Overnight – Stocks spike higher as Trump Describes Iranian response as “weak”

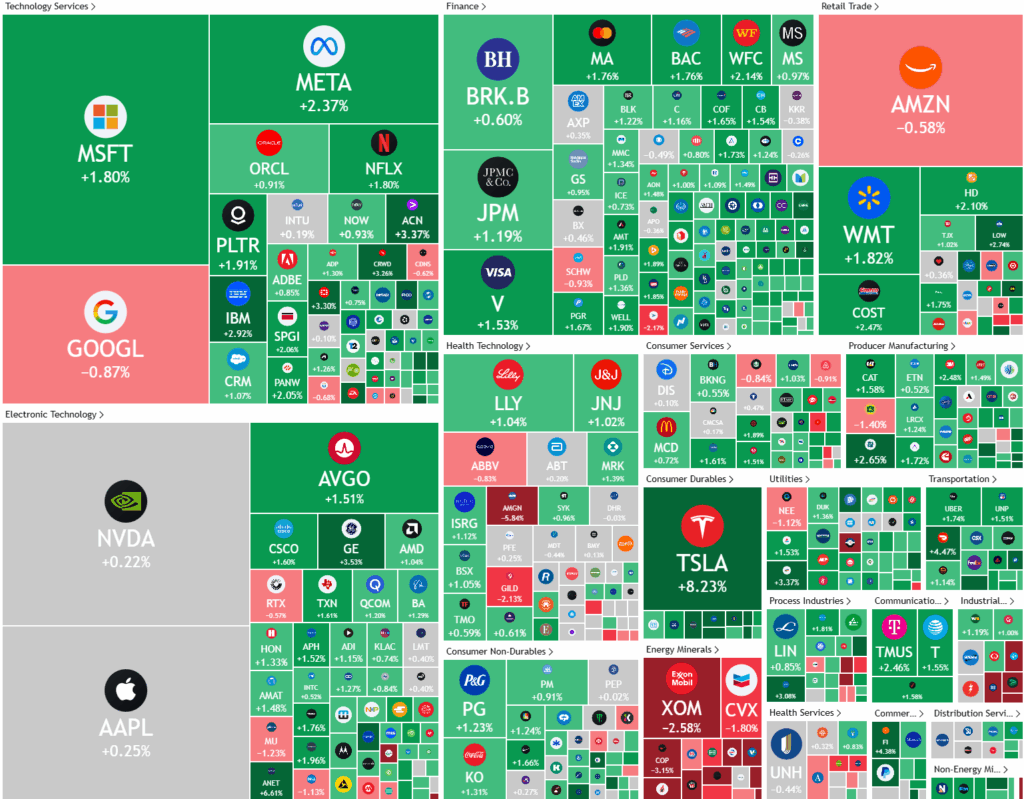

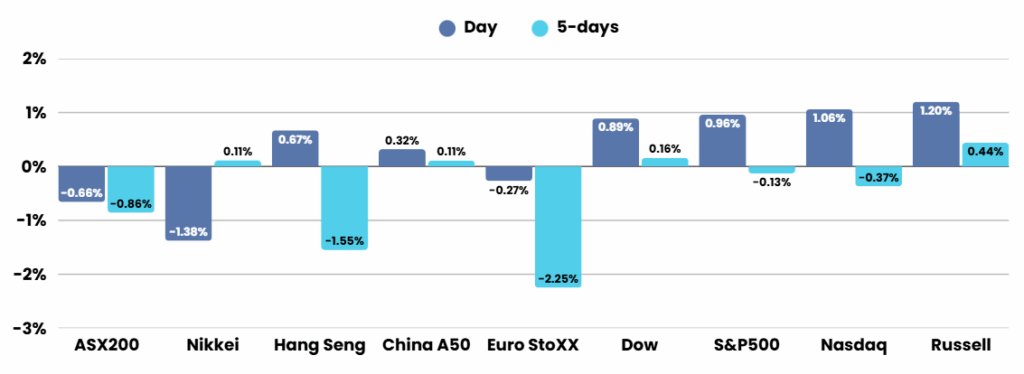

Stocks gained solidly on Monday, despite volatile trading, as Iran released a “very weak” response to the U.S. strikes on three Iranian nuclear sites over the weekend. Additionally, dovish interest rate commentary from Federal Reserve Governor Michelle Bowman contributed to the bid in stocks.

