Overnight – Stocks notch 2nd best week of 2025, but Moodys downgrade US after the bell

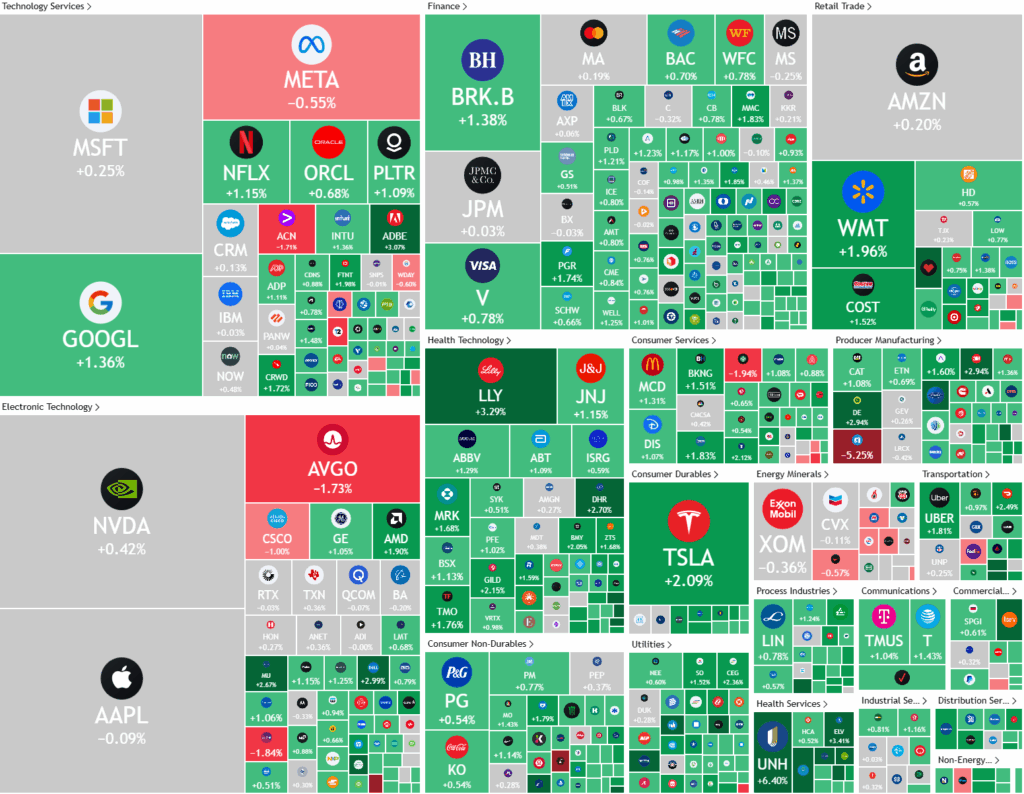

Stocks climbed Friday, notching a big weekly gain, after shrugging off an unexpected dip in consumer sentiment as ongoing optimism about the recent U.S.-China trade continues to support sentiment. However, rating agency, Moodys removed the US AAA rating after the bell sending futures lower

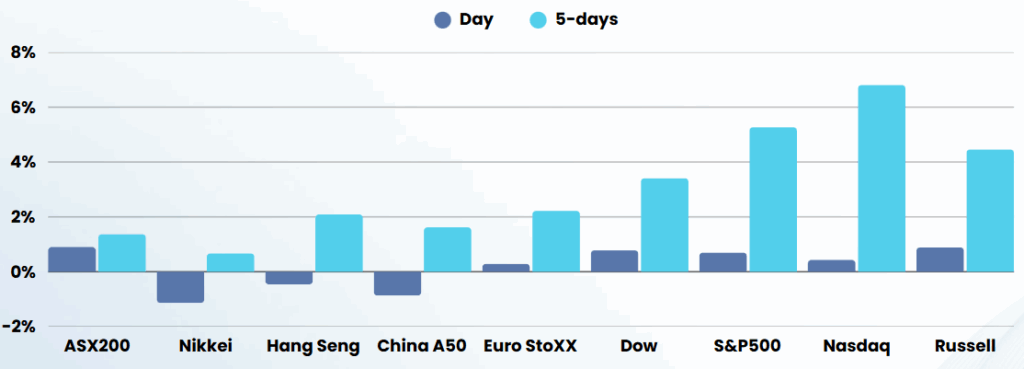

For the week, the S&P 500 was up 5.3%, the Dow has gained 3.4%, and the Nasdaq Composite has jumped 7.2% this week, supported by U.S. and Chinese officials agreeing on a 90-day truce in their tariff measures at the start of the week, which eased investors’ fears of escalating global trade tensions and rising risk to the economy.

