Overnight – Microsoft and Meta drive Tech Stocks Higher

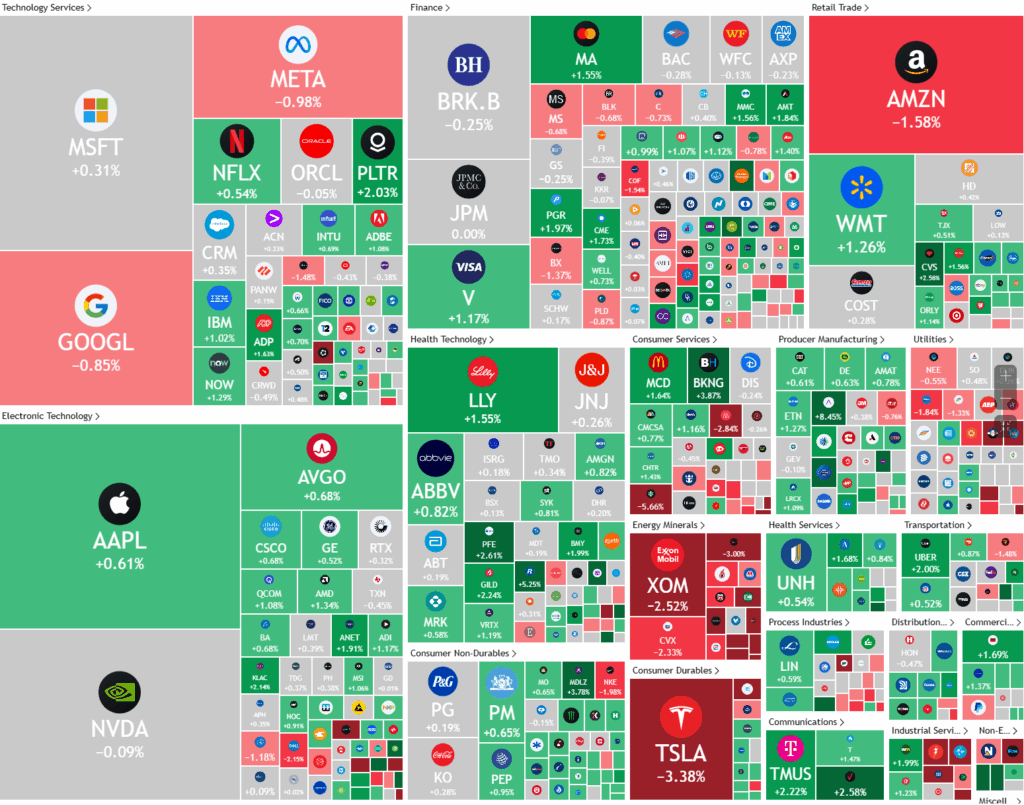

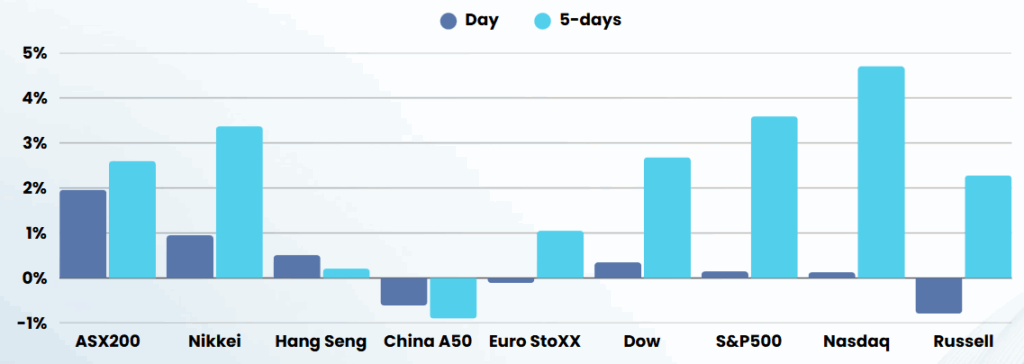

Stocks closed mixed overnight after cutting losses as rising hopes for easing U.S.-China trade tensions offset data showing a surprise decline in first-quarter. After the bell, Microsoft and Meta both beat earnings expectations to rally 6%+

