Overnight – Nvidia does the heavy lifting again with solid earnings results

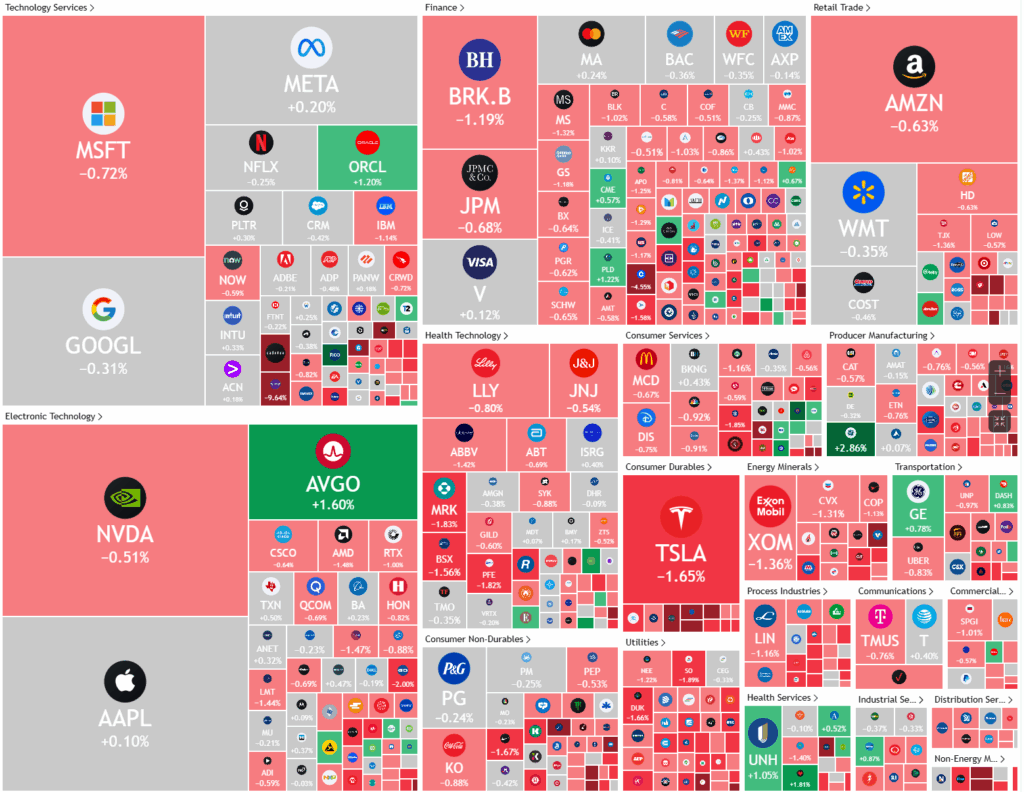

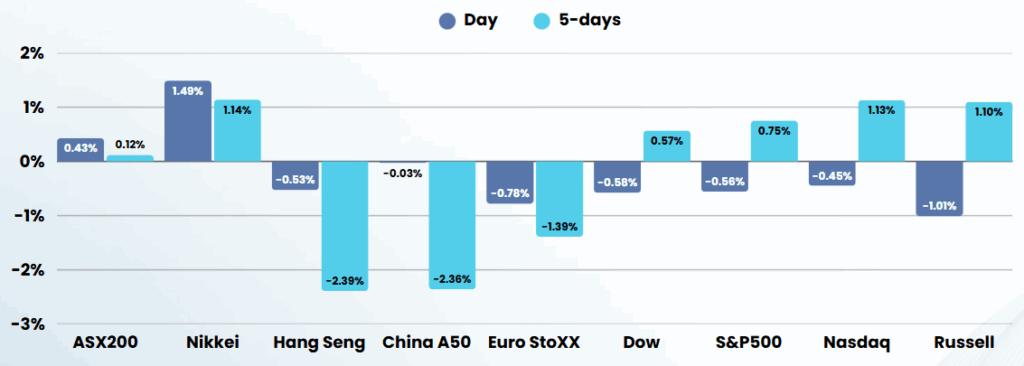

Stocks drifted lower overnight on fresh trade-related angst after President Donald Trump reportedly ordered U.S. chip software makers to stop selling to China, and the Federal Reserve’s May meeting minutes underscoring tariff-related uncertainty.

