Overnight – Tariff uncertainty sees Apple and Amazon left behind after earnings

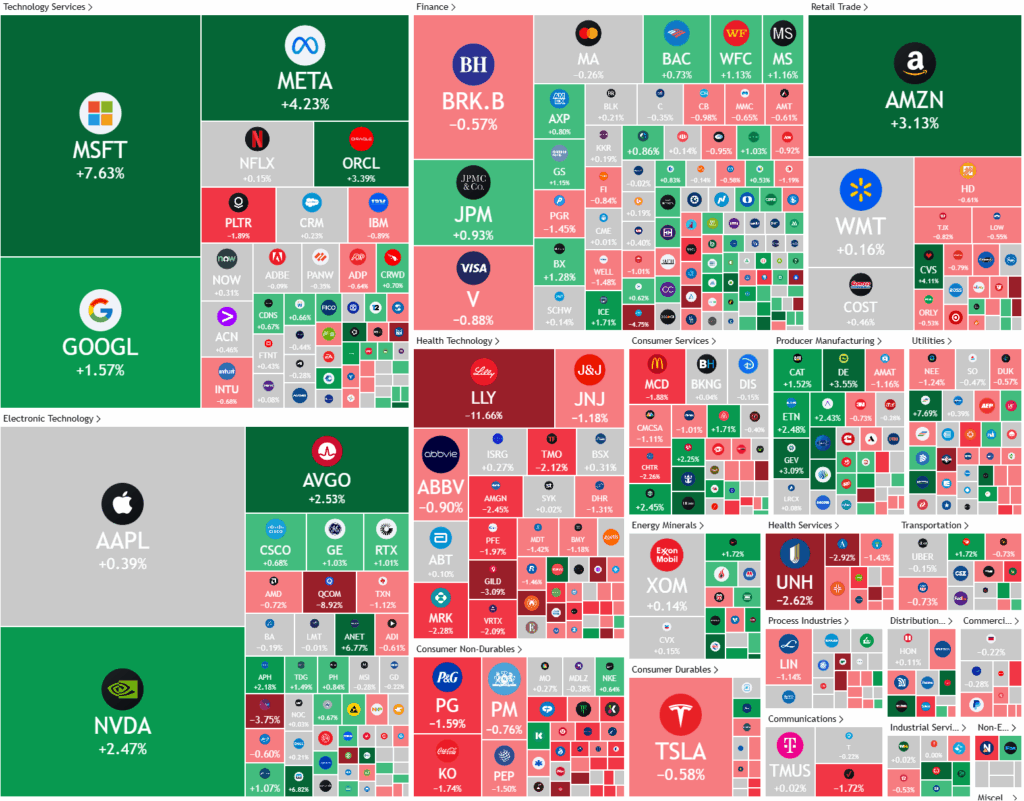

The positive tone during the US days session from yesterdays Meta and Microsoft earnings results was dampened as Apple and Amazon disappointed the market with tariff uncertainty casting a shadow over the results

During the regular session the market way buoyed by robust earnings from Microsoft and Meta Platforms, provided fresh signs that the artificial intelligence boom is far from over, fueling gains across stocks.

