Overnight – Stocks take a breather as global long-end bond yields surge

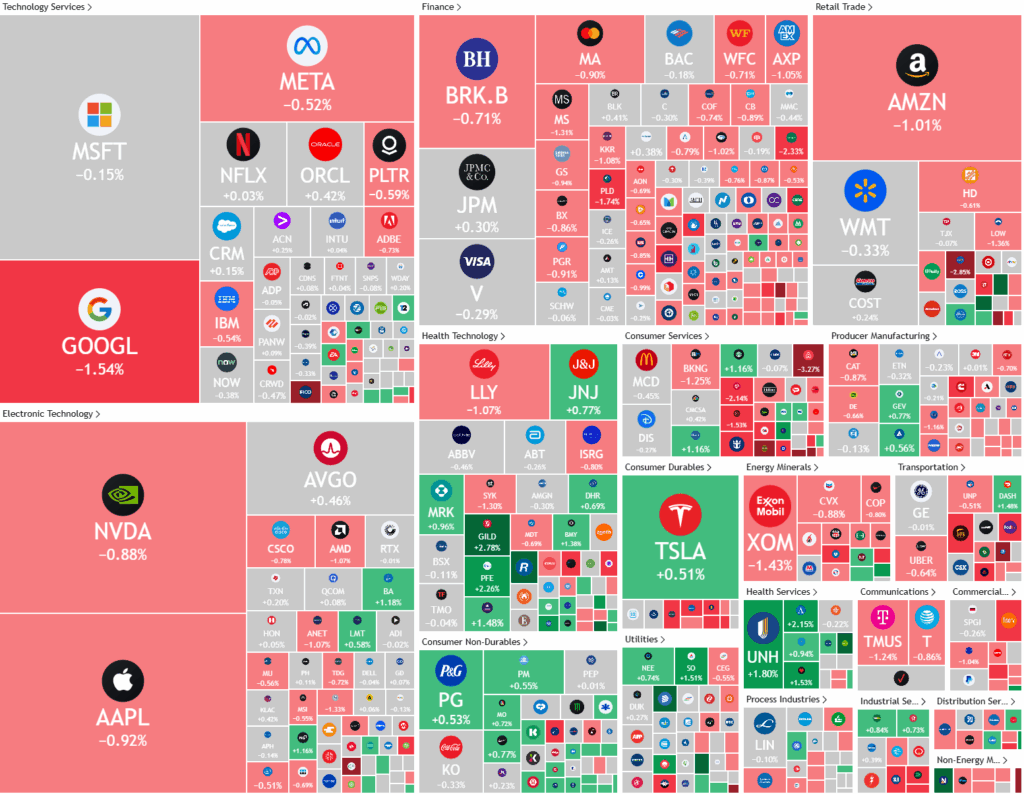

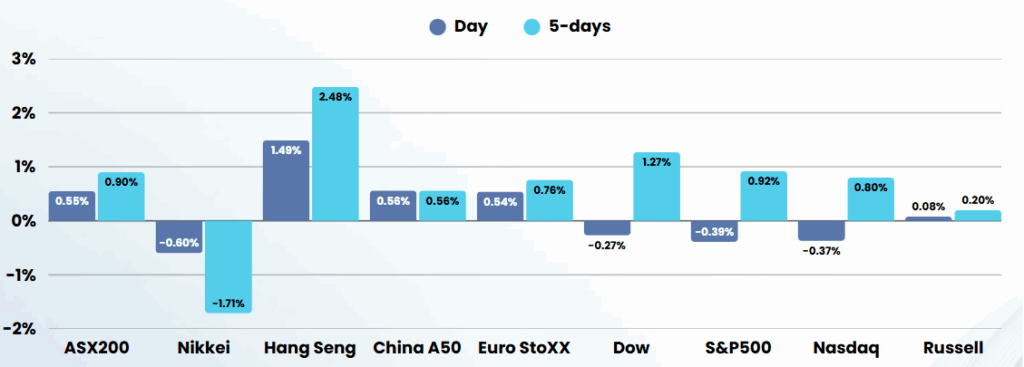

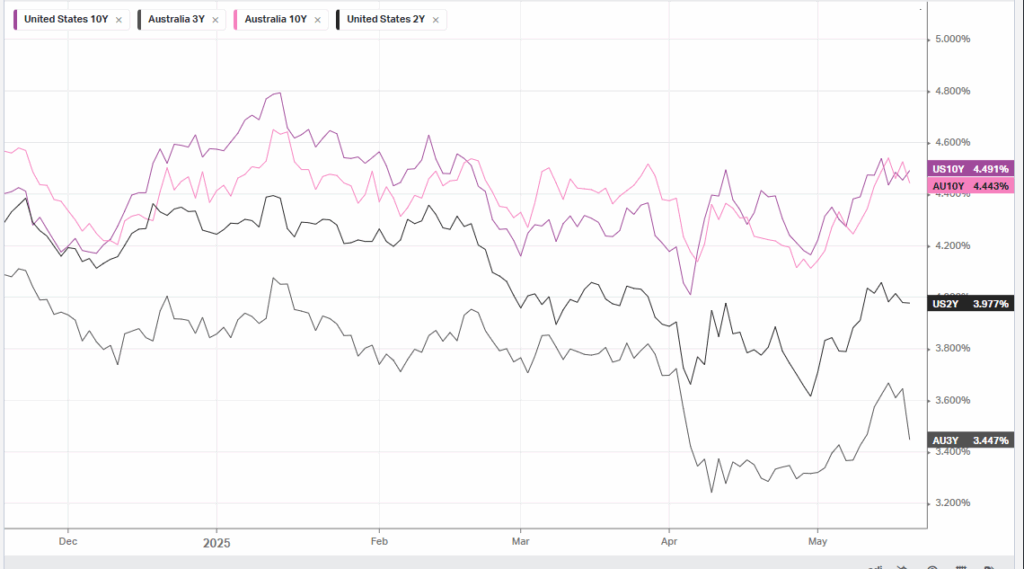

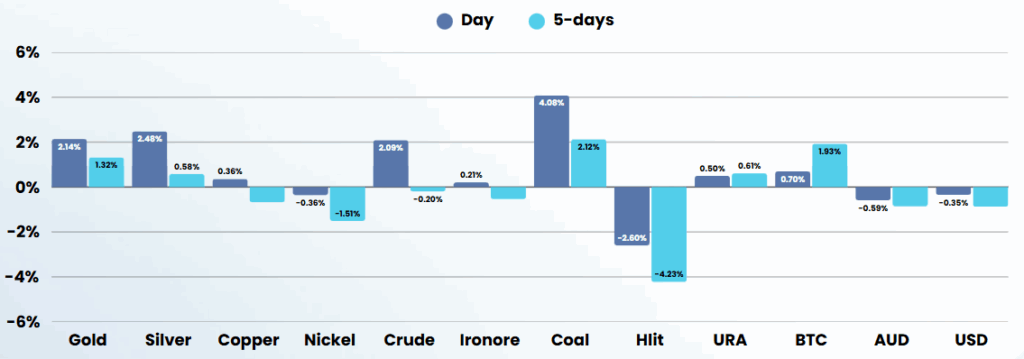

Stocks snapped a six-day win streak, as the tech rally took a breather, while multi decade highs in global 20Y-30Y bond yields cast a dark shadow over the cost of capital long term. Japanese 20Y yields surged to 25 year highs, while 30Y bonds hit record levels.

Investors closely monitored retail earnings this week for signals on the U.S. economy’s health. Home Depot reported first-quarter fiscal 2025 revenue of $39.9 billion, exceeding expectations and marking a 9.4% year-over-year increase, driven by strong sales in key categories and effective spring promotions. However, its earnings per share declined 3% to $3.56, missing analyst estimates, and its stock dipped despite reaffirming full-year guidance and a decision not to raise prices in response to tariffs. The retail sector remains under pressure from cost inflation and tariffs, with Walmart signaling potential price hikes, while Home Depot’s results suggest cautious consumer spending focused on smaller projects.

Broader economic and policy developments also shaped market sentiment. A House committee advanced a major tax cut bill, backed by former President Trump, which proposes income tax reductions and increased spending on defense and immigration. While proponents argue the bill could stimulate growth, critics