Overnight – Stock closed mixed ahead of Mag7 Earnings and Fed

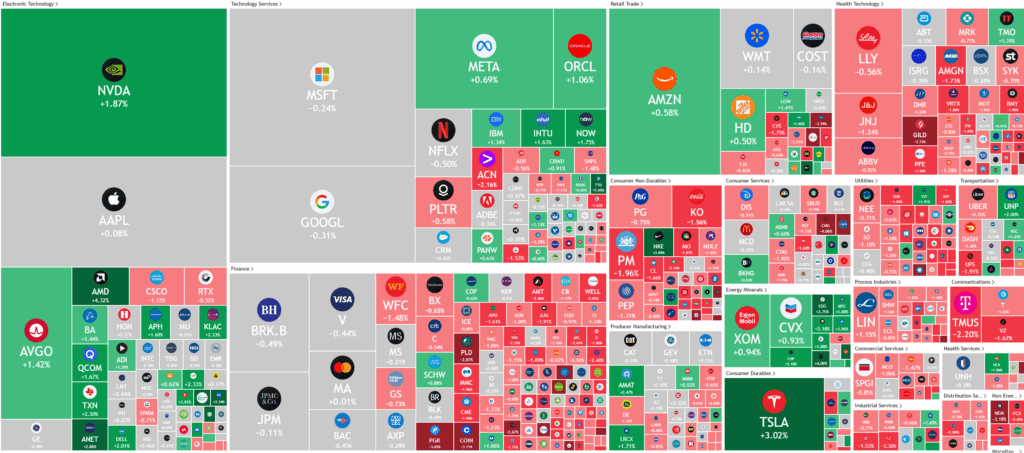

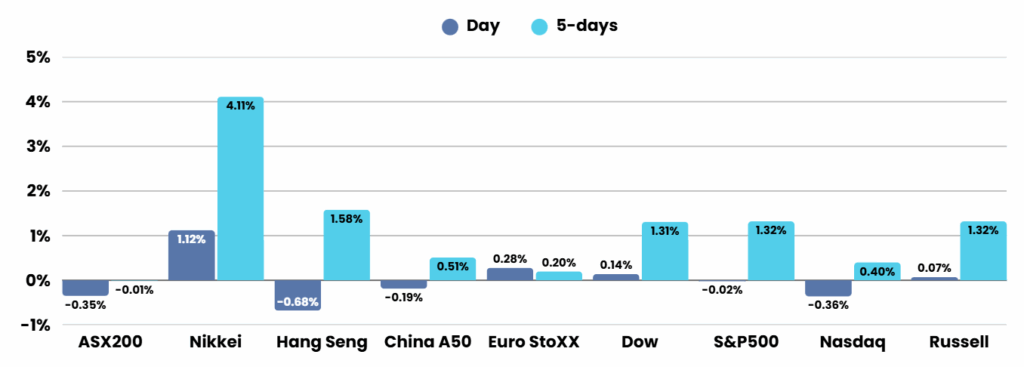

Stock closed mixed overnight as investors parsed the U.S.-EU trade deal ahead of a busy week of data including earnings from the ’Magnificent Seven’ and the Federal Reserve decision.

