Overnight – Stocks Slide, Oil Spikes as Global Markets Rattled by Middle East Conflict

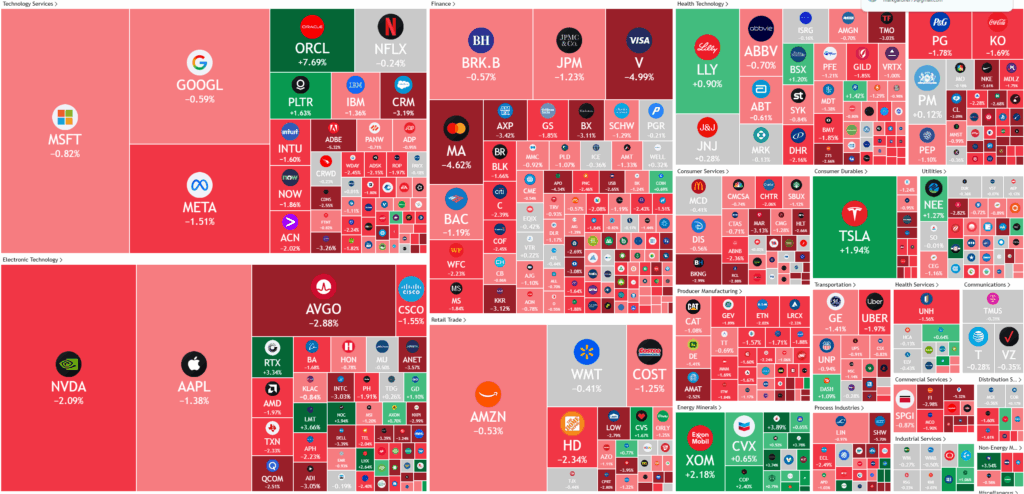

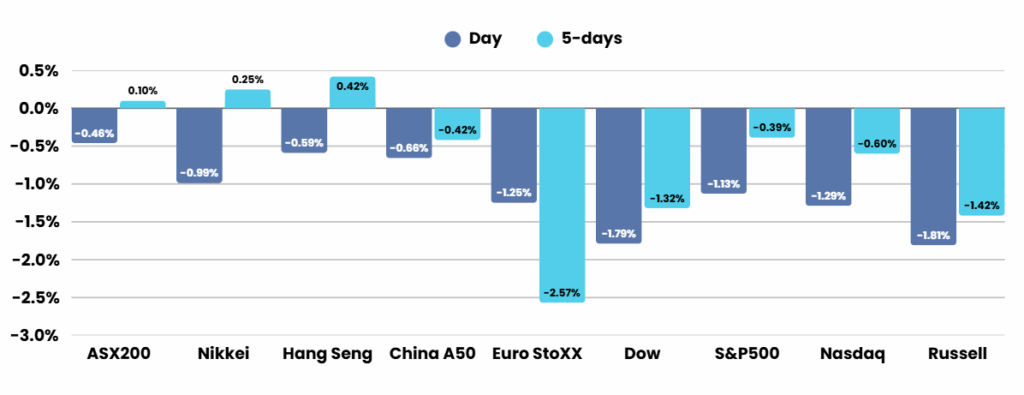

Equity markets closed sharply lower overnight as escalating geopolitical tensions in the Middle East rattled investors and sent volatility soaring. The Dow Jones Industrial Average dropped 1.79%, the S&P 500 slid 1.13%, and the NASDAQ Composite fell 1.30%. Losses were broad-based, with financials, technology, and industrials leading the decline. Energy stocks were the exception, climbing on the back of surging oil prices. Oracle stood out among tech names, jumping 7.7% to a record high after an upbeat AI-driven forecast, while Adobe slipped over 5% as investors questioned the pace of its AI adoption.