warn it may worsen the already record-high federal deficit. Meanwhile, Federal Reserve officials reiterated a patient stance on interest rates, with St. Louis Fed President Alberto Musalem downplaying the inflationary impact of tariffs as likely temporary.

On the corporate front, Tesla’s stock saw modest gains after CEO Elon Musk publicly committed to leading the company for at least five more years, addressing investor concerns about his divided attention amid a historic 13% drop in Tesla’s quarterly sales and a 71% plunge in profits. Musk emphasized his continued control over Tesla’s strategic direction, even as he reduces involvement in government initiatives. Trade tensions also persisted, with the U.S. and China exchanging warnings over technology restrictions, and investors awaiting further clarity from upcoming U.S.-Japan trade talks, though no major deals are expected at the imminent G7 finance ministers’ meeting.

ASX SPI 8421 (+0.62%)

The ASX should have a positive day with a duo of rate cuts from the RBA and the PBOC yesterday, are likely to increase investor optimism in our major sectors of financials, REIT’s and ming sector

Company Specific

- James Hardie reported a 4 per cent decline in full-year earnings, driven by a 3 per cent drop in net sales, though the building materials supplier said its results fell in line with guidance.

- Westpac is preparing to cut more than 1500 employees in the bank’s biggest redundancy round in a decade.

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.