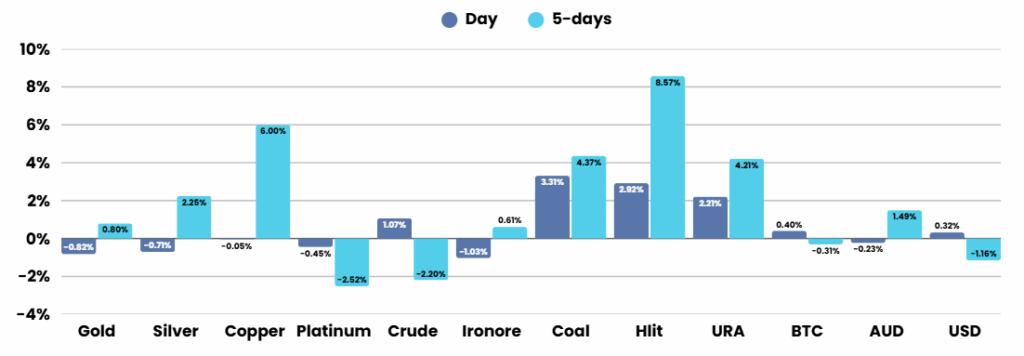

The United States and European Union have reached a tentative trade agreement, introducing a 15% tariff on EU goods entering the U.S. The deal, though still awaiting formal documentation, involves significant economic commitments by the EU, including $750 billion in energy purchases and $600 billion in investments within the American economy. This framework aims to stabilize market sentiment following anxiety over potential trade deadlocks, especially with “reciprocal” tariffs set for August 1. However, analysts caution that the lack of written agreements means uncertainty remains until further details emerge.

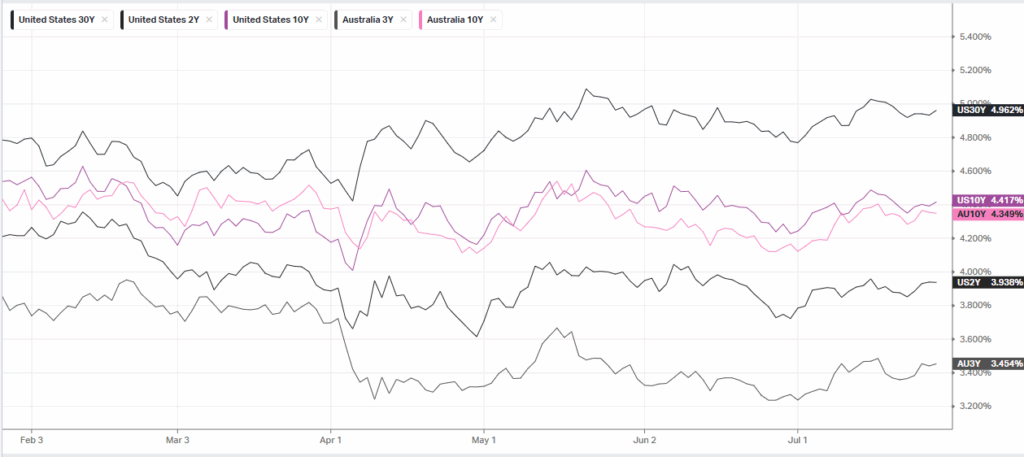

Elsewhere, the U.S. Federal Reserve is commencing its two-day policy meeting, with interest rates expected to remain at 4.25%–4.5%. Investors are watching for signals indicating rate cuts later in the year, particularly hints toward a December move. Alongside the Fed, the Bank of Japan is also holding a pivotal meeting this week, and June’s PCE price index—the Fed’s preferred inflation measure—is anticipated. Key labor market data, including JOLTS, ADP payrolls, weekly jobless claims, and July’s jobs report, will be closely watched for further clues on the economic outlook.

On the corporate front, this week marks a major earnings period with over 150 S&P 500 companies reporting results, including several “Magnificent Seven” tech giants such as Meta, Microsoft, Apple, and Amazon. Market participants are keen to hear management commentary on artificial intelligence spending, which could validate ongoing investment strategies. Morgan Stanley’s Michael Wilson projects an S&P 500 rally to 7,200 by mid-2026, citing robust earnings growth and positive macroeconomic trends. In company-specific moves, Tesla’s shares surged 4% following a $16.5b chip supply deal with Samsung, and Nike likewise climbed after a favorable rating upgrade, while Cisco faced a slight decline after an analyst downgrade.

ASX SPI 8606 (-0.69%)

The ASX will head lower with the broader market in the US lower with only the MAG7 salvaging a positive night for the US.

Quarterly results are expected from Sandfire Resources

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.