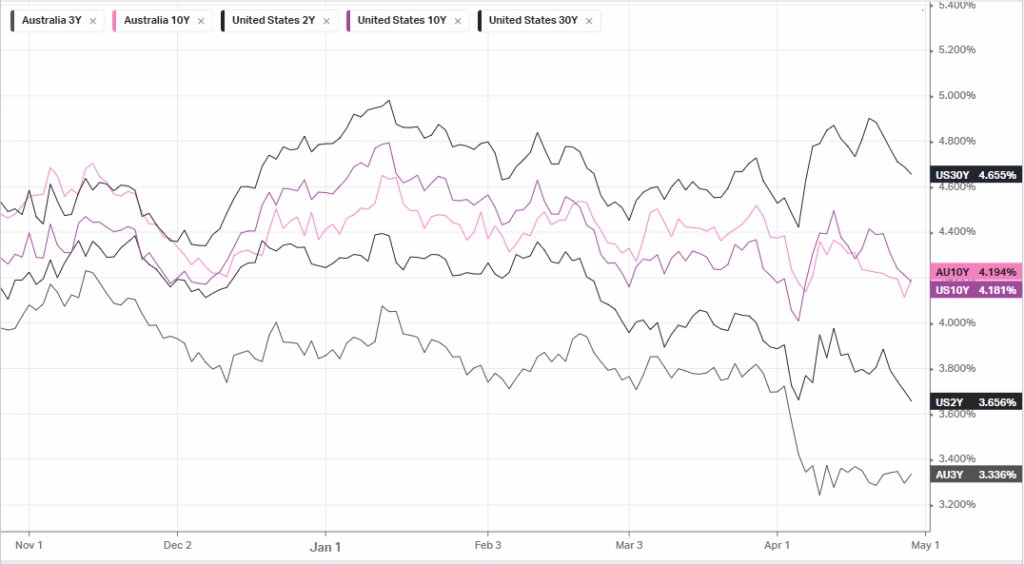

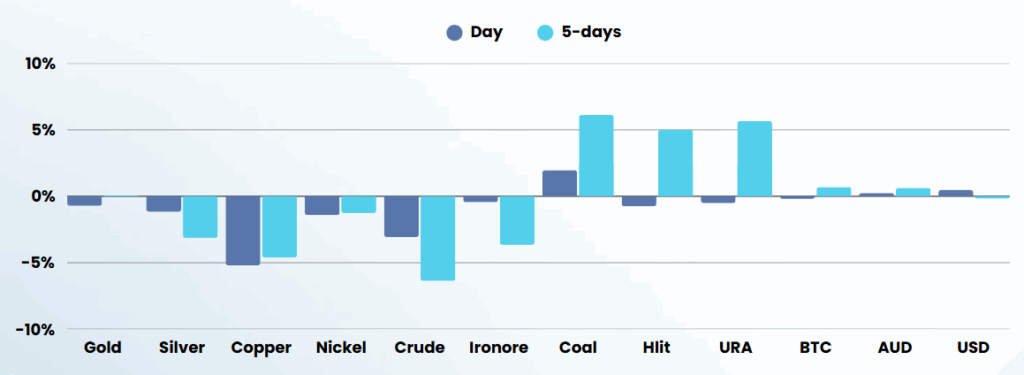

The U.S. economy unexpectedly contracted in the first quarter of 2025, with gross domestic product (GDP) declining at an annualized rate of 0.3%. This marks the first contraction in three years and a sharp reversal from the 2.4% growth recorded in the previous quarter. The downturn was primarily driven by a massive 41.3% surge in imports, as businesses and consumers rushed to purchase goods ahead of the imposition of new tariffs under President Trump’s trade policies. This frontloading of imports widened the trade deficit and was a significant drag on economic growth, even as underlying indicators like consumer spending and business investment remained relatively robust.