The Trump administration has escalated efforts to restrict China’s access to advanced U.S. technology by ordering American chip design software companies, such as Cadence, Synopsys, and Siemens EDA, to halt sales to Chinese entities. This move, part of a broader strategy to curb China’s progress in artificial intelligence and semiconductor manufacturing, led to a sharp decline in the stocks of these companies and weighed on major chipmakers like Nvidia, Intel, and AMD. Nvidia, in particular, reported that tighter U.S. export controls on its AI chips to China are expected to reduce its revenue by approximately $8 billion in the coming quarter. CEO Jensen Huang criticized the export restrictions as ineffective, arguing they have spurred Chinese firms to accelerate their own technological development, thereby diminishing U.S. market share without halting China’s advancements.

Meanwhile, the broader U.S. stock market experienced volatility amid these trade tensions and mixed corporate earnings reports. Nvidia’s strong first-quarter results, driven by robust domestic demand and significant growth in its data center segment, briefly boosted investor sentiment, with its shares rising in after-hours trading despite a cautious outlook due to export curbs. Other retailers showed mixed results: Macy’s exceeded earnings expectations but lowered its full-year outlook due to tariffs and softer consumer spending, while Abercrombie & Fitch and Dick’s Sporting Goods both posted strong quarterly performances, with Abercrombie achieving record sales and Dick’s reaffirming its positive outlook for 2025. In contrast, Okta’s stock dropped despite beating revenue estimates, as its guidance reflected caution over the economic environment.

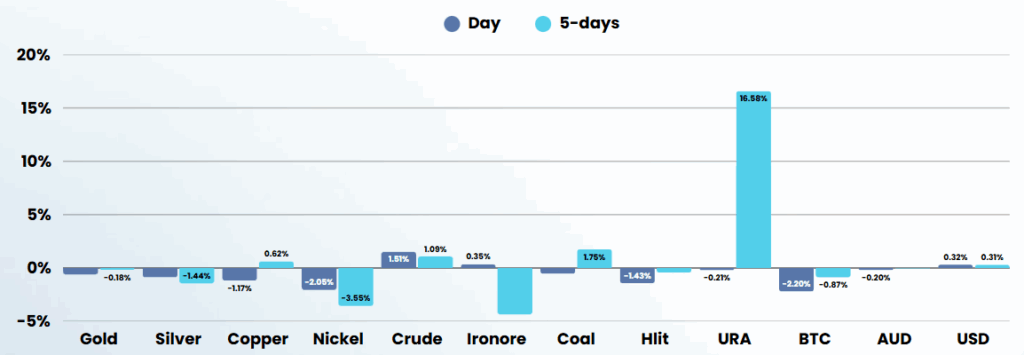

At the macroeconomic level, the Federal Reserve’s latest meeting minutes revealed policymakers’ heightened uncertainty regarding the economic outlook, especially in light of ongoing tariff risks and shifting trade policies. Fed officials acknowledged the potential for “difficult trade-offs” between combating persistent inflation and supporting employment if tariffs continue to disrupt supply chains and raise prices. The global market responded to these uncertainties with modest declines in major indexes, while oil prices rose due to supply concerns following OPEC+’s decision to maintain output levels and the U.S. barring Chevron from exporting Venezuelan crude. Overall, the interplay of U.S.-China tech restrictions, corporate earnings, and evolving trade policies continues to drive market volatility and shape the economic outlook.

Company Specific

- Nvidia +4.5% aftermarket – The AI chipmaker exceeded quarterly sales expectations as customers rushed to buy its AI chips before new U.S. export restrictions to China took effect. However, these curbs are projected to cut $8 billion from the company’s current quarter sales, leading Nvidia to issue a revenue forecast slightly below Wall Street estimates. Despite this, shares rose over 5% in after-hours trading, as the revenue hit was smaller than feared and demand for Nvidia’s new Blackwell chips remains strong, especially among major clients like Microsoft. CEO Jensen Huang criticized the U.S. export controls, arguing they weaken America’s position and accelerate China’s own chip development, while also welcoming the recent rescinding of stricter AI chip export rules. Although Nvidia’s China market share has dropped sharply due to the restrictions, the company is seeking new growth opportunities in the Middle East and other regions. Overall, Nvidia’s revenue surged 69% to a record $44.1 billion last quarter, but the ongoing U.S.-China tech tensions and maturing AI data center market present significant challenges ahead

ASX SPI 84300 (+0.13%)

We are likely to see a mildly stronger day as Nvidia earnings rescued the falling US indexes after the bell in America. There may be some optimism around the international court of trade branding Trumps tariff war illegal, although its highly unlikely the court will hold any weight with the Trump administration

Company Specific

- Champion Iron grew earnings by 44 per cent in the fourth quarter, driven by a record sales of iron ore concentrate, even as realised prices tracked lower.

- Resolute Mining has said it is “seeking further information and clarification” from the Guinean government following media reports that a number of its permits may be revoked in Guinea.

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.