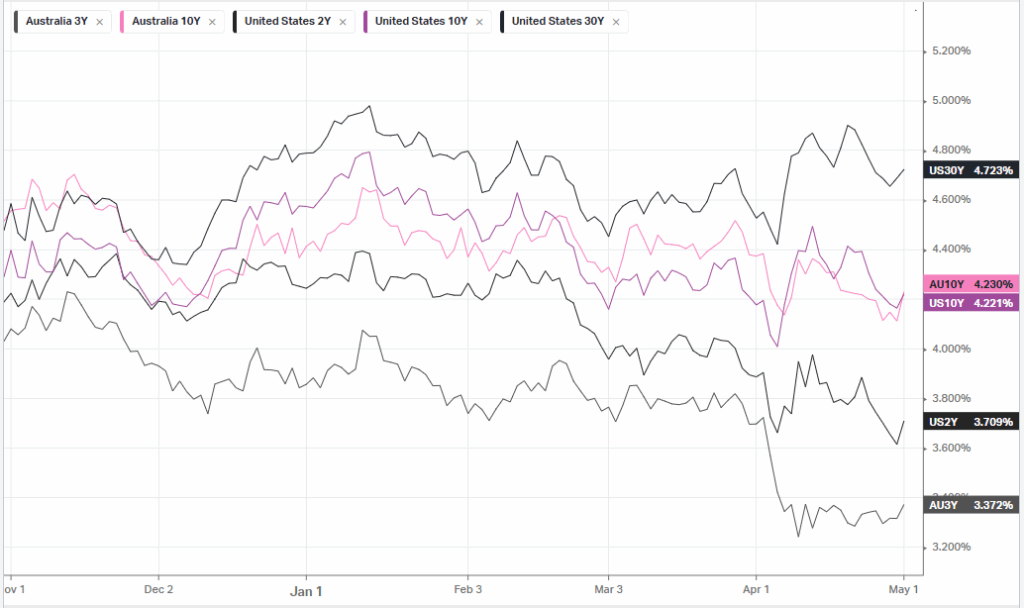

In economic data, the number of Americans filing new applications for unemployment benefits increased more than expected last week as initial claims for state unemployment benefits jumped 18,000 for the week ended April 26, the Labor Department said. This potentially hinted at a pick-up in layoffs from tariffs, which weighed on the economy in the first quarter, ahead of tonight’s key nonfarm payrolls report where economists are expecting 138k jobs to be added to the economy and an unemployment rate of 4.2%

The economy contracted last quarter for the first time in three years, swamped by a flood of imports as businesses tried to avoid duties from President Donald Trump’s tariffs.

Company Earnings

- Amazon – fell 3% in afterhours trade after reporting first-quarter 2025 results that beat analyst expectations, posting earnings per share of $1.59 on $155.7 billion in revenue, driven by higher operating income and strong performance in North America and its cloud division. However, growth in Amazon Web Services (AWS) was a modest 17%, in line with estimates but reflecting a slowdown compared to prior periods, which contributed to investor concerns. Despite the earnings beat, Amazon issued softer guidance for the current quarter, forecasting operating income below Wall Street expectations and sales slightly above consensus, which led to a drop of about 3% in after-hours trading as investors reacted to the cautious outlook

- Apple – Stock fell 2% as the company reported fiscal second-quarter results that beat Wall Street expectations, with earnings per share of $1.65 and revenue of $95.36 billion, driven by stronger-than-expected iPhone sales and improving performance in China. iPhone revenue rose 1% year-over-year to $46.84 billion, outpacing estimates, while sales in Greater China fell by 2% to $16 billion, a smaller decline than the previous year. However, revenue from Apple’s high-margin services segment, including Apple Pay and the App Store, grew to $26.65 billion but narrowly missed analyst forecasts. Other segments were mixed: Mac sales exceeded expectations at $7.95 billion, but wearables, home, and accessories revenue fell short. Following the report, Apple shares dropped over 2% in after-hours trading. The company also announced a $100 billion stock buyback program-down from the previous quarter’s record-and raised its quarterly dividend by 4% to $0.26 per share

- McDonald’s – stock fell more than 1% after the fast food giant posted a surprise decline in first-quarter global comparable sales, with CEO Chris Kempczinski adding the company was navigating the “toughest of market conditions.”

- Eli Lilly – stock dropped 11% after the drugmaker posted disappointing sales of its popular weight-loss drug, Zepbound.

- Estee Lauder – stock fell more than 11% after flagging ongoing challenges in its travel retail business and subdued consumer sentiment in Asia.

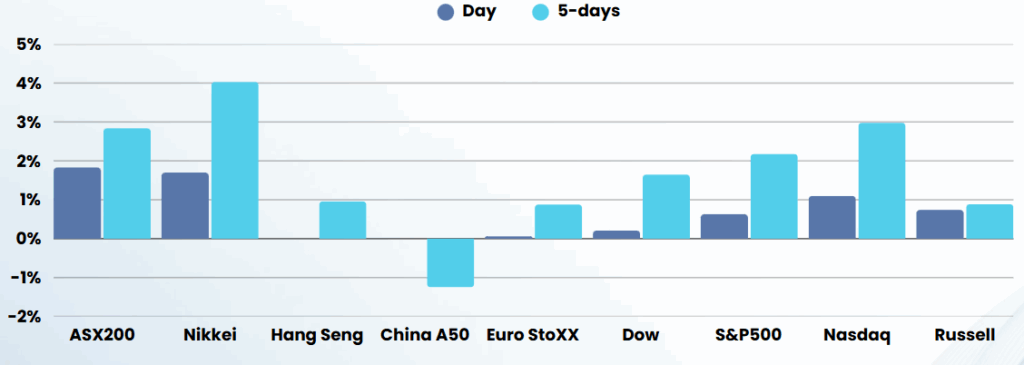

ASX SPI 8130 (-0.39%)

Its unlikely to be an eventful session as global investors wait for the key US employment data tonight and an election on the weekend

- WiseTech said on Thursday night it was mulling the acquisition of New York-listed supply chain platform provider e2open for up to $3.5 billion.