Overnight – Stocks take a breather as Fed and MAG7 Earnings Loom

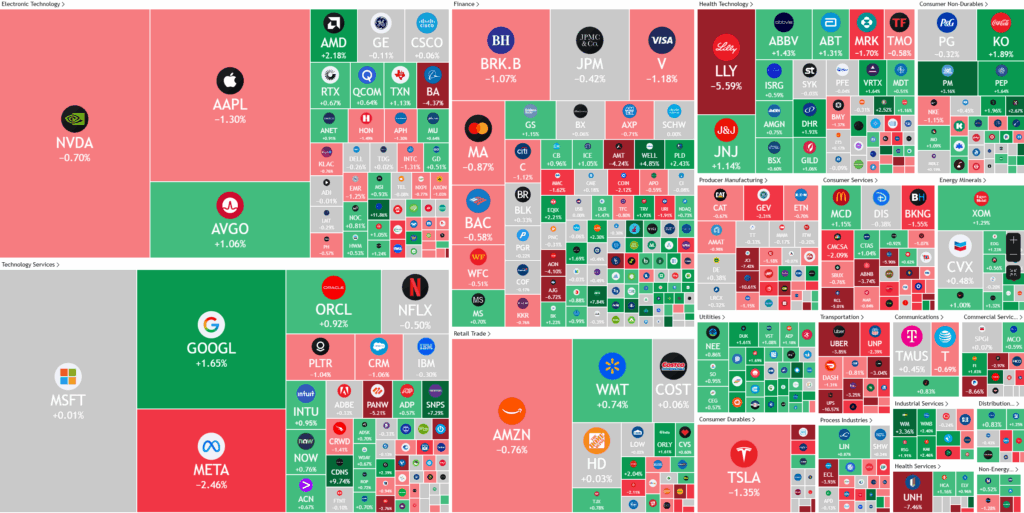

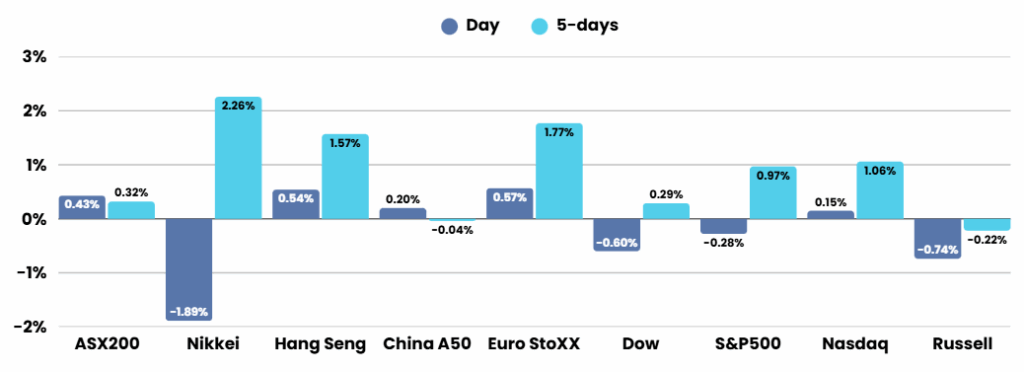

Stock closed lower overnight as investors took a rest from their recent “ultra bullish” tone as 4 of the MAG7 earnings and the Federal Reserve meeting are delivered in the next 2 days.

Investors also digested a deluge of horrible corporate earnings with nearly all of the headliners for the day, being significantly hit.

Adding to the uncertainty was a lack of progress of U.S.-China trade talks. Trade negotiations between the United States and China remain at a pivotal juncture as both sides recently concluded a third round of high-level talks in Stockholm, aiming to avert a return to hefty tariffs. While officials describe the discussions as productive and agree on extending the current tariff truce, no specific breakthroughs were achieved, and the threat of tariffs surging to punitive levels looms if no agreement is reached by the August 12 deadline. This precarious situation keeps businesses and markets on edge, recalling previous periods of elevated tariffs that led to significant disruptions in manufacturing costs and global supply chains.