Shortly before 1 PM ET, Iran launched missile attacks on the U.S. airbase in Qatar, reportedly coordinating with Qatari officials to provide advance notice and minimize casualties. No deaths were reported, and most of the 14 missiles were intercepted, with only one allowed to proceed as it posed no threat. President Trump characterized Iran’s response as “very weak,” thanked Iran for the warning, and expressed hope for regional peace, while U.S. military bases in the region remained on high alert.

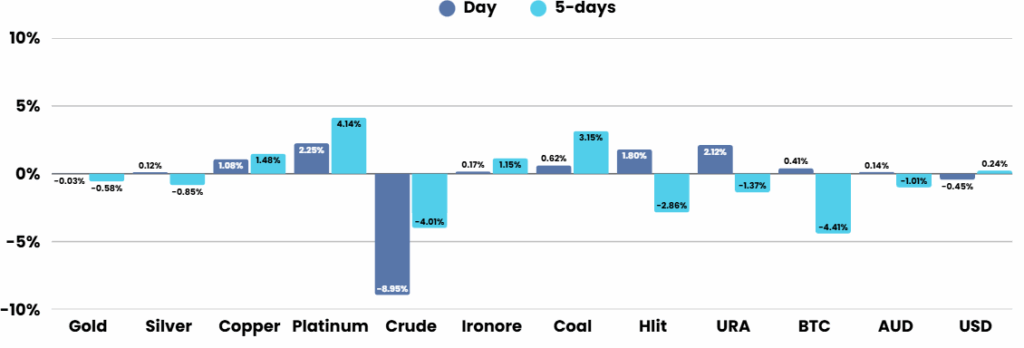

Amid these heightened tensions, Iranian sources suggested the country might consider blocking the Strait of Hormuz, a critical route for global oil shipments, though oil prices unexpectedly plunged as fears of further escalation eased. Analysts noted that the recent exchange reduced uncertainty about potential U.S. retaliation, possibly providing some stability to the situation. President Trump publicly encouraged restraint and called for peace, while also urging Israel to pursue harmony in the region.

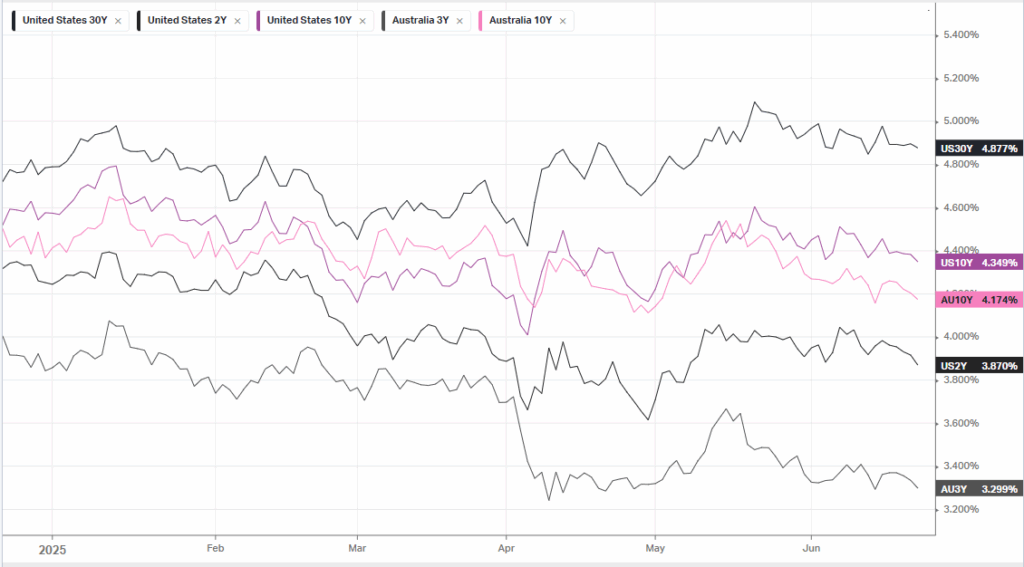

On the economic front, Federal Reserve Governor Michelle Bowman indicated support for a July interest rate cut, citing contained inflation and the temporary impact of Trump’s tariff policies. Despite Middle East turmoil, oil prices fell sharply, with Brent crude dropping 7.5% and West Texas Intermediate down 8.1%, erasing earlier gains. Trump took to social media to urge both countries and companies to keep oil prices low and pressed the U.S. Department of Energy to ramp up domestic drilling.

ASX SPI 8520 (+0.73%)

The local market will bounce in line with US markets as the middle east situation has fizzled for now

investors will keep an eye on China, as the Standing Committee of the 14th National People’s Congress is holding its 16th session through to June 27. The committee is expected to review draft revisions to laws regarding public security, unfair competition, maritime, fisheries and public health

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.