Overnight – Markets digest huge night of Earnings, Interest rates & Tariff announcements

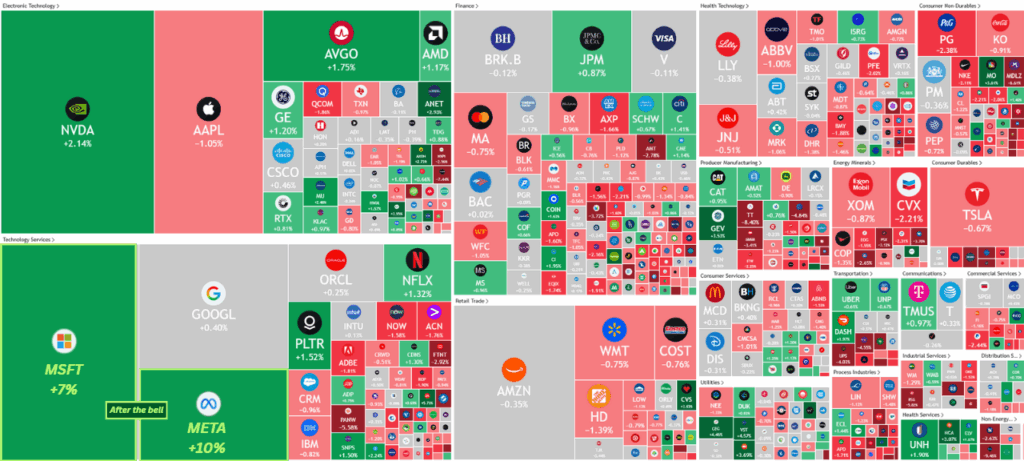

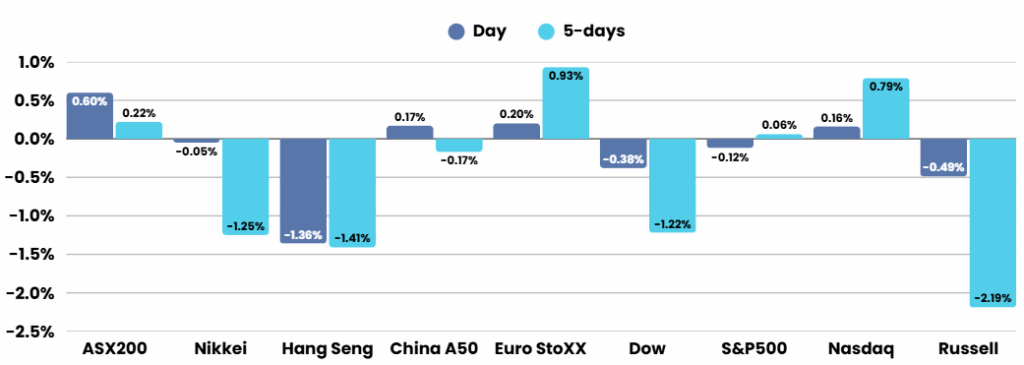

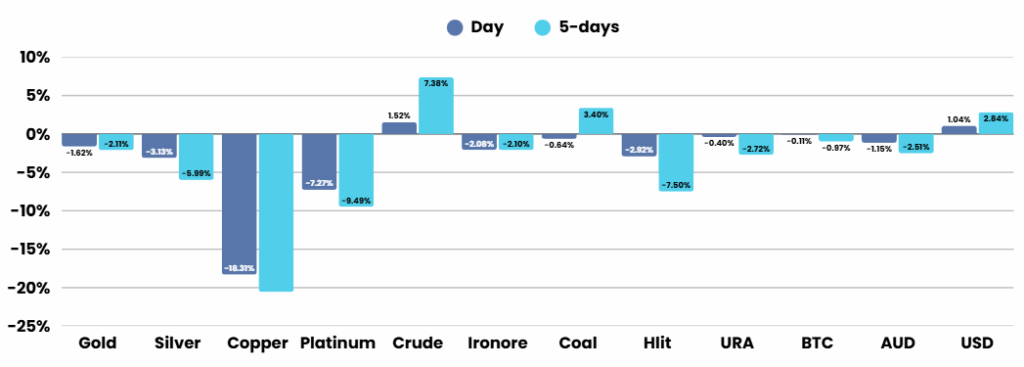

A huge day on markets to digest with the Fed delivering a hawkish hold, Trump making trade/tariff announcements, seeing Copper plummet 20%, and stellar Microsoft and Meta earnings after the bell

The Federal Reserve decided to keep interest rates steady at 4.25% to 4.5% during its July 30, 2025 meeting. However, this decision was notable for a rare double dissent, with two governors preferring a rate cut—a sign of growing division within the central bank. This discord comes despite external pressure from President Trump, who has urged the Fed to lower rates to stimulate growth. The FOMC pointed to lingering inflation and stable market conditions as reasons for maintaining the current stance, while the dissenting governors argued for cuts, believing inflation is under control and economic growth is at risk of slowing. Markets are nervous about Trumps retaliation to this move.

