Overnight – Investors leave the party despite stellar Microsoft and Meta earnings

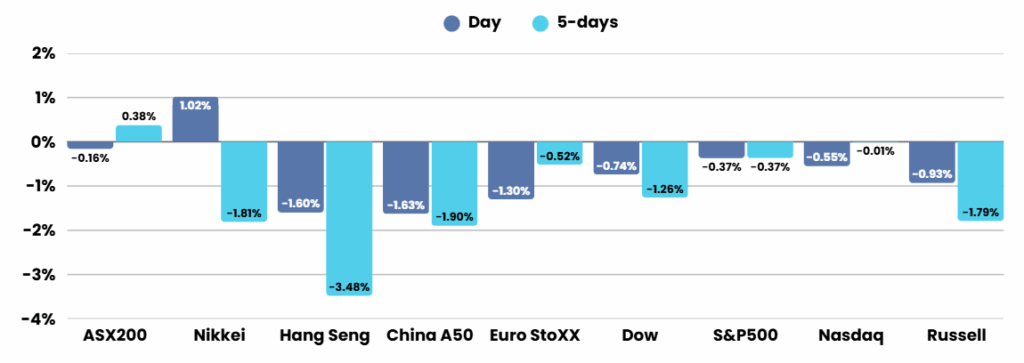

Not even stellar earnings from Microsoft and Meta could hold the market up overnight as the rate cut reality was moved out and the Trade deal deadline loomed large.

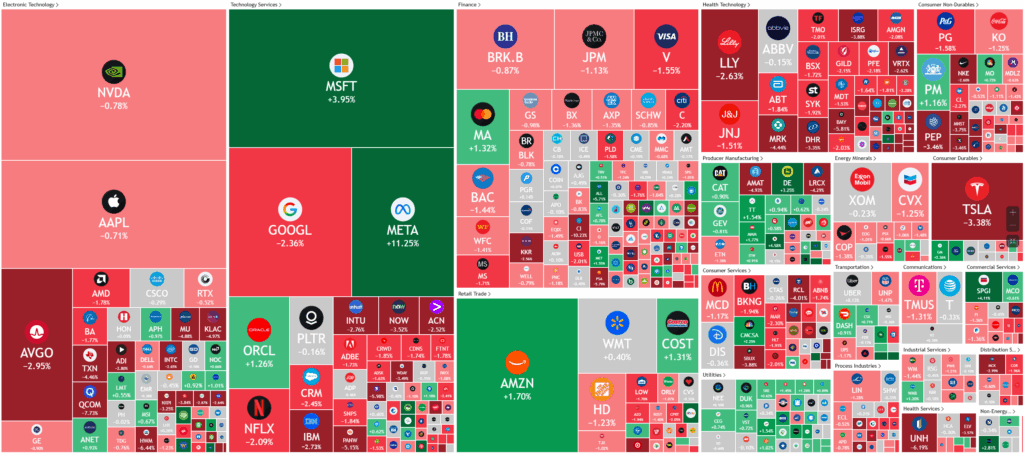

US stocks closed lower on Thursday, retreating from record highs even as major tech firms Meta Platforms and Microsoft surged following strong quarterly results. The S&P 500 briefly reached an intraday record before dipping, while the Dow Jones and NASDAQ also ended the session in the red. Meta’s gains were driven by robust advertising sales and optimism around its AI investments, while Microsoft’s results were powered by growth in its cloud computing business tied to artificial intelligence. Shares of other notable companies, including Comcast, Biogen, Norwegian Cruise Line, and CVS Health, also rose on the back of better-than-expected earnings and positive outlooks, while Qualcomm tumbled amid concerns about losing Apple as a major customer.

