Overnight – Stocks lower as Fed signals slower pace of cuts due to Trump uncertainty

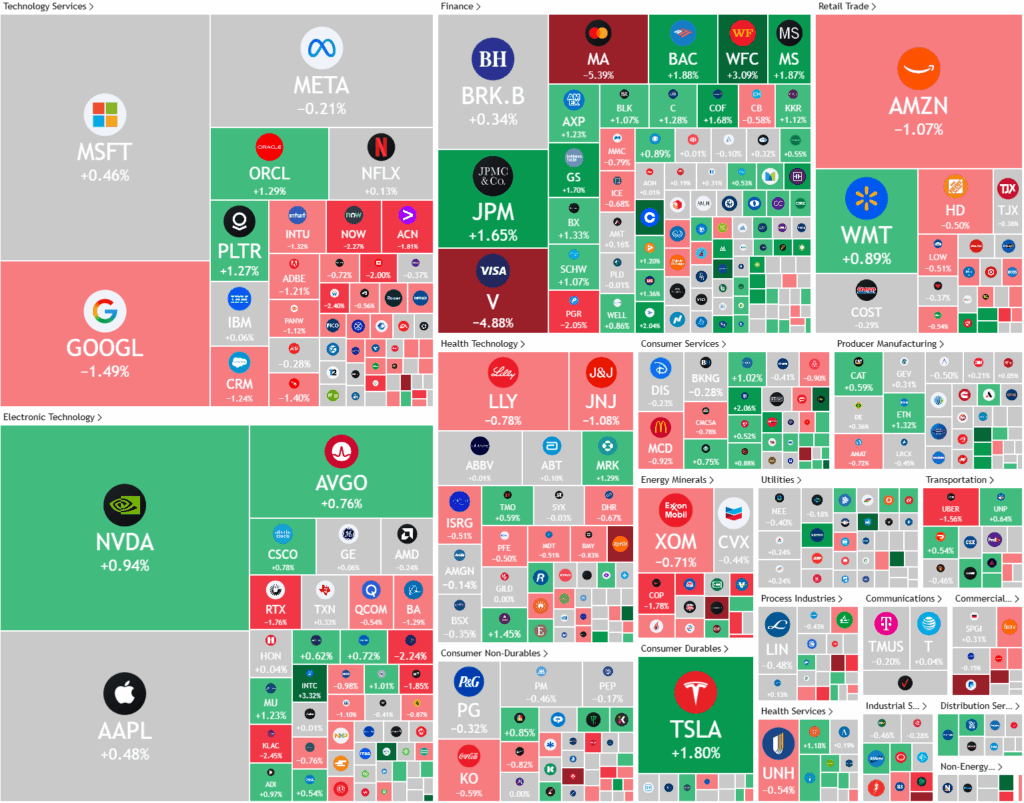

Stocks gave up early gains to close lower overnight, after Federal Reserve left interest rates unchanged, but signaled a slower pace of rate cuts ahead as uncertainty about the impact of President Donald Trump’s polices including tariffs continue to muddy the outlook on the economy

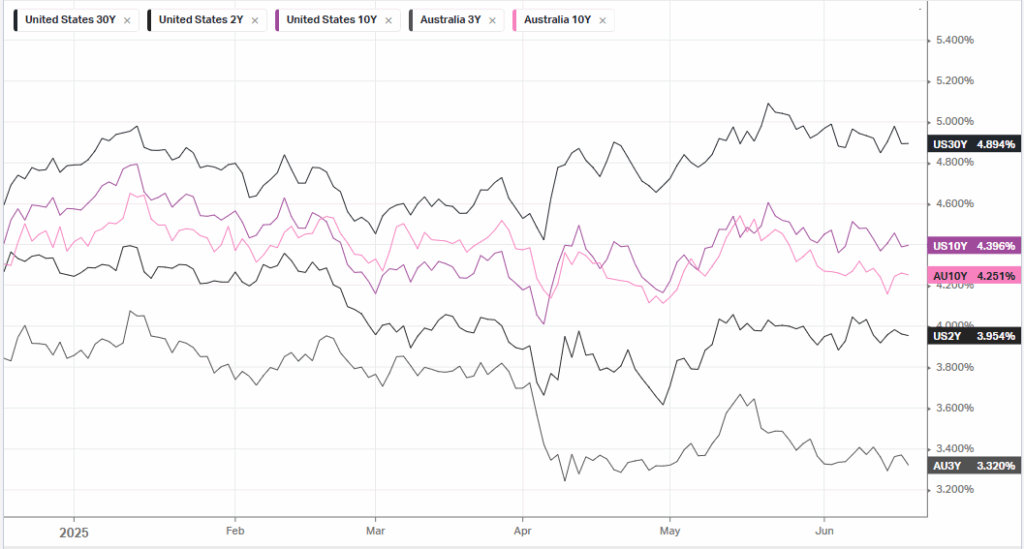

The Federal Reserve decided to keep interest rates steady in the 4.25%-4.50% range, signaling a more hawkish stance by forecasting fewer rate cuts for the coming years due to concerns about slowing economic growth and persistent inflation. While the Fed still anticipates two rate cuts this year, maintaining its projection for the benchmark rate to fall to 3.9%, it now expects a slower pace of cuts in 2026 and 2027, with rates projected to reach 3.6% and 3.4% respectively, both higher than previous forecasts. Recent economic data showed a modest 0.4% increase in U.S. single-family housing starts in May, but a significant drop in building permits suggests ongoing challenges in the housing market, compounded by tariffs and excess inventory. Meanwhile, new unemployment claims fell by 5,000 to 245,000, but the level remains consistent with a weakening labour market.

