Overnight – Investors abandon stocks as Trump threatens his own Central Bank Chief

After a long weekend, we return to yet another Trump tantrum, as the President explored his options to fire the Federal Reserve chief (he hired in his last term) because he wont do what Trump wants. The Presidency is looking more like an autocracy at this juncture, spooking investors into fleeing the USD and US stocks with his irrational and directionless leadership not an attraction for investors

Stocks Thursday, April 17

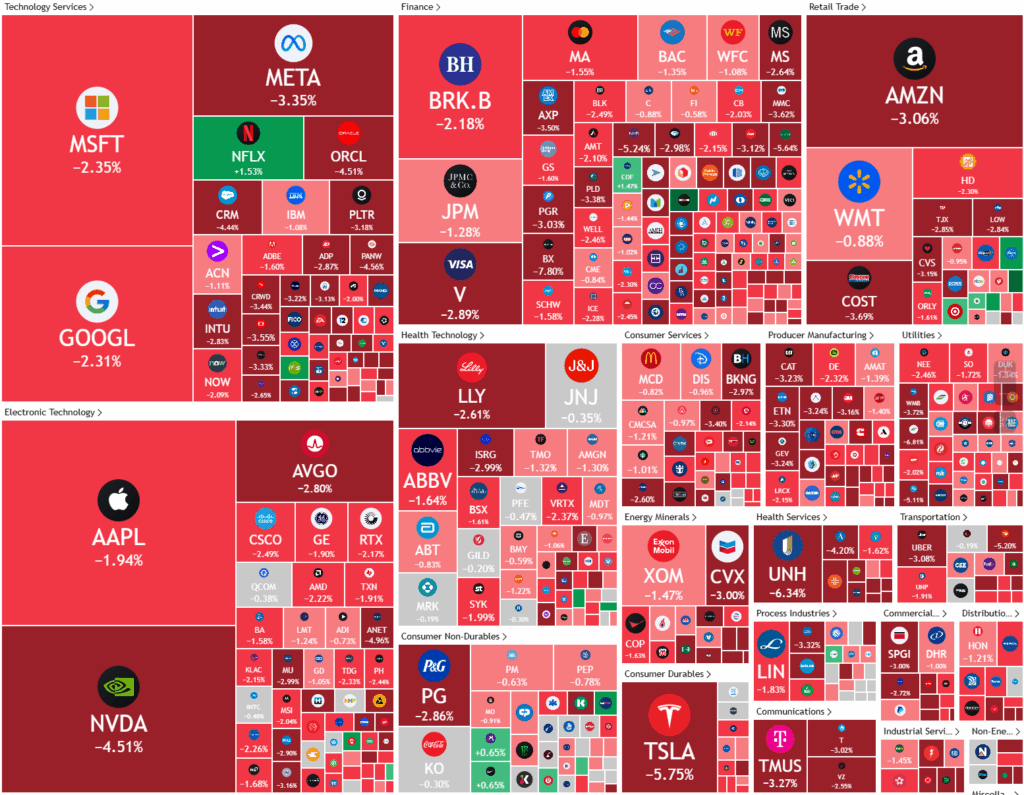

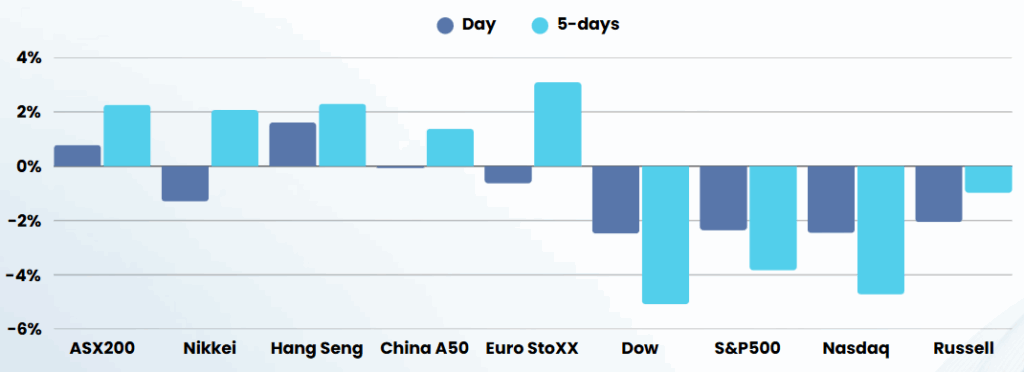

U.S. markets ended a volatile, holiday-shortened week with mixed results as ongoing tariff uncertainty triggered profit-taking and dampened investor sentiment. The Dow Jones Industrial Average fell 527 points (1.3%), while the S&P 500 managed a slight gain of 0.2%, and the NASDAQ Composite slipped by 0.1%. Despite some positive corporate earnings—such as Eli Lilly’s 14% surge on strong diabetes drug trial results and Blackstone’s better-than-expected profits—UnitedHealth’s sharp 22% drop after cutting its annual profit forecast weighed heavily on the market. Other notable moves included Taiwan Semiconductor’s modest gains after a 60% jump in quarterly profit and Hertz’s continued rally following Pershing Square’s investment. Alphabet (Google) shares fell 1.4% after a legal setback, with a judge ruling the company operates an illegal digital advertising monopoly.

