Overnight – Nvidia holds up market despite tariff uncertainty

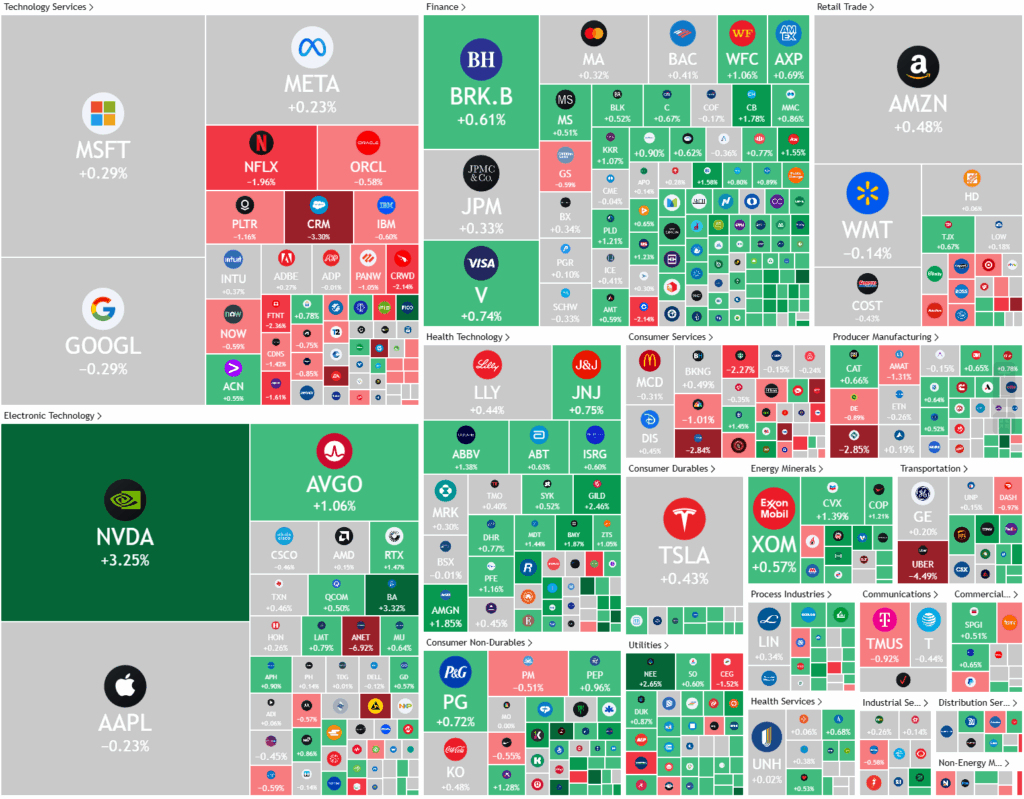

Stocks were lucky to be saved by Nvidia’s earnings result overnight, with the worlds 3rd biggest company, single handedly holding up the index against broader weakness

A federal appeals court has reinstated former President Trump’s reciprocal tariffs after they were initially blocked by the Court of International Trade, which had ruled that Trump exceeded his authority under the International Emergency Economic Powers Act. The legal battle, prompted by a lawsuit from five small U.S. businesses represented by the Liberty Justice Center, has injected new uncertainty into U.S. trade policy, as both sides are now set to present their arguments in early June. This back-and-forth has heightened concerns in financial markets about the potential for further economic disruption and volatility stemming from the administration’s tariff agenda.

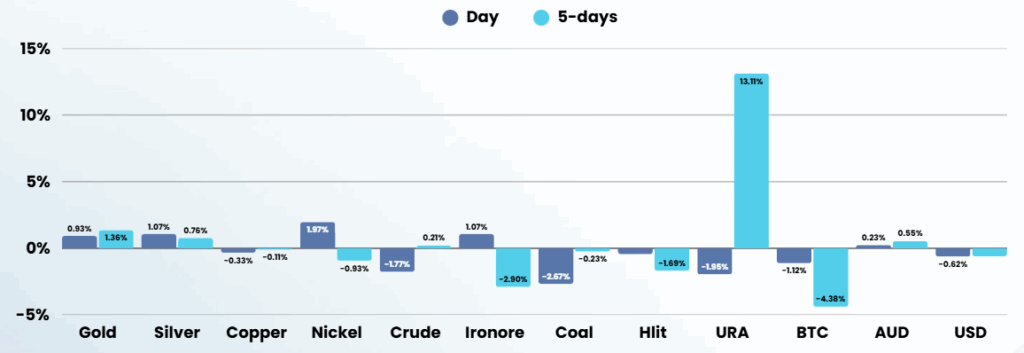

In the corporate sector, Nvidia’s stock surged following a strong quarterly earnings report, driven by robust demand for AI chips and data center servers, particularly from major Wall Street firms investing in AI infrastructure. Despite forecasting an $8 billion revenue hit from stricter U.S. export controls against China, Nvidia’s outlook was still viewed as impressive by analysts, reinforcing its role as a bellwether for ongoing AI investment. Meanwhile, other notable market moves included Tesla’s stock rising after Elon Musk confirmed his departure from the Trump administration, Kohl’s gaining on improved results and cost-cutting efforts, and Best Buy falling after lowering its fiscal 2026 outlook due to the impact of tariffs.

