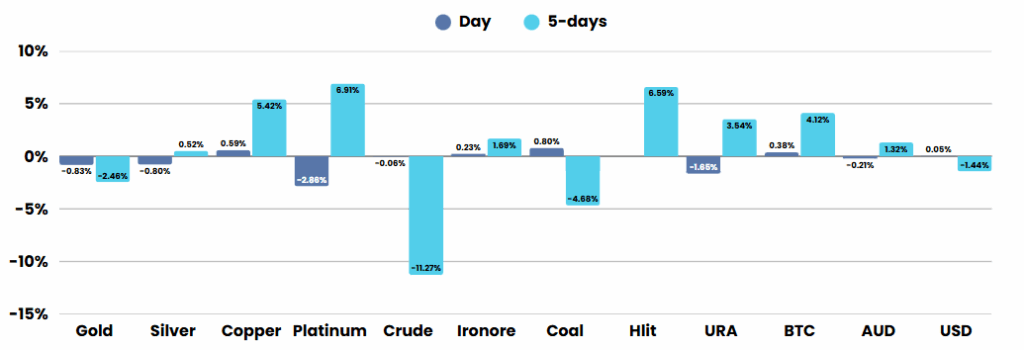

President Donald Trump announced the immediate termination of all trade discussions with Canada, citing Ottawa’s decision to impose a digital services tax on American technology companies. Trump criticized the tax as overly burdensome and accused Canada of copying similar European Union policies, sparking fears of a renewed trade war between the two countries. This development contrasted with earlier optimism in the markets, which had been buoyed by signs of progress in the U.S.-China trade talks, including a breakthrough on rare earth mineral shipments and hints that a broader deal might be reached before the July 9 deadline for tariff pauses.

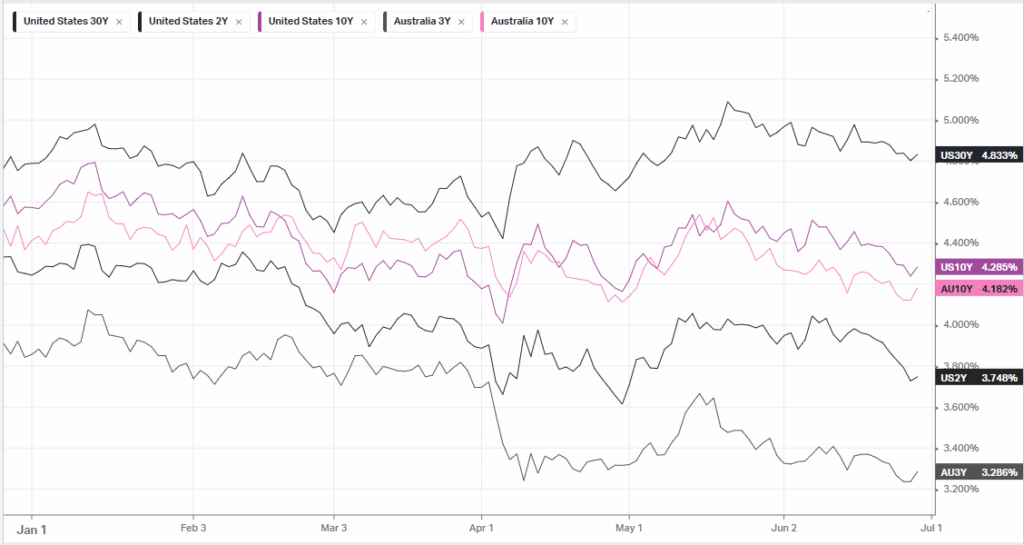

Amidst these shifting trade winds, the U.S. economy showed signs of both resilience and caution. Inflation data for May indicated a mild increase, with the core personal consumption expenditures price index rising 2.7% year-over-year—slightly above forecasts but still within manageable levels. The Federal Reserve has adopted a wait-and-see approach to interest rate changes, concerned about the potential for tariffs to drive prices higher in the months ahead. Meanwhile, the U.S. economy experienced a contraction in the first quarter, its first since 2022, highlighting the delicate balance between growth and the effects of ongoing trade disputes.

