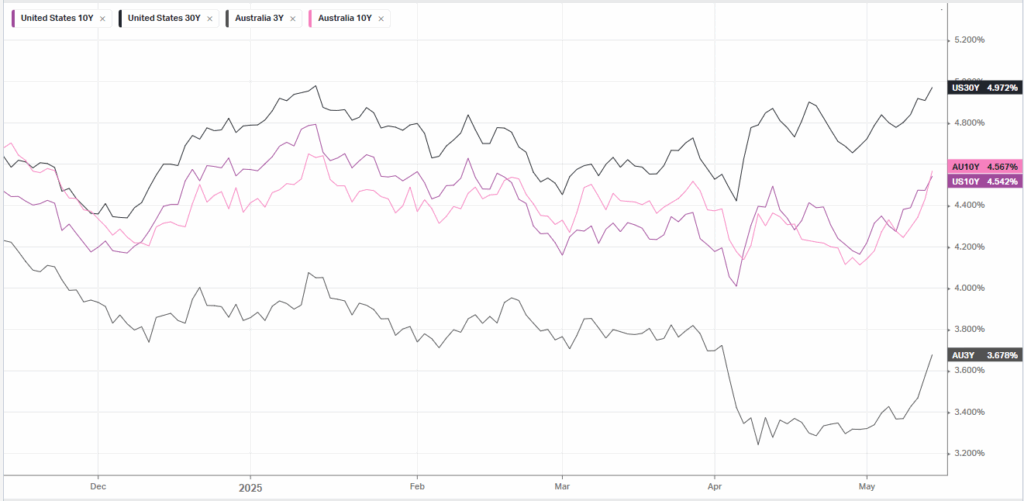

Despite the positive momentum, Federal Reserve officials have cautioned that lingering tariff-related uncertainties could still cloud the inflation outlook. While the easing of trade tensions is expected to support growth and potentially reduce inflationary pressures, the Fed is likely to remain cautious, with analysts predicting that any rate cuts will be modest and not occur before September. Overall, the recent trade breakthroughs and investment commitments have injected fresh confidence into financial markets, particularly benefiting tech and chip stocks, but policymakers and investors remain attentive to potential risks as negotiations and economic adjustments continue

Company Earnings

- American Eagle Outfitters- stock slumped after the clothing retailer withdrew its outlook for the year after posting disappointing preliminary first-quarter results.

- Ford –stock fell with the auto giant having to recall over 273,000 vehicles in the United States as a loss of brake function may increase the risk of a crash.

ASX SPI 8271 (-0.43%)

Domestically we are likely to drift off today as investors start to realise we have come a long way, very, very fast. In economic data April’s employment numbers will be released at 1130

Company Specific

- Accounting software giant Xeroreported a 30 per cent jump in net profit for the 2025 financial year, driven by a boom in new subscribers.