Overnight – AI earnings drive stocks higher, while Trump & Powell have tense exchange

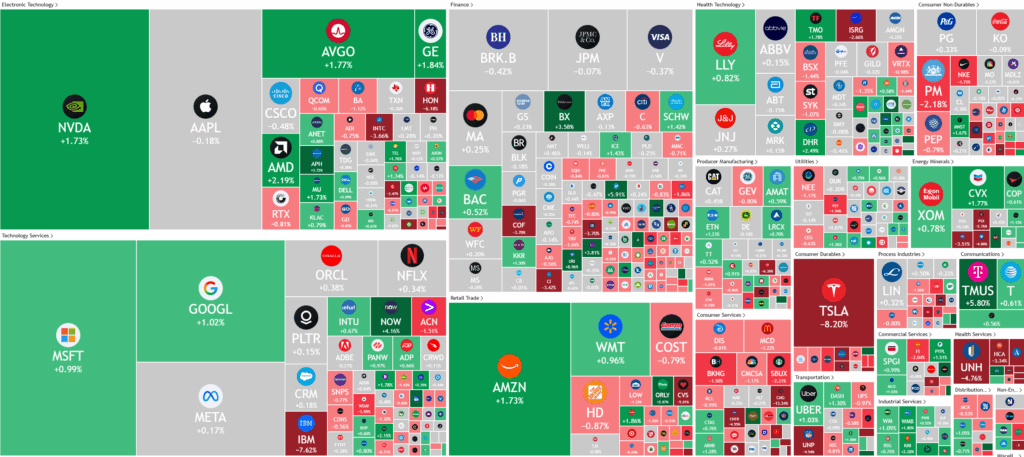

Stock clinched another record closing high overnight underpinned by trade deal optimism and an Alphabet-led climb in tech.

Donald Trump and Central bank chair Powell had a tense exchange at the Fed building, where The Fed chair corrected Trump on the spot as he tried to accuse Powell of budget blow outs on construction of Fed Buildings.

A strong second-quarter earnings season has unfolded, with about a quarter of S&P 500 companies reporting results so far. Notably, 67% of firms have exceeded revenue estimates and 88% have surpassed earnings per share projections. Alphabet stood out after beating Wall Street expectations, buoyed by rising demand for its cloud services. The tech giant also increased its 2025 capital spending target to $85 billion and signaled further investments in 2026, with analysts remarking that its financial strength is building a wider business moat even amid heavy investment in generative AI infrastructure.

Meanwhile, other corporate results were mixed. Tesla shares fell after CEO Elon Musk warned of challenging quarters ahead, following a disappointing second quarter. IBM stock also declined on weaker-than-expected software revenue.

Beyond earnings, optimism over global trade strengthened market sentiment. Reports indicated progress toward a U.S.-EU trade agreement with proposed baseline tariffs, calming concerns related to potential escalation from Trump’s tariff agenda.

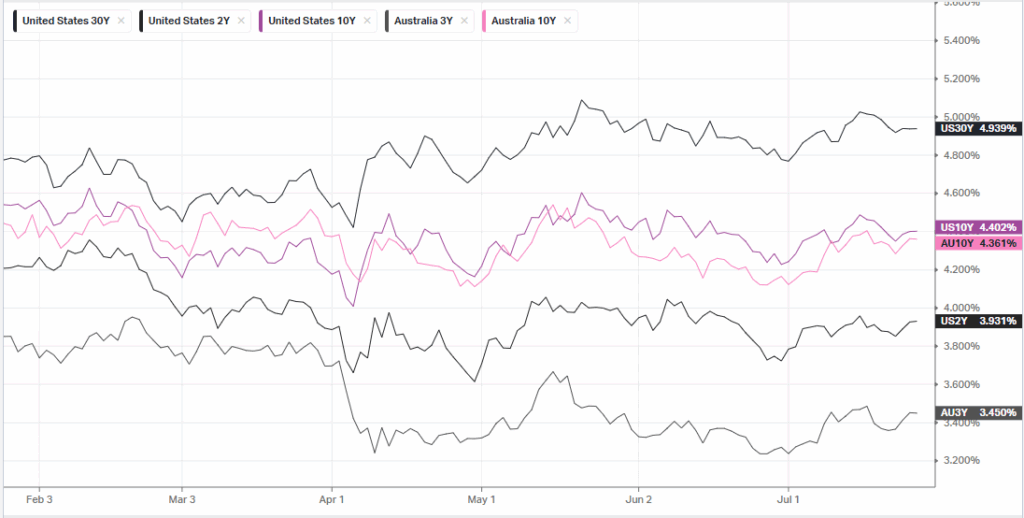

On the economic front, initial U.S. jobless claims for the week ending July 19 dropped to 217,000, below expectations, pointing to continued labor market resilience despite ongoing uncertainty. Attention now turns to flash PMI figures and the Federal Reserve’s upcoming policy meeting, with economists expecting a slight dip in manufacturing and a modest uptick in services activity.

Corporate Earnings

- Intel -3.5% – reported Thursday upbeat revenue guidance for the current quarter following second quarter revenue that topped expectations even as the chipmaker flagged a hit to earnings from write-downs amid plans to scale back chip factory construction plans.

- UnitedHealth -4.8% – the insurer revealed it was cooperating with a Department of Justice probe into its Medicare practices, following reports of both criminal and civil investigations.

- Honeywell -6.5% – raised its 2025 profit and revenue forecasts after surpassing Wall Street expectations in Q2, driven by robust demand for aerospace parts and maintenance, with total sales up 8.1% and adjusted profit per share at $2.75, despite margin pressures from higher costs and tariffs.

ASX SPI 8640 (-0.45%)

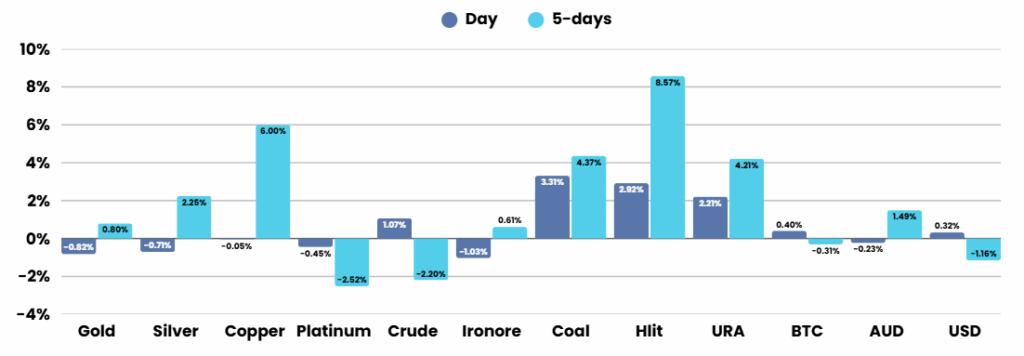

The ASX will likely drift lower on the open and then have a fairly quiet day as there is little catalyst to move things outside the open in China for commodity futures like Iron ore and Lithium, which were limit up +8% yesterday

Quarterly results are expected on Friday from Newmont and Whitehaven Coal.

You can now listen & Watch to the Pre Market Pulse

Be Alert, But Not Alarmed: Cracks Showing in Credit Markets

With so much happening in AI, precious metals, geopolitics & US politics, it’s easy to get caught up in the day-to-day noise. But one thing that is very important to monitor is the subtle yet significant shift is emerging in credit markets that’s worth keeping on your radar.

The Scramble for Critical Minerals: A Boom for ASX Investors?

In the high-stakes world of global commodities, a new scramble is underway—one that could redefine supply chains and spark massive investment opportunities