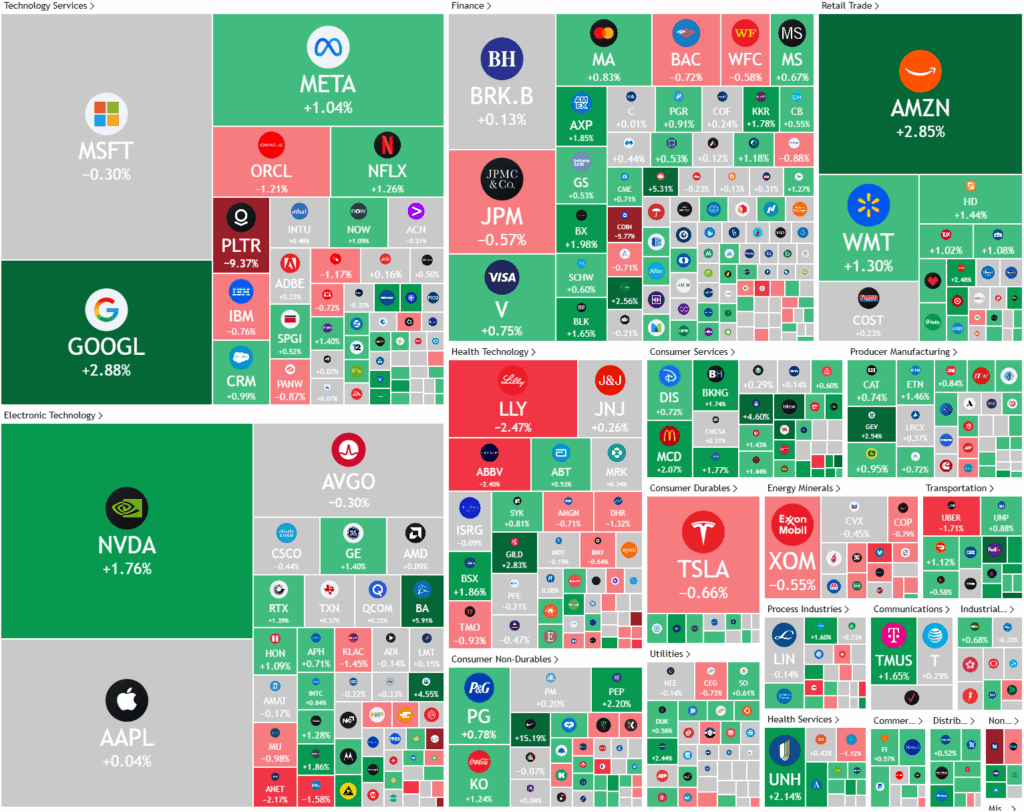

In the corporate world, Nike’s stock surged after the company exceeded earnings expectations for its fiscal fourth quarter and suggested that the worst of its financial difficulties might be over. Nike executives also announced plans to move more production out of China and into the United States, aiming to avoid higher costs from tariffs. Elsewhere in the financial sector, analysts expected major banks to perform well in the upcoming Federal Reserve stress tests, which are seen as less demanding than in previous years, reflecting confidence in the sector’s health despite broader economic uncertainties.

ASX SPI 8521 (+0.05%)

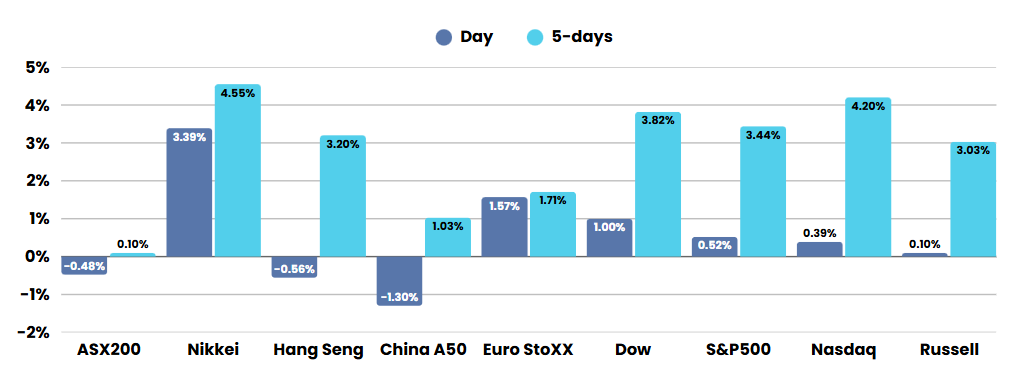

The ASX is likely to see a bid tone for the final day of the AU Financial year as fund managers make sure they lock in the best year since COVID, in what would have seemed an impossible result just 80 days ago when we hit bear market territory in the US indexes.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.