Overnight – Stocks lower as Fed signals slower pace of cuts due to Trump uncertainty

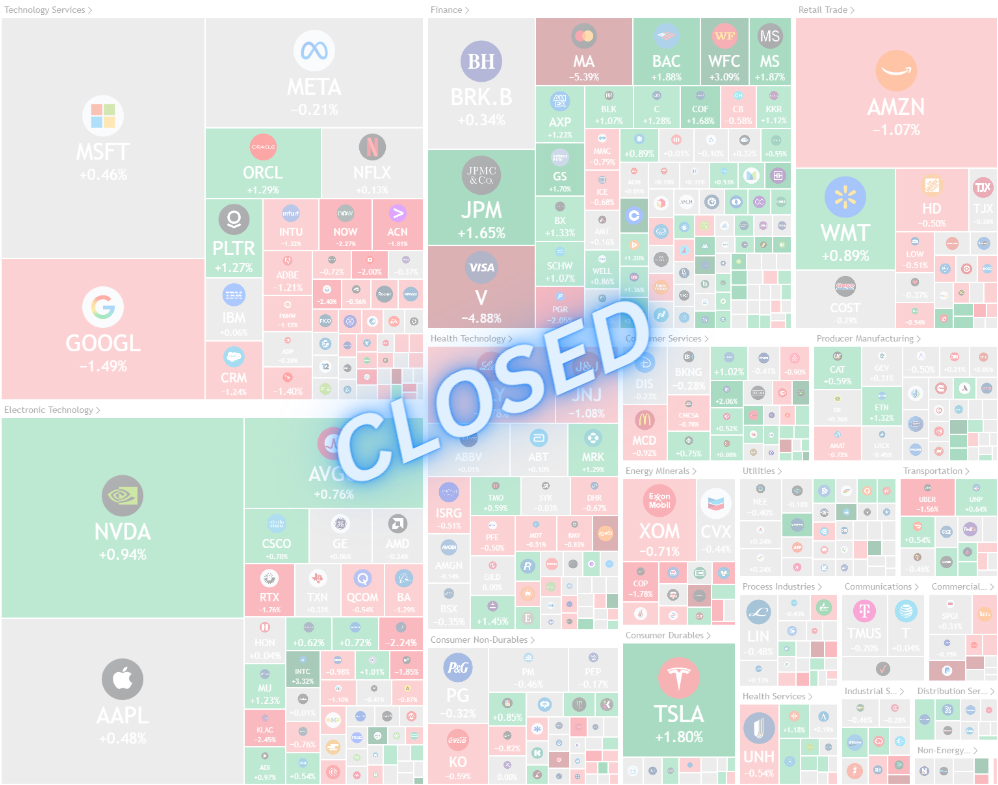

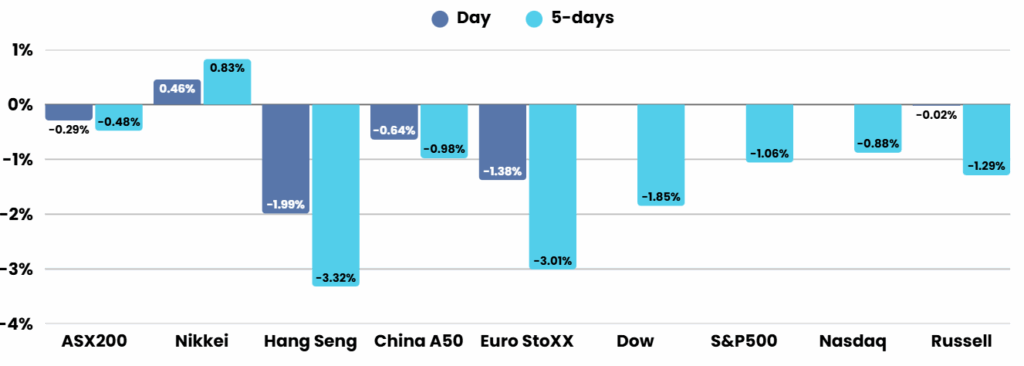

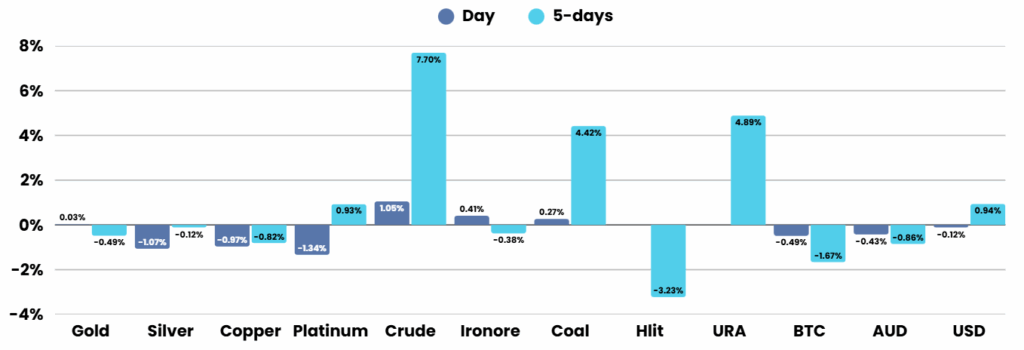

Global stock markets declined and the U.S. dollar strengthened as investors sought safe havens amid growing concerns about possible U.S. involvement in the Israel-Iran conflict. President Donald Trump’s ambiguous comments regarding potential military action heightened uncertainty, fuelling speculation about a broader regional war and its impact on global energy supplies. This anxiety pushed oil prices sharply higher, with Brent crude climbing close to its highest level since January, while gold remained elevated as a traditional safe asset.

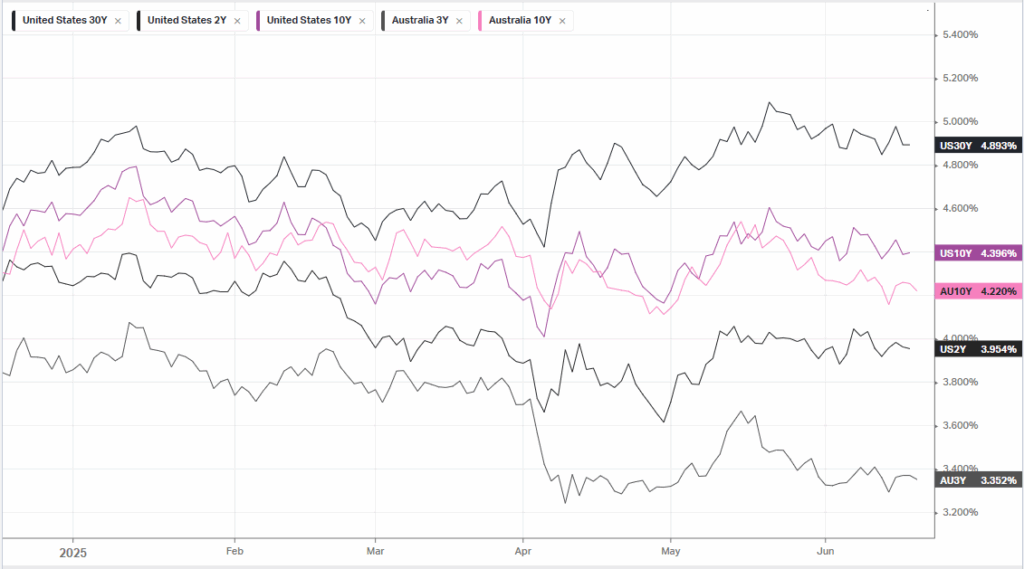

Central banks faced added challenges due to the volatile geopolitical and economic environment. The U.S. Federal Reserve kept interest rates unchanged but maintained its outlook for rate cuts later in the year, even as it warned of ongoing inflation risks, partly driven by trade tensions and tariffs. In Europe, the Bank of England also left rates steady, highlighting the negative impact of trade policy uncertainty, while other central banks like Norway’s and Switzerland’s took divergent paths with their own rate decisions, affecting their respective currencies.

The overall market sentiment remained cautious, with European and U.S. equity indices posting declines and risk-sensitive currencies weakening against the dollar. Investors remained on edge, wary that a significant escalation in the Middle East could further disrupt energy markets and global economic growth. The combination of geopolitical risks and central bank caution signalled a challenging outlook for financial markets in the near term.

ASX SPI 8496 (-0.24%)

The ASX is in for an uneventful day with little reason to for a “risk-on” catalyst with the public holiday in the US overnight and the weekend approaching while the middle east conflict continues

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.