The economic contraction coincided with a steep decline in consumer confidence, which fell in April to its lowest level since the early days of the COVID-19 pandemic. The Conference Board’s Consumer Confidence Index dropped by 7.9 points to 86.0, with expectations for the future plummeting and concerns about tariffs and inflation dominating consumer sentiment. Many Americans now anticipate fewer jobs and higher prices in the coming months, with nearly a third expecting a recession within the year. While some policymakers have sought to ease the impact of tariffs and have initiated talks with China to reduce trade tensions, the uncertainty surrounding trade policy and its inflationary effects continue to weigh heavily on both business and consumer outlooks, raising concerns about the potential for further economic slowdown or even a recession later in the year

Company Earnings

- Meta Platforms – rose 6% after they reported strong first-quarter 2025 results, beating revenue estimates with $42.31 billion and earnings per share of $6.43, surpassing expectations of $41.40 billion and $5.28 respectively, driven by robust advertising demand and user growth to 3.43 billion daily active users. The company raised its 2025 capital expenditure forecast to $64-$72 billion, up from $60-$65 billion, reflecting increased investments in AI data centers and infrastructure amid rising hardware costs, signaling a strong commitment to AI development despite broader economic uncertainties and tariff-related concerns. Meta’s second-quarter revenue guidance of $42.5-$45.5 billion aligns with analyst expectations, helping ease investor worries about tariff impacts on growth. CEO Mark Zuckerberg highlighted progress in AI initiatives including Meta AI with nearly 1 billion monthly active users and AI glasses development, while the company navigates regulatory challenges and competitive pressures in AI innovation. Shares rose nearly 6% in after-hours trading following the earnings release

- Microsoft – stock rose 8% aftermarket as the company reported strong third-quarter results, driven by robust growth in its Azure cloud business, which saw revenue jump 33%-well above expectations-with artificial intelligence contributing 16 percentage points to that growth. Overall, the company posted revenue of $70.1 billion (up 13% year-over-year) and net income of $25.8 billion, both surpassing analyst forecasts. The Intelligent Cloud segment, which includes Azure, generated $26.8 billion in revenue, and Microsoft’s total cloud revenue reached $42.4 billion, up 20% from the prior year. Commercial bookings rose 18%, partially boosted by a new Azure contract with OpenAI. Despite concerns about tariffs and elevated inventory levels, Microsoft’s strong cloud and AI performance reassured investors, sending shares up as much as 8% after hours. The company also signaled continued heavy investment in AI infrastructure, although it is shifting spending from long-lived assets like data centers to shorter-lived assets such as chips

- Caterpillar – reported a lower first-quarter profit, hurt by softer demand due to economic uncertainty.

- Norwegian Cruise Line – stock fell more than 7% after the cruise operator reported disappointing first-quarter earnings, and lowered its full-year adjusted net income guidance, citing softening demand.

- Super Micro Computer – stock slumped 11.5% after the AI server maker cut its third-quarter revenue and profit expectations due to delays in customer spending, amplifying worries of a pullback in AI-linked investments.

- Snap – stock dropped more than 12.5% after the Snapchat parent reported better-than-expected first-quarter revenue but declined to provide guidance, citing macroeconomic uncertainties that could weigh on advertising demand.

ASX SPI 8118 (-0.29%)

The local market will be mixed with China manufacturing numbers, the federal election and yesterdays inflation numbers weighing on investors minds.

- Woolworths′ e-commerce sales surged 15.7 per cent to $2.2 billion in the first quarter, driving a marginal rise in group sales.

- Sims expects a $25 million hit from its decision to stop developing plasma-assisted gasification technology for the processing of automotive shredder residue waste.