Overnight – Stocks higher on middle east “peace” deal & Dovish Powell

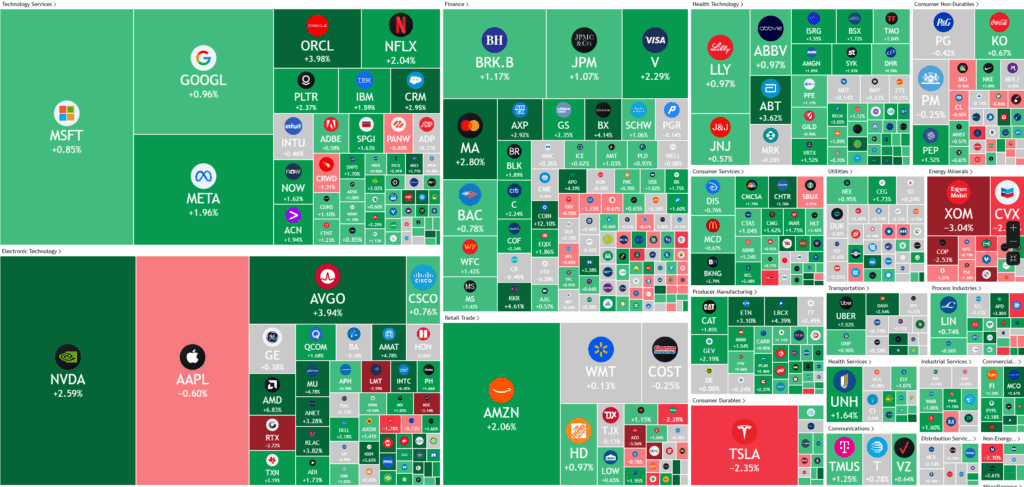

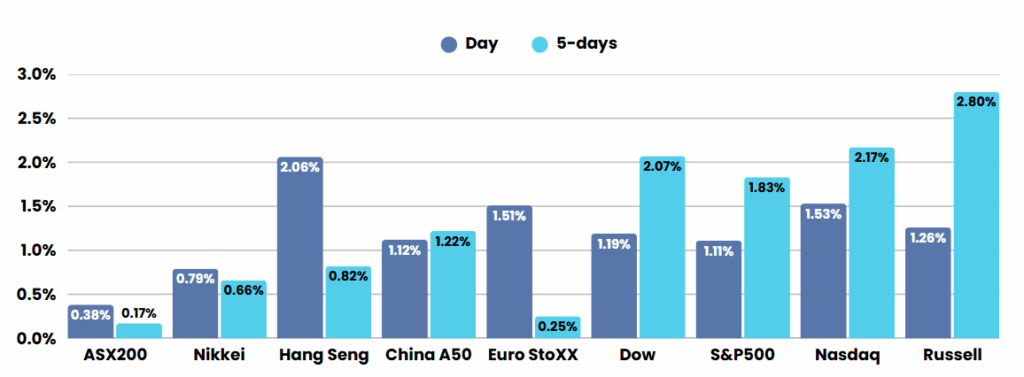

The stock market continued to defy logic, rallying a further 1% overnight, underpinned by de-escalating Middle East tensions amid an Iran-Israel ceasefire and remarks by Federal Reserve chairman Jerome that kept the door open to rate cuts.