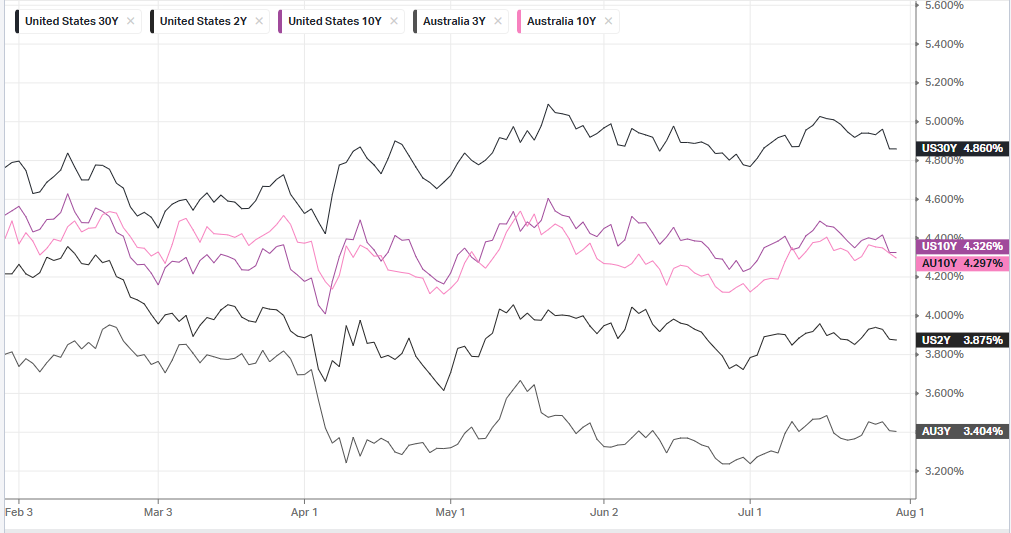

Simultaneously, the U.S. Federal Reserve has begun its two-day policy meeting, with investors focused on whether signals of a future interest rate cut will emerge. The Fed is widely expected to maintain its benchmark interest rate at 4.25%–4.5% for now, despite persistent pressure from President Donald Trump to ease rates and bolster the economy. Chair Jerome Powell and most committee members have argued for patience amid inflation uncertainties driven by trade policies, though internal dissent has surfaced, and market expectations are tilted toward a possible rate cut later this year as more labour market and inflation data become available.

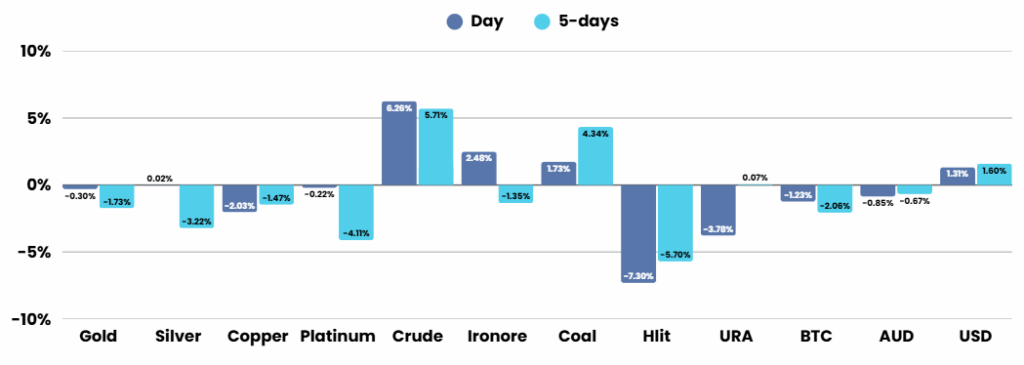

In commodity markets, oil prices surged over 3% on Tuesday, reaching their highest levels since late June. This rally was fuelled by optimism that easing U.S. trade tensions with key partners could support global energy demand and by President Trump’s intensified pressure on Russia regarding the Ukraine conflict, including newly announced threats of tariffs and sanctions if progress is not made. Investors continue to closely monitor geopolitical developments, central bank meetings, and critical labour statistics for further influence on market sentiment and economic forecasts

Earnings was a horror show overnight for … well, everyone, with some significant downside moves across the board, with the only positive move from Starbucks +3.75%

Corporate Earnings

- Merck -1.64% – stock fell after the drugs giant announced job and cost cuts it said will save $3 billion a year as it posted lower second-quarter results due to continuing weak demand for its Gardasil vaccine in China.

- Spotify -11.6% – guided for current-quarter earnings and revenue below analysts’ estimates, as the streaming music giant flagged the impact of negative currency effects and elevated payroll expenses.

- Novo Nordisk -21.83% – stock slumped after the maker of weight-loss drug Wegovy warned that full-year sales and operating profit would grow less than previously expected, marking its second forecast cut of 2025.

- PayPal -8.7% – stock fell after the payments company guided to a current-quarter profit that was roughly flat from a year earlier, even as it raised its full-year profit forecast.

- United Parcel Service -10% – stock fell after the parcel delivery service reported a decline in second-quarter profit and revenue, as demand took a hit from the Trump administration’s volatile trade policies.

- Unitedhealth -7.3% – stock fell after the health insurer reinstated the full-year profit forecast that it pulled over two months ago, but its guidance still fell short of analysts’ already-lowered expectations.

- Whirlpool -13.4% – stock plunged after the home appliance company reporting disappointing second-quarter results and slashed its 2025 full-year guidance.

ASX SPI 8662 (-0.10%)

The ASX will hang in better than the US with commodities and energy hanging in there. Although lithium stocks may take a hit from the overnight lead.

Before the bell, Atlas Arteria Group, Champion Iron, Pilbara Minerals and Mineral Resources will release updates and Rio Tinto is set for its earnings release at 4.15pm AEST.

Also, AU monthly CPI data will be released at 1130 which could make headlines if the reading is lower than expected, giving the media and pundits a chance to “bash” the RBA on rates. If the reading is higher than expected, it will likely be a footnote.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.