Overnight – Chip Stocks Slide, Fed Divides, and Middle East Keep Markets on Edge

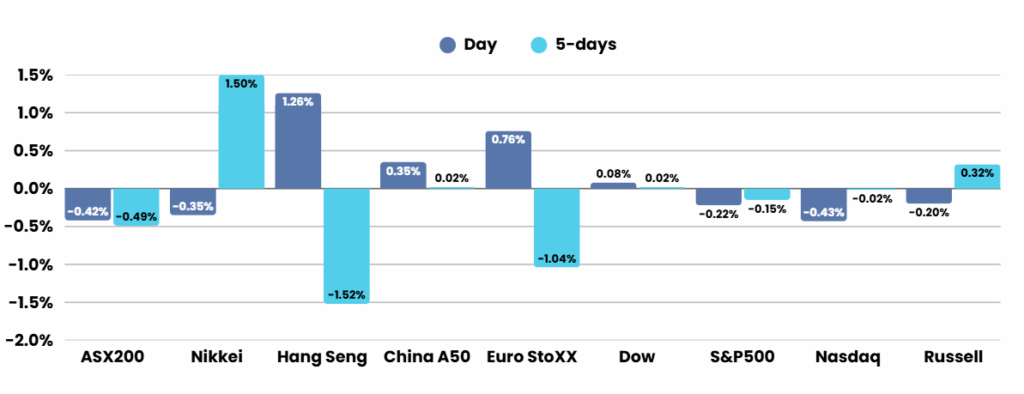

Stocks closed lower Friday, as weakness in chip stocks offset remarks from a top Federal Reserve official calling for rate cuts as soon as the Fed’s next meeting

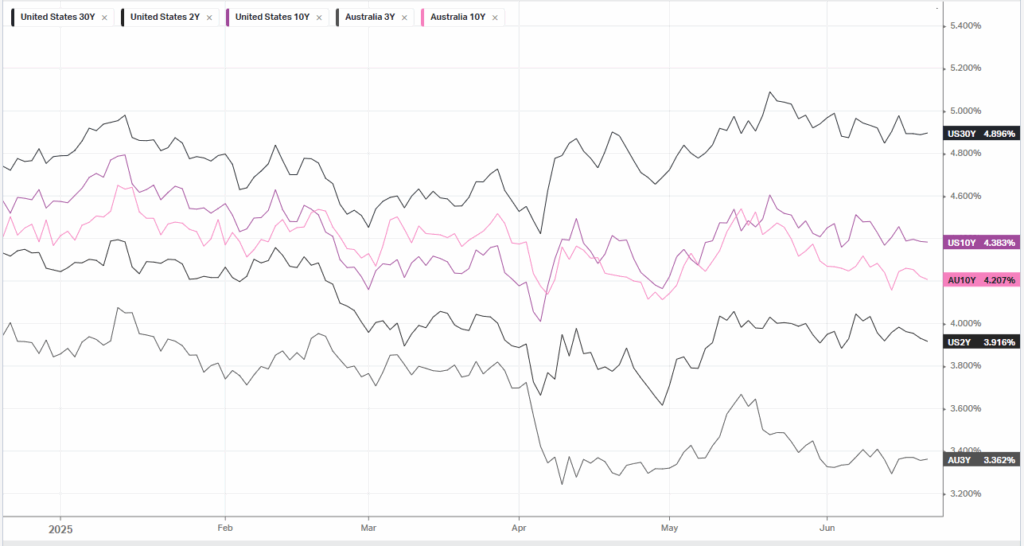

Wall Street experienced a cautious week, with trading volumes spiking due to a “triple-witching” event and the market closure for Juneteenth. Investors were hesitant to make big moves amid heightened geopolitical tensions and uncertainty over U.S. economic policy. Chip stocks like Nvidia and Broadcom led declines following reports of potential new U.S. restrictions on semiconductor exports to China. Meanwhile, the Federal Reserve held interest rates steady, with officials split on the timing of future cuts. Some, like Fed Governor Christopher Waller, advocated for a rate cut as early as July, citing subdued inflation, while others, including Chair Jerome Powell, warned of persistent inflation risks, particularly if tariffs start impacting consumer prices.

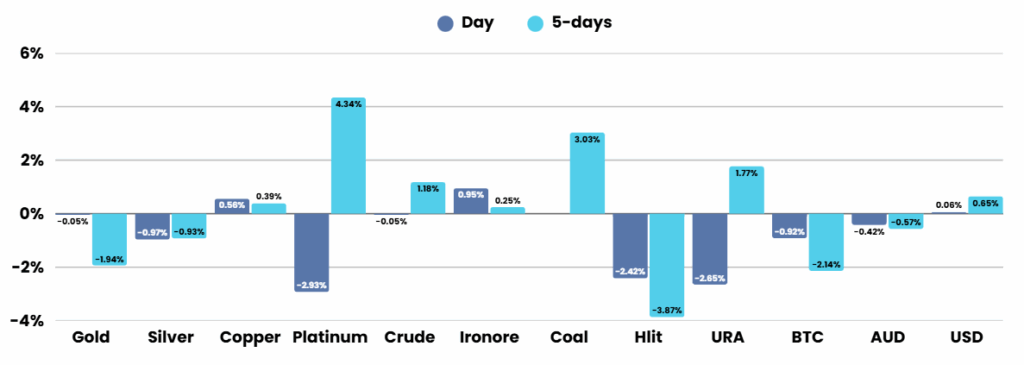

Geopolitical risks were front and center as President Trump announced he would decide within two weeks whether the U.S. would join Israel in direct action against Iran, amid escalating conflict between the two countries. The threat of a broader Middle East conflict and its potential impact on oil prices made investors more risk-averse, pushing oil prices higher and raising concerns about energy-driven inflation. Iran refused to return to nuclear talks while under attack, and European efforts at diplomacy showed little progress. This uncertainty contributed to a mixed market performance, with the S&P 500 ending the week lower and the Nasdaq posting a modest gain.

On the corporate front, Apple accelerated plans to shift iPhone production to India in response to ongoing U.S.-China trade tensions, signaling a significant change in its manufacturing strategy. Darden Restaurants increased its dividend and announced a major share buyback after strong quarterly results, while CarMax reported impressive earnings thanks to higher sales and strong margins. Accenture’s shares fell despite beating earnings estimates, due to weaker bookings. Overall, the week’s trading was volatile, shaped by central bank decisions, mixed economic data, and the looming risk of a wider conflict in the Middle East.

ASX SPI 8469 (-0.25%)

The ASX will remain soft with multiple issues globally create uncertainty.

The US strikes on Iran and closure of the Sraight of Hormuz and the Red Sea, will see oil prices rise above $80, wihich will significantly impact the ability for the worlds central banks manage inflation. Make no mistake, Trump will want a swift resolution to this conflict, as energy inflation and tariff inflation are the worst possible conbination for inflation and the admisitration needs interest rates lower to refinance the debt.

We expect price reatcions to this conflict to be extreme today, then reverse quickly as Trump Plays Peacemaker

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.