Overnight – Stocks led lower by Tesla as Trump threatens to “deport Elon”

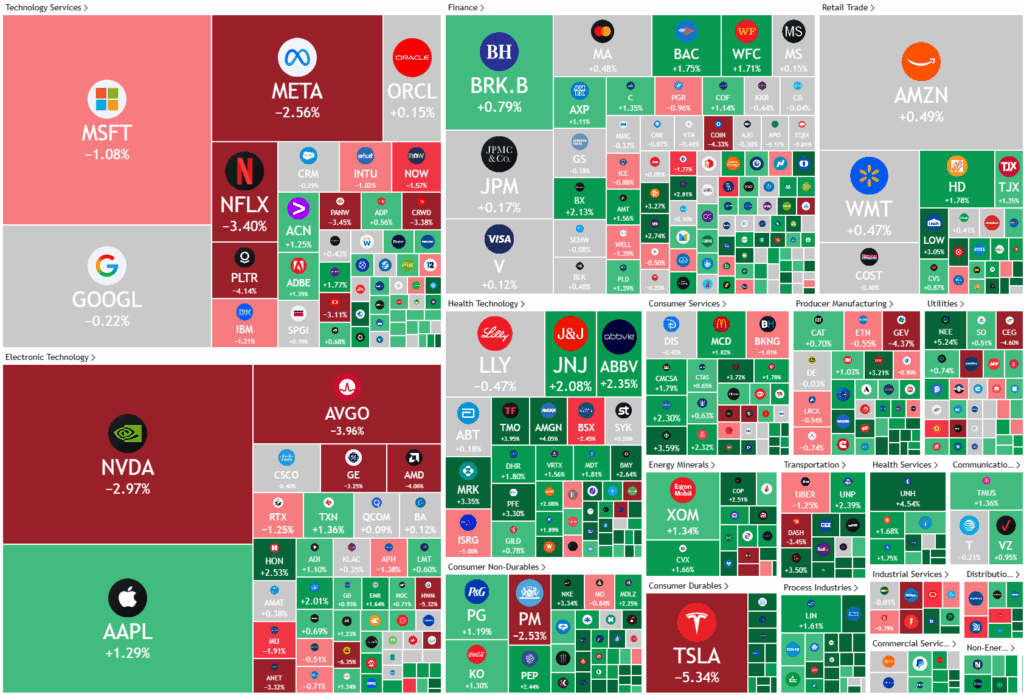

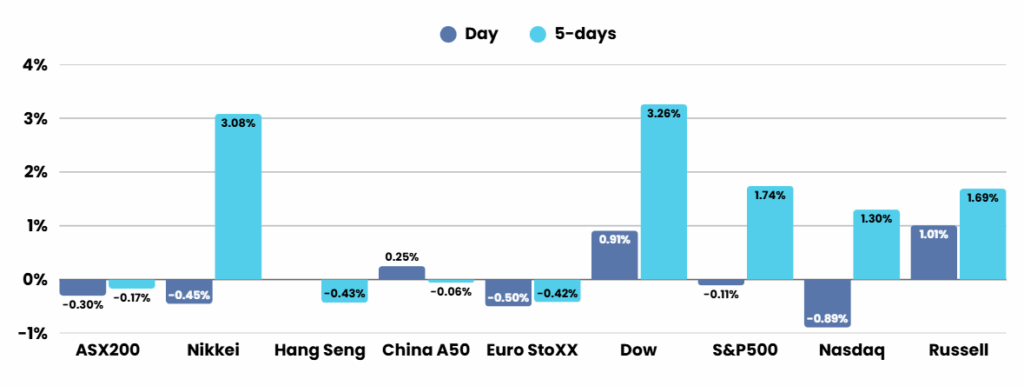

Stocks fell retreating from record levels after big tech started the third quarter on the back foot as investors weighed up updates on trade and fiscal policy as well as a rise in Treasury yields.

Recent developments in global trade have increased expectations for new agreements ahead of President Trump’s July 9 deadline. The U.S. reached a trade deal with China, and Canada withdrew its digital services tax on tech companies just before implementation. However, negotiations with Japan remain challenging, prompting the Trump administration to pursue narrower, phased agreements with select countries to avoid steep reciprocal tariffs that could reach as high as 50%. While these limited deals may shield some nations from the harshest tariffs, a 10% baseline tariff would still be enforced as broader negotiations continue.