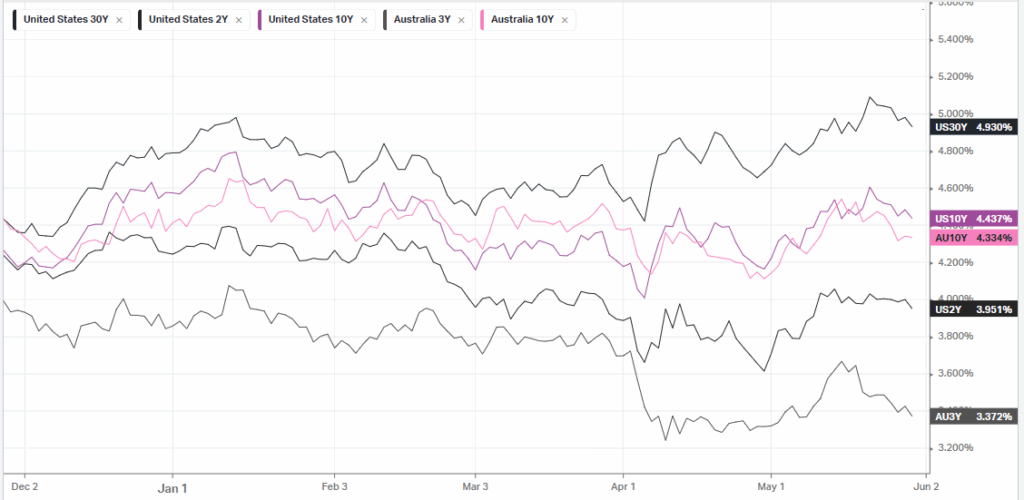

These positive corporate developments have partially offset concerns about the broader U.S. economy, which contracted by 0.2% annualized in the first quarter, according to the latest GDP estimate from the Bureau of Economic Analysis. This marks a slowdown from the previous quarter’s 2.4% growth rate and comes amid rising initial jobless claims, signaling a softening labor market. The economic outlook remains clouded by ongoing trade policy uncertainty and volatility, with several Federal Reserve officials scheduled to offer their perspectives in the coming days.

Company Specific

- Costco Wholesale (-0.50%) – missed third-quarter revenue expectations, reporting $61.96 billion versus the anticipated $63.19 billion, but beat earnings estimates and saw strong 8% same-store sales growth. To soften the impact of U.S. tariffs, Costco pulled forward shipments and rerouted goods, stressing that price hikes would be a last resort—unlike Walmart, which plans to raise prices soon. Despite higher supply chain costs and weak consumer sentiment, Costco’s value-focused private label and bulk-buying appeal have helped it outperform, though the company remains cautious amid ongoing economic uncertainty.

ASX SPI 8404 (-0.20%)

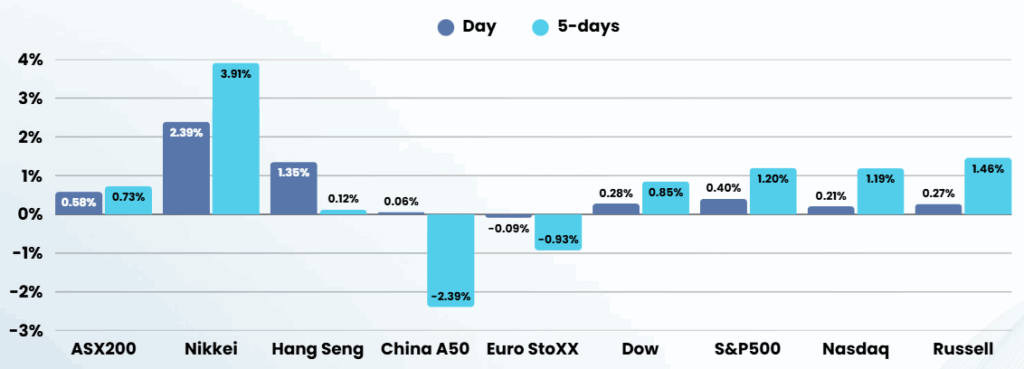

The local market is likely to be subdued, with most of the heavy lifting done by tech in the US (a small percentage of our index)

The news of Trumps tariffs being contested was at peak optimism yesterday and the developments overnight will reverse that sentiment

Company Specific

- HealthCo Healthcare & Wellness REIT has struck an agreement with Healthscope and its receivers to partially defer rental payments.

- Rio Tinto has awarded NRW Holdings a $157 million contract to construct non-process infrastructure facilities at two new mine deposits being developed by the mining giant. It comes weeks after NRW warned of a $113 million impairment from a messy dispute over who controls the Whyalla port.

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.