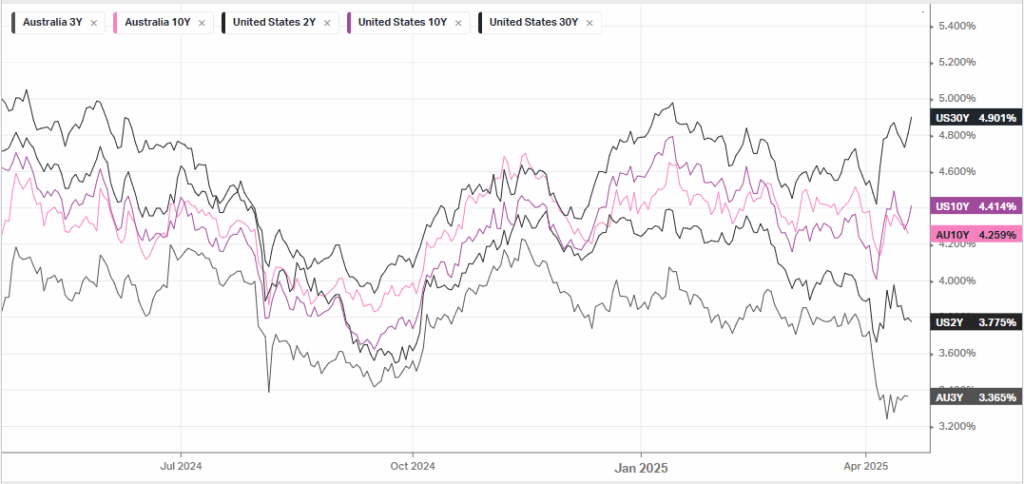

Beyond earnings, global trade developments were in focus. President Trump announced “big progress” in trade negotiations with Japan, raising hopes for broader tariff settlements and easing fears of a global trade war. The European Commission and China also signaled openness to negotiations, though China demanded greater respect from the U.S. administration. Meanwhile, Federal Reserve Chair Jerome Powell reiterated the Fed’s reluctance to cut interest rates soon, citing inflationary risks from new tariffs. Trump escalated his criticism of Powell, publicly suggesting he could remove the Fed chair, adding to market jitters. Labor data showed steady unemployment claims, but single-family homebuilding hit an eight-month low, underscoring mixed economic signals.

Over the Weekend and Monday, April 21

Tensions escalated over the weekend as China retaliated against the U.S. by sanctioning several American lawmakers and officials in response to previous U.S. sanctions related to Hong Kong. China’s foreign ministry warned of further reciprocal measures and criticized any trade agreements that might harm Chinese interests, signaling a hardening stance amid ongoing trade disputes. The Ministry of Commerce also cautioned other nations against aligning with Washington at China’s expense, while reiterating readiness to counter unilateral U.S. actions. These developments heightened uncertainty around global trade and added to the market’s unease.

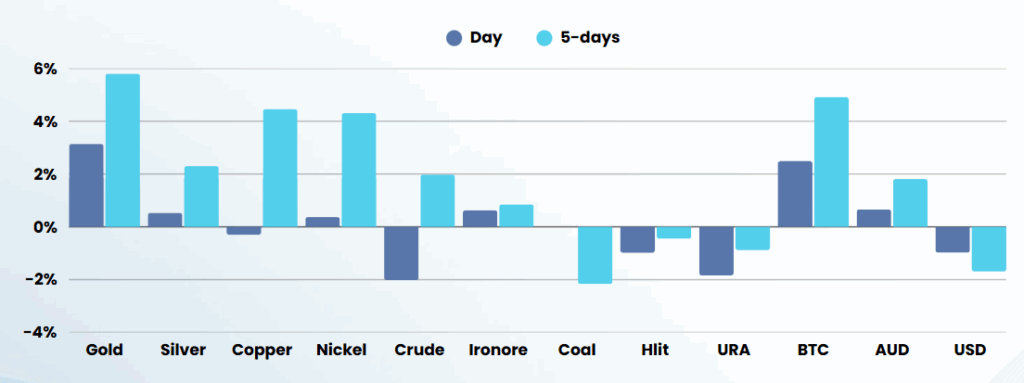

On Monday, April 21, U.S. stocks suffered sharp declines as President Trump intensified his attacks on Fed Chair Powell, amplifying concerns about central bank independence and rattling investor confidence. The S&P 500 fell 2.36%, the Nasdaq dropped 2.55%, and the Dow Jones slid 2.48%, with thin trading volumes due to Easter holidays in many markets. The VIX volatility index spiked nearly 14%. Market commentators cited the lack of progress on trade negotiations and Trump’s threats against Powell as key factors driving the selloff. Investors expressed growing anxiety over the unpredictability of tariff policies and the risk of political interference in monetary policy, with some warning that persistent uncertainty could further erode U.S. asset appeal. Meanwhile, gold hit a record high and Bitcoin climbed as investors sought safe havens amid the turmoil. Looking ahead, markets were bracing for major tech earnings reports, hoping for relief from the ongoing volatility.

ASX SPI 7803 (-0.38%)

Uncertainty is never good for stocks, markets or economies and Trumps “plan” is high on uncertainty, low on details and constantly manoeuvring without the democratic process, meaning that investors, voters and politicians are ALL going to lack confidence until the picture gets some sort of resemblance of an actual plan. Until then, Gold, defence stocks and cash will be the best safe harbour