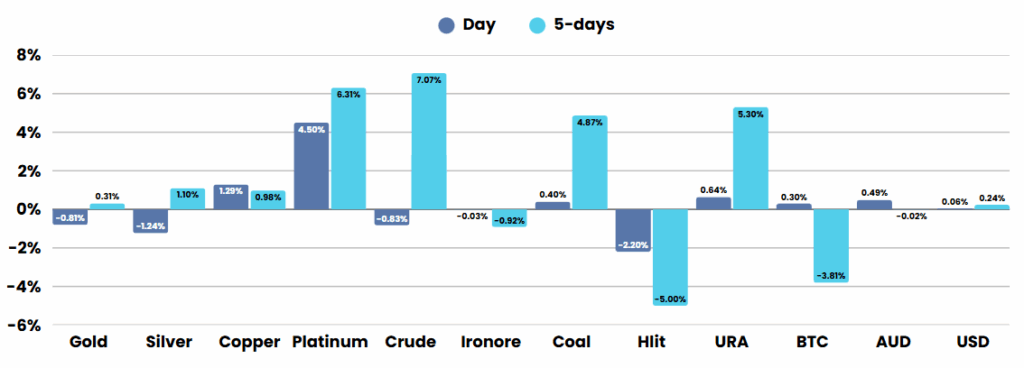

Geopolitical tensions in the Middle East have intensified, impacting investor sentiment. Iran’s Supreme Leader Ayatollah Ali Khamenei publicly rejected U.S. President Donald Trump’s demands for unconditional surrender, emphasizing that Iran would not yield to threats and warning of severe consequences if the U.S. pursued military intervention. This statement followed recent Israeli strikes on Iran and comes as President Trump and his administration consider various options, including possible military action against Iranian nuclear facilities, though Trump also indicated that Iran is open to negotiations.

In the financial sector, U.S. bank regulators are reportedly planning to lower the enhanced supplementary leverage ratio (ESLR) for the largest banks, such as JPMorgan Chase, Goldman Sachs, and Morgan Stanley, from 5% to a range of 3.5%-4.5% to address concerns that current requirements restrict their trading of U.S. Treasurys. Elsewhere in the markets, Peloton Interactive’s stock rose nearly 2% after securing financing and reducing costs, Hasbro’s shares edged higher following a 3% workforce reduction amid higher tariffs, and Circle Internet Group surged 20% after the Senate passed the GENIUS Act, establishing a regulatory framework for stablecoins and potentially paving the way for broader adoption.

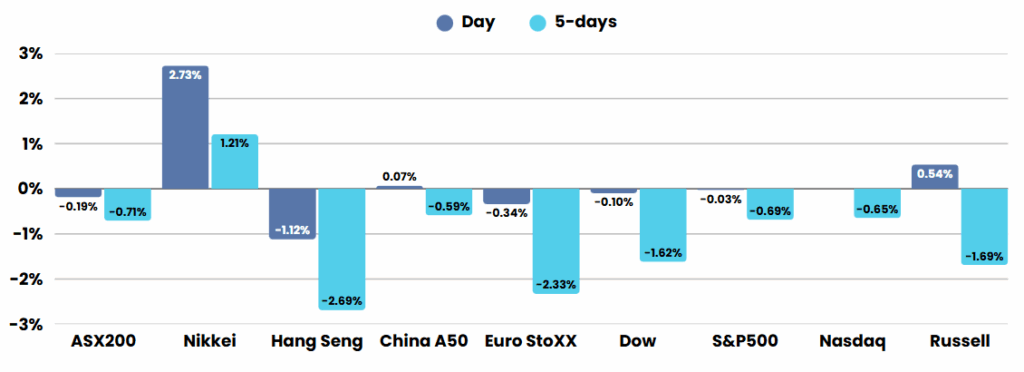

ASX SPI 8513 (-0.23%)

The local market is likely to continue to drift lower as the Fed meeting, middle east conflict and iron ore prices weigh on investor sentiment.

In addition to the multiple macro and geopolitical issues going on in global markets, we are heading into seasonally weak period from early July to early October, near record highs. Current levels are a good opportunity for tax-loss selling, trimming risk and sitting on elevated levels of cash for a period

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.