Overnight – Stock Drift lower on US/China deal nerves and new Trump tariffs

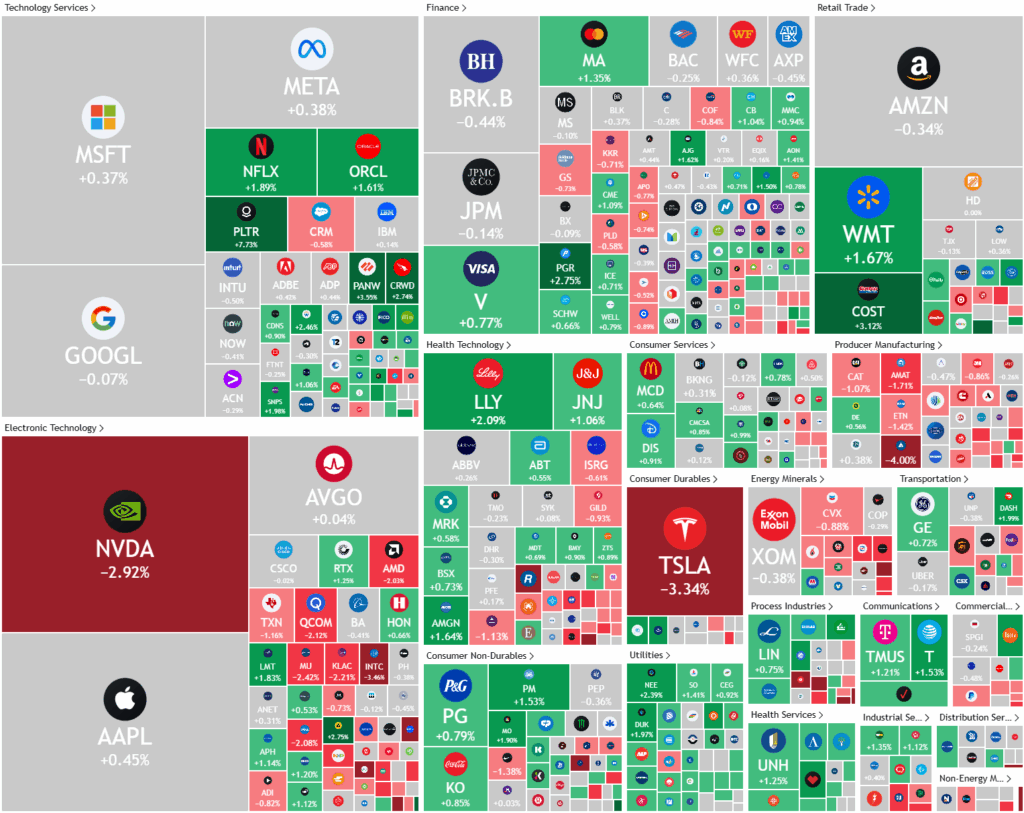

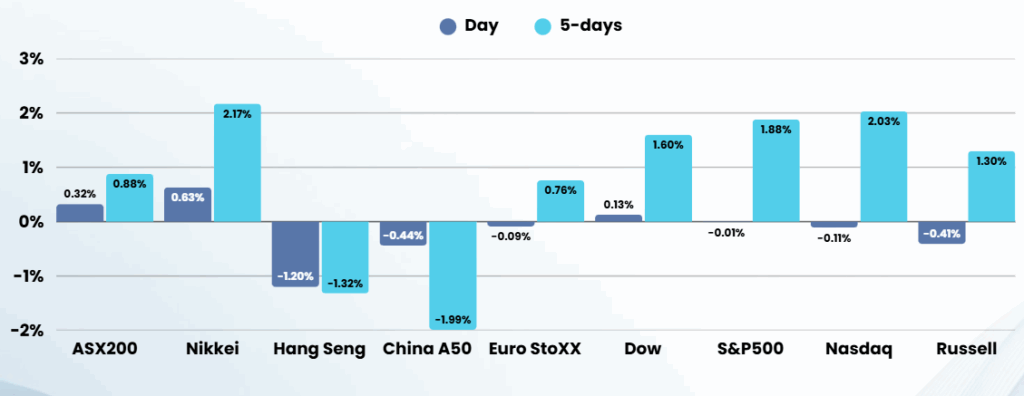

Stocks ended lower on Friday as chip stocks including Nvidia were pressured rising U.S. China trade tensions, wrapping up a month where the US indices had their strongest month since 2023.

Nvidia shares fell sharply as the company warned of an $8 billion revenue hit from lost chip sales to China, following the Trump administration’s expanded restrictions on AI chip exports and related technologies. These measures are part of a broader U.S. strategy to curb China’s access to advanced semiconductors, effectively closing off a $50 billion market for Nvidia and slashing its China market share for high-end AI chips from 95% to 50% over the past four years. Nvidia’s CEO Jensen Huang criticized the export controls, noting that they not only hurt U.S. companies but also accelerated the development of domestic Chinese competitors, such as Huawei, which have stepped in to fill the void left by U.S. firms.

