Overnight – Stocks higher as Trump finally seals a meaningful trade deal

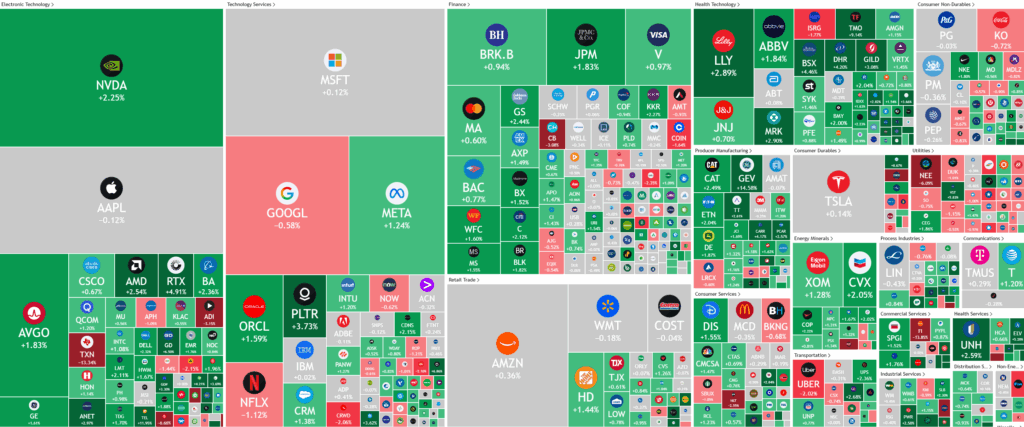

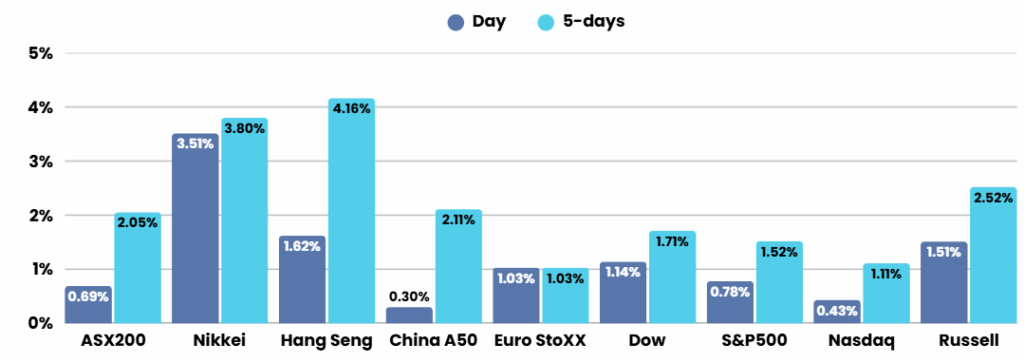

US stocks closed at another record high overnight, as the US-Japan trade deal stoked optimism that the Trump administration would be able to seal further deals, averting a messy trade war.

On the heels of a major U.S.-Japan trade agreement, President Donald Trump indicated that further deals are forthcoming, notably with the European Union. He emphasized the urgency of reaching an agreement with the EU to avoid the imposition of a 30% U.S. tariff on imports from Europe, scheduled to take effect on August 1. The recent pact with Japan involved a 15% tariff—lower than the 25% previously threatened—and included commitments from Japan to invest $550 billion in the U.S. and open its markets to more American automobiles and agricultural products, like rice.

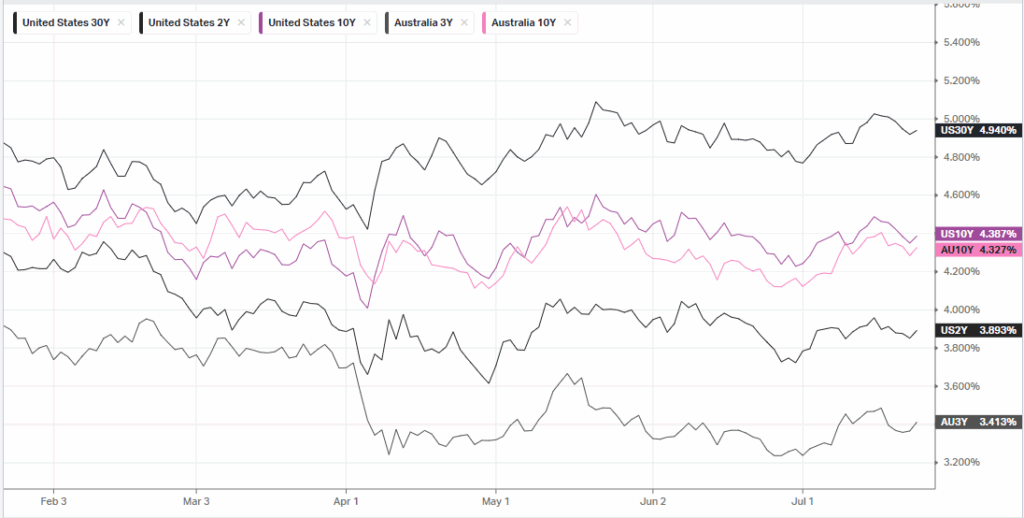

These developments reflect some progress in resolving Washington’s ongoing trade disputes before the looming tariff deadline. However, uncertainty remains high, as analysts and the Federal Reserve have warned that continued tariff threats could influence inflation in the months ahead.