Economic data released on the same day painted a mixed picture. The U.S. economy rebounded in the second quarter, growing at a 3% annualized rate following a 0.5% contraction in the first quarter. This stronger-than-expected growth was partly propelled by a sharp drop in imports and a modest rise in consumer spending, counterbalancing ongoing trade uncertainties and fresh tariffs. The labor market also appeared healthy, with private payrolls expanding by 104,000 jobs in July and wages up 4.4% year-over-year, according to ADP data.

Internationally, trade tensions remained unresolved. U.S.-China negotiations in Sweden failed to yield a breakthrough, risking the expiration of a major tariff truce in August, yet both sides called the discussions constructive and left the door open for further dialogue. Meanwhile, President Trump announced a 25% tariff (plus unspecified penalties) on Indian imports, to take effect August 1, 2025. This move, targeting $87 billion in Indian goods, comes as the U.S. criticizes India’s high tariffs and its procurement of Russian energy and arms. The new tariff puts Indian exporters at a marked disadvantage compared to other U.S. trade partners such as Japan and Vietnam, threatening to unravel months of bilateral trade talks.

In corporate news, several prominent U.S. companies reported quarterly results that moved markets. Starbucks posted higher-than-expected revenue but saw net earnings plunge 47%, tied to a drop in global store sales. Health insurer Humana raised its full-year outlook despite a year-over-year drop in net income. Etsy topped revenue forecasts but missed on earnings per share as its transaction volume slowed. VF Corporation, parent of Vans, beat revenue expectations thanks to higher apparel and footwear demand. Separately, Trump finalized a 50% copper tariff, focused only on semi-finished products, causing U.S. copper futures to drop as key raw materials were excluded—an outcome welcomed by major producers but met with caution from U.S. mining firms

Corporate Earnings

- Microsoft +7.5% – the Tech giant surpassed Wall Street expectations in its fiscal fourth-quarter earnings, reporting an 18% year-over-year revenue increase to $76.4 billion, higher than the forecasted $73.8 billion. Driven by strong demand for artificial intelligence and cloud services, Azure revenue climbed 39% for the quarter and exceeded $75 billion for the fiscal year, outpacing analyst estimates. Total Microsoft Cloud revenue reached $46.7 billion, a 27% annual growth, with overall quarterly earnings per share at $3.65, also beating projections. Shares jumped over 6% in extended trading, reflecting optimism in the company’s ongoing cloud and AI momentum, even as industry-wide capacity constraints and intensified competition persist

- Meta Platforms +10% – reported strong second-quarter earnings, surpassing analyst expectations with earnings of $7.14 per share and revenue of $47.52 billion, both well above estimates. The company’s daily active user base grew 6% to 3.48 billion, signaling continued engagement across its family of apps. Looking ahead, Meta issued upbeat guidance for third-quarter revenue at a midpoint of $49 billion, outpacing analyst forecasts. However, the company cautioned that year-over-year growth could slow in the fourth quarter of 2025 due to tough comparisons. Capital expenditures for 2025 are projected between $66 billion and $72 billion, slightly narrowing previous estimates, mainly due to infrastructure and employee cost

ASX SPI 8669 (-0.22%)

The ASX is likely so be fairly sporadic in terms of movement today, with great news for US earnings, a slight disappointment for RIO on earnings, and the drop in copper likely to be in focus.

Materials will drag down the index, while tech and interest rate sensitive sectors are likely be buoyant, de-railing the “great rotation” in the ASX200 index

Quarterly reports expected on Thursday from Beach Energy, Liontown Resources and Origin Energy.

RBA deputy governor Andrew Hauser will participate in a fireside chat at the Barrenjoey Economic Forum, Sydney at 9.20am AEST.

A wave of data is set for release at 11.30am AEST, including June retail sales, building approvals, private sector as well as import and export price data.

You can now listen & Watch to the Pre Market Pulse

Is OpenAI the Poster-Child of AI, or the AI Bubble?

You would think that the company that brought us ChatGPT – the one that supposedly aces every math test thrown at it – would be able to do the math on its own business model and cash-flow forecasts. But apparently not.

7 Candlestick Patterns Every Investor Should Know

Candlestick charts, invented by Japanese rice trader Munehisa Homma in the 18th century, are a powerful tool for visualizing price movements and market sentiment. Each candlestick shows an asset’s open, high, low, and close prices for a period, revealing the battle between buyers (bulls) and sellers (bears). Green or white candles indicate bullish closes (close > open), while red or black signal bearish ones (close < open). Understanding these patterns can help predict short-term reversals or continuations, but always confirm with other tools like support/resistance or volume.