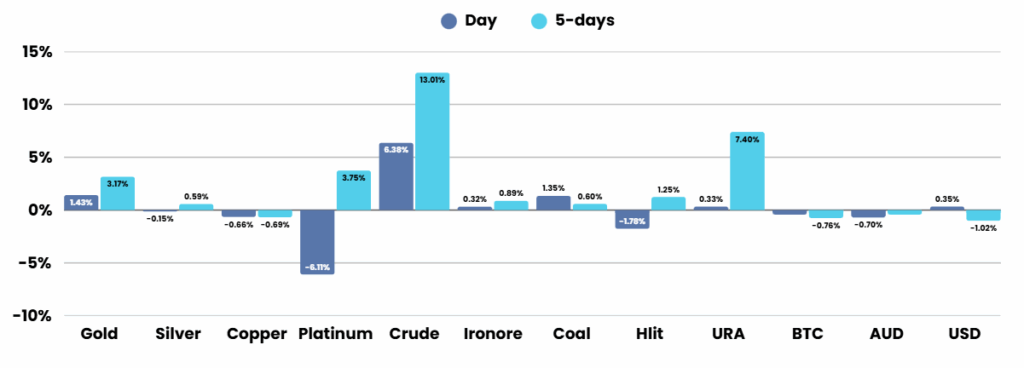

The market’s anxiety was fuelled by a dramatic escalation between Iran and Israel. Iran launched hundreds of missiles at Israel in retaliation for Israeli strikes on Iranian nuclear and military sites, marking the most significant military exchange between the two countries in decades. The conflict stoked fears of a wider regional war, especially given the Middle East’s pivotal role in global oil production. Oil prices surged nearly 7%, with U.S. energy giants like Exxon and Diamondback Energy rallying in tandem. The CBOE Volatility Index spiked over 15%, reflecting heightened investor uncertainty.

Sector-specific reactions were pronounced. Airline stocks, including Delta, United, and American Airlines, tumbled as higher crude prices threatened to drive up fuel costs. In contrast, defense companies such as Lockheed Martin, RTX, and Northrop Grumman saw strong gains as investors anticipated increased military spending. Meanwhile, payment giants Visa and Mastercard fell sharply after reports that major retailers are exploring cryptocurrencies to bypass traditional payment systems, adding another layer of disruption to the market.

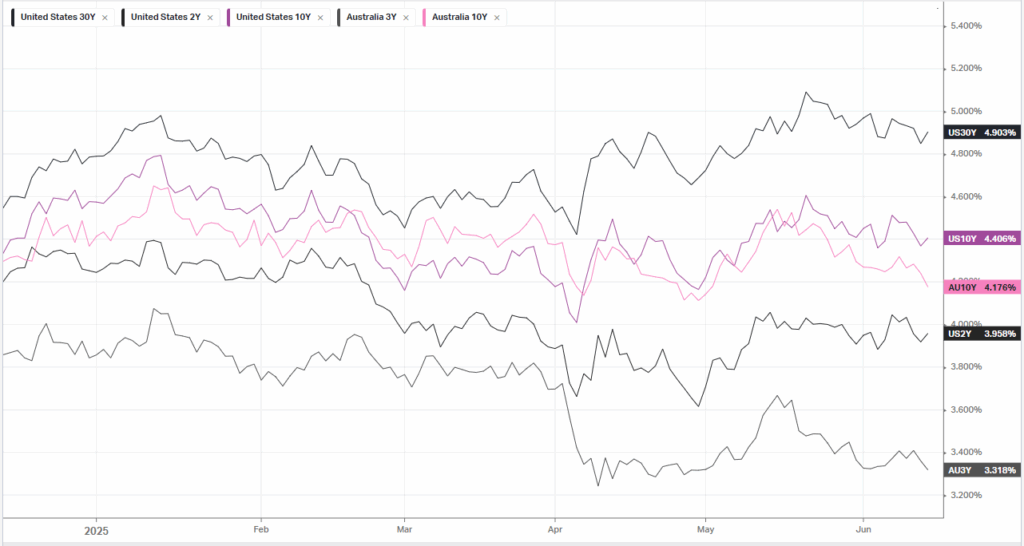

Despite the turmoil, some economic data provided a counterbalance. The University of Michigan’s consumer sentiment index rebounded in June, and recent inflation readings came in cooler than expected, suggesting that the full impact of trade tariffs has yet to be felt. President Trump continued to signal the possibility of further tariffs, keeping trade uncertainty elevated. As investors look ahead to the Federal Reserve’s upcoming meeting, expectations are for rates to remain unchanged, with hopes pinned on progress in trade negotiations to stabilize markets. Overall, declining stocks far outnumbered gainers, and the week ended with the major indices in the red.

ASX SPI 8532 (-0.23%)

Australian shares are likely to open lower on continued conflict in the middle east and growing concerns over trade deals (or the lack thereof)

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.