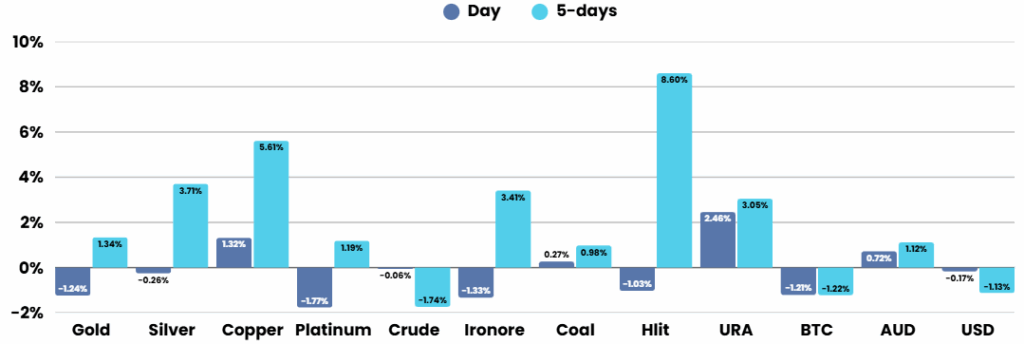

Meanwhile, in commodities markets, copper reached record highs near $6, silver approached $40 for the first time since 2011, and uranium stocks also saw notable gains.

Corporate Earnings

- Alphabet (GOOGL) +2% – reported strong second-quarter results for 2025, with revenue rising 14% year-over-year to $96.43 billion and net income up 19% to $28.2 billion, both exceeding Wall Street expectations. Earnings per share reached $2.31, topping forecasts of $2.17, while Google Cloud saw standout growth with revenue surging 32% and operating margin rising to 20.7%. The company ramped up its 2025 capital expenditure plan to $85 billion, reflecting a 13.3% increase from last year, as it invests aggressively in AI and cloud infrastructure. Despite this, Alphabet maintained stable operating margins, and CEO Sundar Pichai highlighted robust momentum in search, YouTube, and cloud services, even as short-term free cash flow dipped due to the higher investments

- Tesla +0.7% – reported a 12% year-over-year revenue decline to $22.5 billion, driven by lower vehicle deliveries, reduced average selling prices, and less revenue from regulatory credits. Operating and net income fell sharply, and free cash flow dropped 89%, though Tesla maintained a strong cash position at $36.8 billion. Tesla made notable advances: it launched its Robotaxi service in Austin, expanded AI training infrastructure, and began production of a more affordable vehicle slated for higher volumes later in 2025. Its Energy Storage and Services segments grew, with record Powerwall deployments and a 17% rise in services revenue. Internationally, Tesla expanded into India and set delivery records in key Asian markets.

Looking forward, Tesla emphasized its transition from automaker to AI and robotics leader, betting on future growth from software, autonomy, and energy products.

- IBM -5.20% – second-quarter earnings below Wall Street expectations on Tuesday, though revenue edged past expectations and the company raised its full-year cash flow guidance on the back of continued AI-driven demand.

- ServiceNow +6.73% – lifted its full-year guidance after reporting Wednesday second-quarter results that beat Wall Street estimates.Q2, the company reported adjusted earnings per share of $4.09 on revenue of $3.22 billion, compared with Wall Street estimates of $3.57 a share and $3.12B, respectively. Current remaining performance obligations, or cPRO, a gauge of booked revenue over the next 12 months, climbed by 29% to $23.9B. For Q3, the company forecast subscription revenue in a range of $3.26B to $3.27B, with cPRO growth expected at 18.5% from a year earlier.

ASX SPI 8721 (+0.23%)

The local market should broadly drift higher with individual stock focus likely to take center stage with quite a few quarterly updates

Quarterly Updates – Fortescue, Coronado Global Resources, Insignia Financial, Karoon Energy, Lynas Rare Earths, Northern Star Resources, Sandfire Resources and Syrah Resources. Macquarie Group will host its annual general meeting, starting at 10.30am at its new headquarters in Sydney.

RBA governor Michele Bullock will speak about – The RBA’s Dual Mandate – Inflation and Employment – at the Anika Foundation in Sydney at 1.05pm.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.