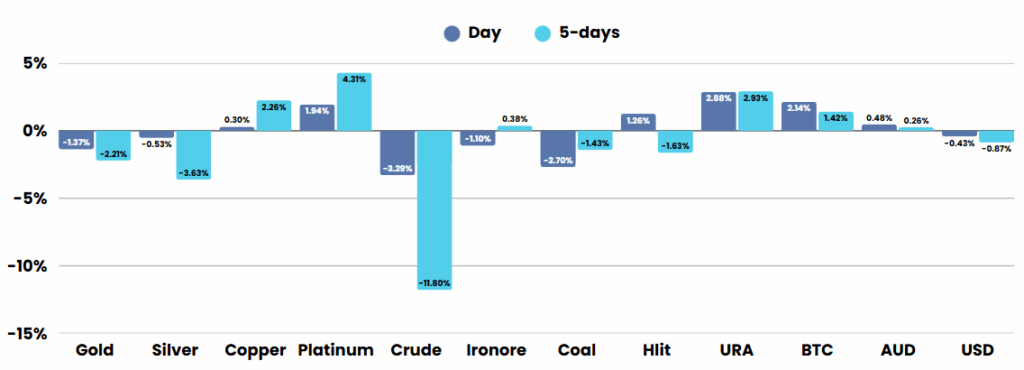

Wall Street saw a boost as optimism grew over a ceasefire between Iran and Israel, following President Trump’s announcement that both sides had agreed to halt hostilities. This news brought relief to investors, ending nearly two weeks of conflict that had driven market volatility and pushed oil prices higher. With the risk of further Middle East supply disruptions reduced, oil prices dropped sharply, easing concerns about global inflation and helping lift major stock indices. However, doubts persisted about the ceasefire’s stability, as both Israel and Iran accused each other of violating the agreement soon after it was implemented.

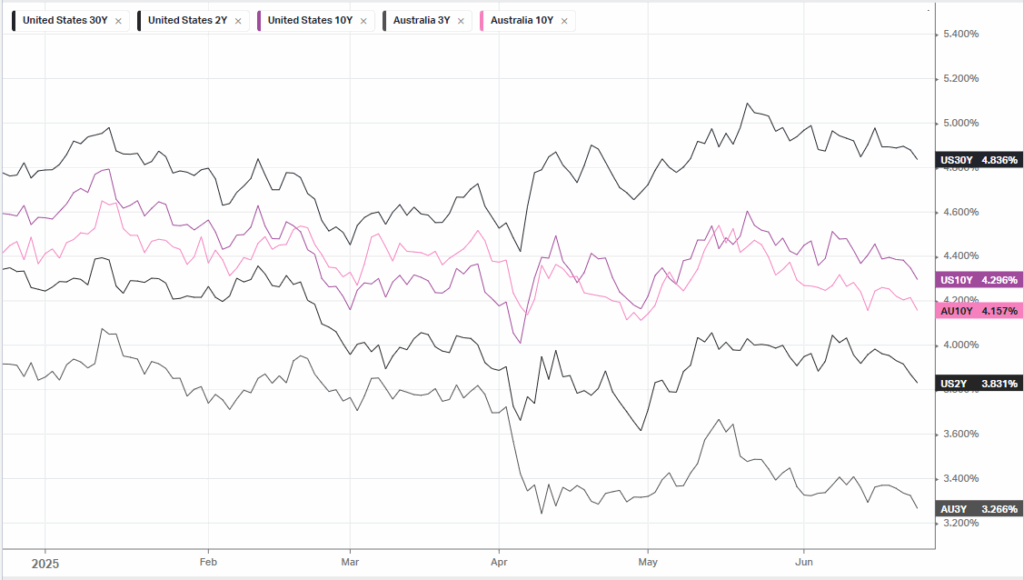

At the same time, Federal Reserve Chair Jerome Powell addressed Congress, signaling that the central bank remains open to multiple paths for monetary policy, including possible rate cuts. Despite calls from President Trump and some Fed officials for immediate action, Powell stressed the need for patience, citing uncertainty over how recent tariff increases might affect inflation. He indicated that the Fed would wait for more economic data before making any policy changes, leading markets to temper expectations for a near-term rate cut.

In corporate news, Tesla’s stock continued its upward momentum after the company launched its new Robotaxi service in Austin, Texas, showcasing its progress in autonomous vehicle technology. Meanwhile, Chewy’s shares fell following the announcement of a $1 billion public offering, though the company also revealed a $100 million share buyback plan. KB Home’s stock declined as the homebuilder lowered its full-year revenue guidance, reflecting ongoing challenges in the housing market despite efforts to manage costs and sustain profitability.

ASX SPI 8540 (+0.05%)

The ASX wont see as much optimism as the US markets with energy and commodity prices drifting off after the ceasefire. Xero has announced a 3.9B deal to acquire Melio in the US to broaden ins reach, the offer is scrip and cash. On the economic front, we have CPI numbers today expected at 2.3% YoY

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.