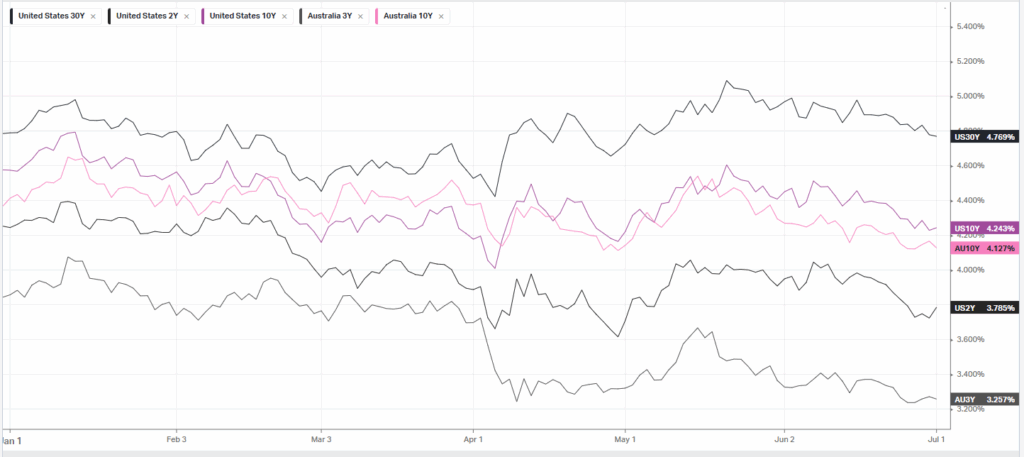

On the monetary policy front, President Trump has intensified his criticism of Federal Reserve Chair Jerome Powell, urging for significant interest rate cuts in light of weaker inflation data and persistent economic uncertainty caused by Trump’s tariff policies. Trump sent Powell a handwritten note demanding lower borrowing costs and hinted at possibly naming a successor, which could undermine Powell’s authority. Market expectations for a Fed rate cut in September have surged above 90%, with upcoming economic data, especially the monthly jobs report, likely to influence these odds further.

In domestic politics, Senate Republicans narrowly advanced debate on Trump’s comprehensive tax cut and spending bill, which the Congressional Budget Office estimates would add $3.3 trillion to the federal deficit over the next decade. The bill also proposes a $5 trillion increase to the debt ceiling, surpassing the House version by $1 trillion. Meanwhile, Tesla shares dropped sharply after Trump publicly criticized CEO Elon Musk over government subsidies, escalating their ongoing feud, while Hasbro’s stock hit record highs following a favorable analyst upgrade.

ASX SPI 8558 (+0.21%)

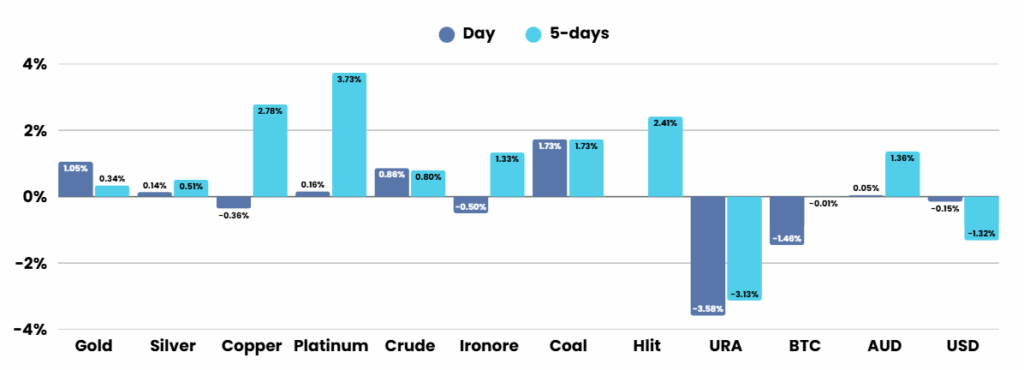

Commodities are likely to drag the market higher today as tech wanes. The focus will be on May retail sales and building approvals data set for release at 11.30am

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.