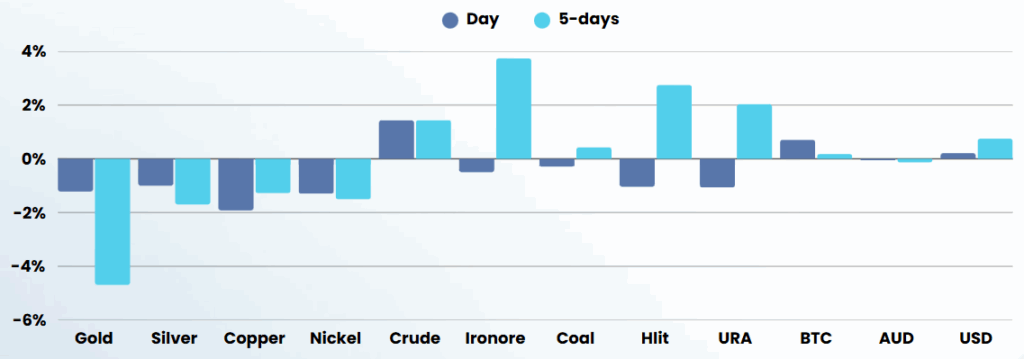

The preliminary reading of the University of Michigan’s consumer sentiment survey for May was reported at 50.8, down from 52.2 in April, confounding expectations for a rise to 53.4. Sentiment has been down almost 30% since January 2025. Meanwhile, 1-year inflation expectation from the survey surged to 7.3% versus 6.5% expected. The 5-10 year inflation expectation was 4.6%, versus 4.4% expected. The impact of tariffs, albeit now much more tame than the those rolled on Apr. 2, will is expected to be reflected in economic data over the next few months, with some Wall Street warning of price pressures ahead.

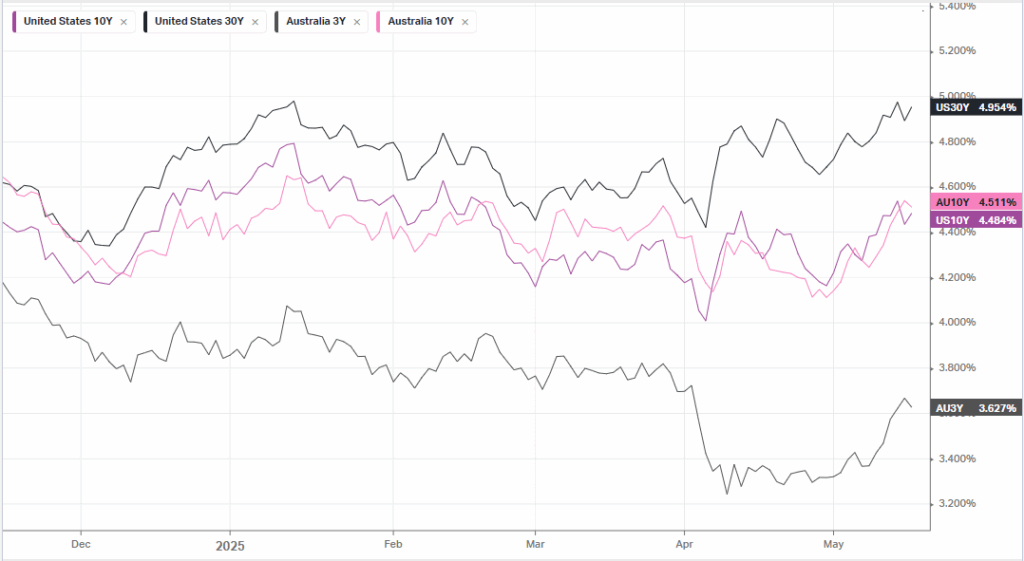

The trade agreement between Washington and Beijing has prompted Barclays to upwardly revise its U.S. growth forecasts, predicting that the world’s largest economy will not slip into a recession later this year. It now expects the U.S. economy to grow 0.5% this year and 1.6% next year, the bank said in a note released late Thursday, up from previous forecasts of -0.3% and 1.5%, respectively. Still, U.S. data released on Thursday showed soft retail sales as well as producer prices unexpectedly falling in April. The PPI figures came on the heels of a tame consumer price reading earlier in the week, cementing bets that the Fed is likely to cut rates at least twice this year.

The emerging possibility for stagflation (softer economy and rising inflation) should be of great concern for investors, especially at these elevated levels.

After the bell, Moodys downgraded the US credit rating below the revered AAA status. This has implication for the market and saw futures drop 0.5% after the close Click here to read more about implications for equities of Moodys downgrade

ASX SPI 8360 (-0.01%)

The ASX is likely to get hit on the back of worries around the US credit downgrade by Moodys after the bell. It will be key to watch US futures for a lead as previous downgrades have led to 10% falls

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.