On the economic front, US labour market data showed a marginal increase in new unemployment claims, indicating continued stability, though layoffs are taking longer to resolve. Consumer spending rebounded in June with a 0.3% increase, and the Personal Consumption Expenditures Price Index—a key inflation measure—rose 0.3% for the month and 2.6% year-over-year. The core PCE index, which excludes food and energy, was also up, pointing to moderate but persistent inflation pressures, partially attributed by analysts to the early effects of recent U.S. tariff policies.

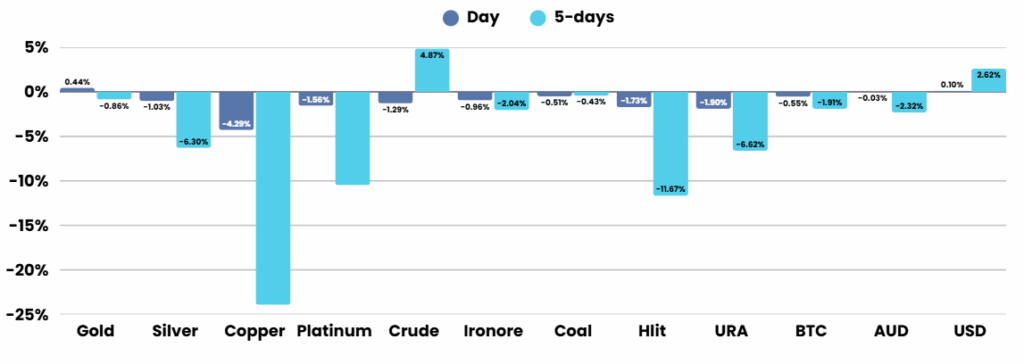

Meanwhile, the Federal Reserve opted to keep interest rates unchanged, but a rare double dissent among Fed governors highlighted divisions within the central bank. This decision drew sharp criticism from President Donald Trump, who continues to pressure the Fed for rate cuts to stimulate economic growth. Trump also announced new tariffs, including a 15% levy on South Korean imports and a 25% tariff plus penalties on Indian goods, citing security concerns and India’s procurement of Russian military equipment. These new tariffs, along with “reciprocal” tariffs on other countries, are set to take effect August 1, adding further complexity to the economic outlook.

Corporate Earnings

- Apple +2% – reported strong fiscal third-quarter results, outperforming Wall Street expectations with earnings of $1.57 per share on $94.04 billion in revenue, buoyed by a 13% jump in iPhone sales to $44.58 billion as demand rebounded in China and services revenue reached a record $27.42 billion. Despite ongoing trade tensions, production shifts to India and Vietnam, and looming U.S. tariffs, Apple saw its Americas sales rise 9.3% and set new highs in its active device base across all segments. CEO Tim Cook noted early purchases likely contributed to sales growth, while Apple continues to invest significantly in artificial intelligence and faces regulatory and competitive pressures globally. Wearables and iPad sales missed estimates, but Mac sales surpassed expectations, and gross margins reached 46.5%, beating analyst forecasts. Concerningly, AI was discussed during Apple’s Q3 2025 earnings call, but it was not a dominant or recurring theme; the main focus remained on iPhone and services sales, trade tensions, and margin impacts from tariff

- Amazon -7% – second-quarter 2025 revenue rose 13% to $167.7 billion and net income reached $18.2 billion, both exceeding expectations. Amazon Web Services (AWS) revenue grew 17.5% to $30.9 billion, yet AWS margins narrowed and its cloud growth lagged behind Microsoft and Google. Despite beating forecasts and offering an optimistic third-quarter sales outlook, investor concerns persist over slower AWS growth and increasing operating pressures. AI investments are driving innovation, but Amazon faces rising costs from tariffs and goods sourced from China, even as its core e-commerce dominance remains strong

ASX SPI 8639 (-0.74%)

The local market is likely to be “risk off” today as all eyes will be on the US employment numbers tonight and the weekend risk of the trade deal deadline and President trumps potential actions.

We highly recommend taking some risk off from today with the view to returning to a cash balance above 30%+ over the next fortnight

Resmed is the key corporate report scheduled for today

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.