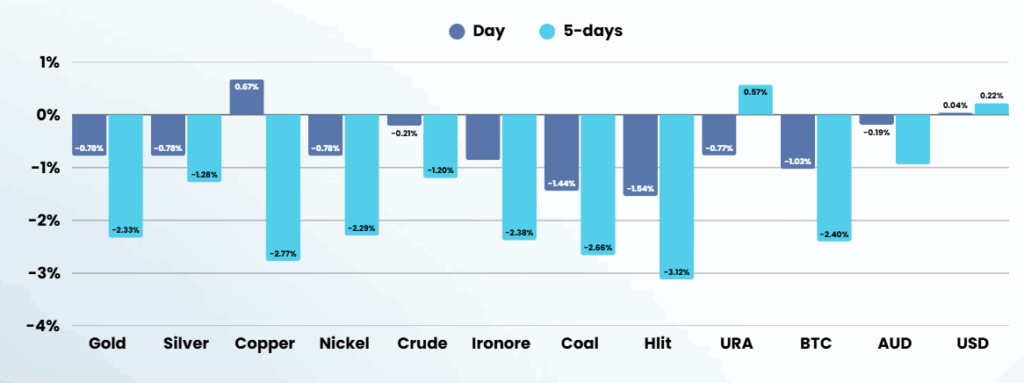

The tech sector’s downturn was compounded by escalating U.S.-China trade tensions. President Trump accused China of violating a recent trade agreement, reigniting uncertainty just after both countries had agreed to a temporary 90-day reduction in reciprocal tariffs—from 125% to 10%—in an effort to de-escalate the trade war. Despite this reprieve, the underlying issues remain unresolved, and the threat of renewed tariffs looms large. Legal battles over the legitimacy of Trump’s tariffs have added to market volatility, with a federal appeals court temporarily reinstating the levies after a lower court ruled the president had exceeded his authority. This legal uncertainty has delayed corporate decisions on hiring, investment, and pricing, further weighing on economic sentiment.

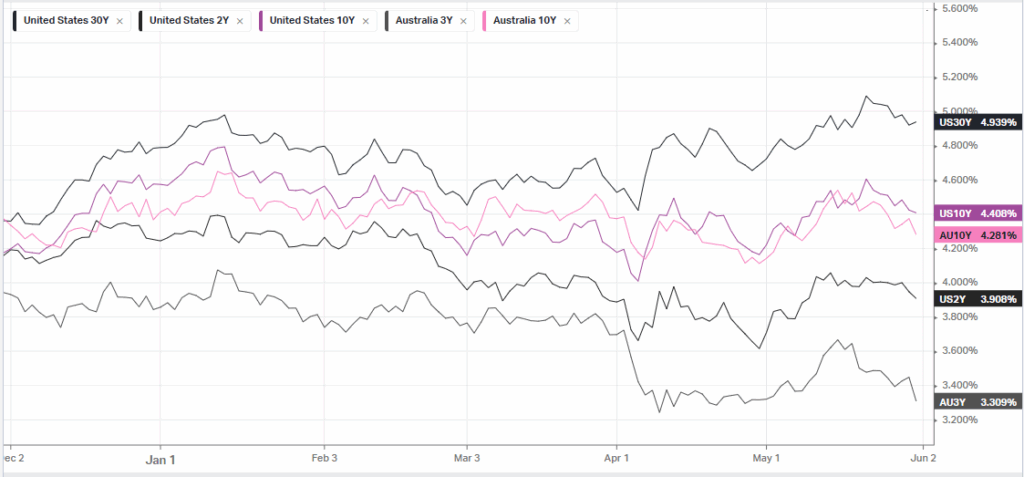

The broader economic impact of these trade policies is evident in the latest corporate earnings and macroeconomic data. Gap warned that tariffs could reduce its operating income by $100 million to $150 million, while American Eagle flagged weaker demand and shrinking margins due to higher import costs. Meanwhile, Dell reported mixed results as tariffs dampened demand, though it raised its full-year outlook on strong AI server sales. On the macro front, the U.S. economy contracted slightly in the first quarter, and inflation—as measured by the PCE price index—continued to ease, potentially giving the Federal Reserve more room to adjust monetary policy. However, the ongoing trade and regulatory uncertainty, especially in the technology sector, remains a significant headwind for both corporate America and the broader economy.

Company Specific

- Gap – stock slumped after the clothing retailer delivered another strong quarterly earnings beat, but said tariffs could cost the company between $100 million and $150 million with mitigation efforts.

- Ulta Beauty – stock soared after the cosmetics company boosted its full-year outlook after beating first-quarter expectations, signalling that shoppers are keeping up with non-essential beauty purchases.

- Dell Technologies – stock rose after the tech giant lifted full-year earnings guidance despite reporting mixed Q1 results as earnings missed estimates on a tariffs-related hit to demand.

ASX SPI 8465 (+0.01%)

The ASX is likely to head lower today as a the Ukraine strike on Russian bombers, the announcement of steel tariffs and ever increasing nerves around the US/China trade deal will grind on investors confidence

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.